MARTIN Lewis has warned 800,000 Brits they could be entitled to claim thousands of pounds.

The MSE highlighted one benefit that is “critically underclaimed” despite it offering an average boost of £3,900 to eligible claimants’ incomes.

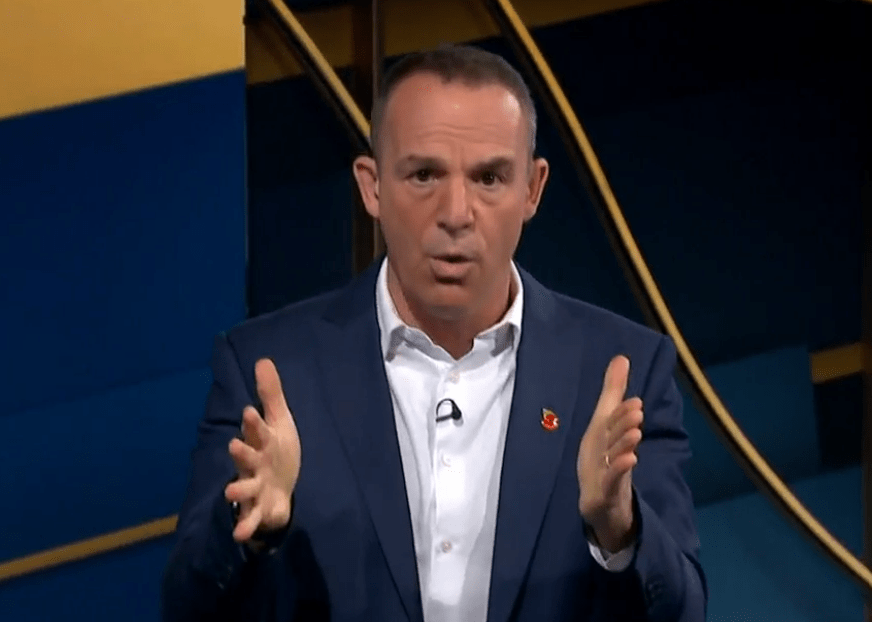

Speaking on his Martin Lewis Money Show tonight, he ran through the main points of Rachel Reeves’ 2024 Autumn Budget yesterday.

One decision that sparked fury among pensioners was the Winter Fuel Payment cut.

Up until now, every pensioner received a £300 payment to help with their bills but this boost has now become means tested.

Rachel Reeves said on Good Morning Britain today: “Because of our commitment to the triple lock, we were able to announce that the new State Pension will rise by just over £470 by next April.”

The Chancellor confirmed that both the old and new State Pension are set to rise by 4.1% on 6 April 2025.

This is what is known as the ‘triple lock’ guarantee.

It means those on the full New State Pension, anyone who started receiving their pension from 2016, will see their weekly pension rise from £221.20 to £230.25.

Meanwhile, those on the Old State Pension, from before 2016, will see a weekly rise from £169.50 to £176.45.

But, Martin Lewis highlighted that while the Chancellor advertised pensioners will be seeing an extra £470 in their accounts amid a £300 Winter Fuel Payment cut – three quarters of pensioners are actually on the Old State Pension and will not see that level of money.

The MSE urged the 800,000 pensioners who are eligible to Pension Credit to apply immediately.

He said: “Three quarters of pensioners are on the Old State Pension, they see £360, plus this is those who get the full amount.

“Millions of the poorest don’t have this, so their rise will be lower.

“What is the protection here? Pension Credit.”

What will I get when I claim Pension Credit?

SOME people will receive thousands of pounds once they claim Pension Credit, while others will be given just pennies.

But it is still worth making a claim either way as it opens the door to more financial help.

Once you claim Pension Credit you may receive:

- Housing Benefit if you rent – worth thousands a year.

- Mortgage Interest support – on up to £100,000 of your mortgage or loan.

- Council tax discount – worth thousands each year.

- Free TV licence if you are aged over 75 – worth £169.50 a year.

- NHS dental treatment, glasses and transport costs for hospital appointments help.

- Royal Mail redirection service discount – worth up to £48.

- Warm Home Discount if you get Guaranteed Pension Credit – worth £150.

- Cold Weather Payment – worth £25 for every seven day period of cold weather between November 1 and March 31.

- Winter Fuel Allowance – worth up to £300 a year.

The Pension Credit threshold will go up to £227 per week from £218, or £347 for a couple.

Rachel Reeves added on GMB: “We’re protecting the poorest pensioners, those who are on Pension Credit.”

However, Martin Lewis responded on his show tonight and said: “Around 800,000 people eligible don’t claim this. It is critically underclaimed.

“Protecting the poorest pensioners through Pension Credit – with the 240 question form, the people many with early on-set dementia who don’t claim – we are not protecting 800,000 of them.

“I just want to say if you know someone on the State Pension on a very low income, they’ve lost their Cost of Living payment, they’ve lost Winter Fuel Payment, please get them to check if they’re eligible for Pension Credit.”

The MSE has a handy 10-minute benefits check that could help.

The Guarantee Element of Pension Credit is also set rise by 4.1% from April 2025 which works out to an annual increase of £465 for single pensioners, or £710 for couples.

Pension Credit can boost a weekly income to £218.15, equalling £11,343.80 annually, or up to £332.95 for couples, totalling £17,313.40 a year.

There can also be an extra cash for those with extenuating circumstances, such as disabilities or caring roles.

WINTER FUEL PAYMENT CHANGE

Winter Fuel Payment is now a means-tested benefit.

Starting this winter you’ll only be eligible for Winter Fuel Payment if you’re:

- Over State Pension age; AND

- Receiving one of the following benefits:- Income Support;

– Income-based Jobseeker’s Allowance;

– Income-related Employment and Support Allowance;

– Pension Credit; or

– Universal Credit (for example, through a joint claim with your partner).

These changes will apply across England, Northern Ireland, Scotland and Wales.

Mr Lewis also encouraged anyone who is struggling but may not be entitled to Pension Credit to check with their local council to see if they’re eligible for the Household Support Fund.

How do I apply for pension credit?

YOU can start your application up to four months before you reach state pension age.

Applications for pension credit can be made on the government website or by ringing the pension credit claim line on 0800 99 1234.

You can get a friend or family member to ring for you, but you’ll need to be with them when they do.

You’ll need the following information about you and your partner if you have one:

- National Insurance number

- Information about any income, savings and investments you have

- Information about your income, savings and investments on the date you want to backdate your application to (usually three months ago or the date you reached state pension age)

If you claim after you reach pension age, you can backdate your claim for up to three months.