Article content

(Bloomberg) — US inflation is proving stubborn while consumer spending shows scant signs of any concerning slowdown, laying the groundwork for a more cautious approach to interest-rate cuts from the Federal Reserve.

Even though inflation has dropped notably over the past two years, the government’s October consumer price report underscored the challenge facing Fed officials: ensuring their policy actions support the labor market while guarding against a reacceleration of price pressures.

Article content

Elsewhere, the European Commission sees a gradual firming in euro-area economic growth next year. China’s trade surplus is on pace to hit a record this year, highlighting its continued reliance on exports to compensate for weak domestic demand.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

The so-called core consumer price index — which excludes food and energy costs — increased 0.3% for a third month. Over the last three months it rose at a 3.6% annualized rate, marking the fastest pace since April, according to Bloomberg calculations. Economists see the core gauge as a better indicator of the inflation trend than the overall CPI.

Retail sales advanced in October, boosted by a jump in autos purchases, while other categories signaled some momentum heading into the holiday season. Categories were mixed, but the upward revision to September sales suggests consumers entered the final months of the year on a stronger footing than previously thought.

US household debt climbed to a fresh high last quarter, with rising incomes leaving many consumers able to manage the burden, but lower-income groups showing signs of financial strain.

Article content

Europe

The euro area’s economic growth will pick up as obstacles to consumption and investment fade away, though geopolitics poses an increasing threat, according to the European Commission. Gross domestic product will increase by 1.3% next year and by 1.6% in 2026, the EU’s executive arm said.

Germany’s economy will hardly grow next year as underlying problems add to cyclical weakness, according to Chancellor Olaf Scholz’s independent panel of experts. Surveys point to poor sentiment, particularly after the election of Donald Trump in the US and the collapse of Germany’s government.

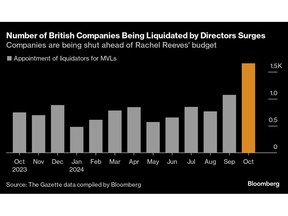

Company insolvencies are surging in the UK after the Labour government reduced tax breaks and increased levies for owners.

Asia

China’s trade surplus is on track to hit a fresh record this year, increasingly leaving it on a collision course with some of the world’s biggest economies by aggravating an imbalance in global commerce.

India’s trade deficit widened significantly in October as imports climbed during the Hindu festival season, even though exports posted robust growth.

Article content

Emerging Markets

Argentine President Javier Milei foreshadowed Tuesday he would change his currency policy after the end of the year if inflation stays constant in November and December. Milei said he would slow the monthly pace of currency devaluation that the central bank controls, known as the crawling peg, to 1% from 2% if price increases stay at or below October’s 2.7% reading.

Russians are facing a surge in food prices, creating a headache for President Vladimir Putin as he tries to balance the Kremlin’s military ambitions with a need for domestic stability.

A boom in Brazil’s agriculture sector sparked a rush of investments, with the $7 billion market for agribusiness funds luring people from all walks of life in the past three years. But with bumper crops across the globe sending prices plunging and Brazilian farmers filing for bankruptcy at alarming rates, the retail investor is paying the price.

World

China has made a $1.3 billion bet that a new port in Peru will boost access to South America’s agricultural bounty. Chancay port, about 44 miles north of Lima, is majority-owned and operated by China’s Cosco Shipping. While the facility promises to slash travel times for cargo going between China and South America, significant hurdles threaten to diminish its success — especially when it comes to getting goods from Brazil.

Mexico delivered a third straight interest-rate cut as a key measure of underlying inflation retreats and concerns mount over the slowdown in Latin America’s No. 2 economy. Zambia’s central bank raised its key interest rate to the highest level since 2017 to contain price pressures and prop up its bruised currency. Uruguay held rates steady.

—With assistance from Isis Almeida, Clarice Couto, Rachel Gamarski, Swati Gupta, Jonnelle Marte, James Mayger, Zoe Schneeweiss, Dayanne Sousa, Alex Tanzi, Manuela Tobias, Alexander Weber and Sylvia Westall.

Share this article in your social network