MILLIONS of workers will get a bumper pay rise from 2028 when income tax and National Insurance thresholds are unfrozen.

The measure, announced today by Rachel Reeves, will mean thousands will save up to £211 a year in tax.

The Chancellor had been widely expected to extend the freeze, which has been in place since 2021, in today’s Budget.

But in a surprise move, the thresholds will increase again in 2028, boosting incomes.

It will see the earnings level at which you become liable to pay income tax and national insurance (£12,570 a year) increase in line with inflation.

The freeze on higher and additional rate income tax bands will also end.

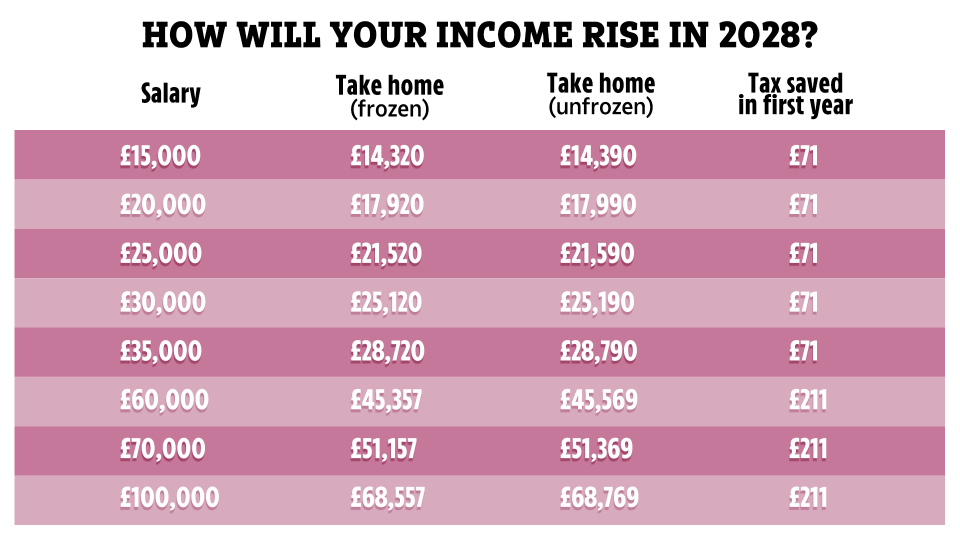

This adjustment means that individuals earning between £15,000 and £35,000 annually will save £71 per year in income tax and National Insurance, assuming a 2% increase to the thresholds.

For those with incomes exceeding £60,000 per year, the savings could amount to up to £211 a year starting in 2028.

Shaun Moore, personal tax expert at Quilter: “Despite widespread speculation that Labour would break its pledge not to raise taxes for working people by extending the income tax threshold freeze beyond 2028, the Chancellor has confirmed that the freeze will thaw as originally intended.

“This decision brings relief to many taxpayers who were concerned about the potential for prolonged fiscal drag.”

You currently pay no income tax on the first £12,570 of your earnings.

This is known as the personal allowance.

You then pay tax at 20% on income over this and up to £50,271.

Then, on earnings over that and up to £150,000, pay 40%.

The threshold at which employees begin paying National Insurance contributions (NICs) is also set at £12,570 per year.

Most people pay 8% NICs on earnings between £242 and £967 a week.

Plus, you have to pay 2% on anything you earn over £967 a week – or £4,189 per month.

Like the personal allowance, the NICs threshold has been frozen since 2021.

The “trick and treat” Halloween package included:

Frozen tax thresholds act as a “stealth tax,” allowing the government to collect extra revenue without raising tax rates.

As wages increase due to inflation or other factors, more people will find their incomes pushed into higher tax brackets.

This phenomenon, known as “fiscal drag,” leaves more people paying more taxes, thereby reducing their disposable income.

However, from April 2028 both thresholds will become unfrozen, meaning they’ll rise with inflation.

For example, if the personal allowance and NICs threshold rise by 2%, it will be worth £12,822 in 2028.

What is the personal allowance?

THE personal allowance is the amount you can earn each year tax-free.

In the current tax year – which runs from April 6 2024 to April 5 2025 – the figure is £12,570.

Any earnings above this threshold are taxed at different rates, depending on the income bracket.

However, this amount may be larger if you claim certain allowances, including a blind person’s allowance, marriage allowance and child tax credit.

Income tax also applies to money you make outside your job, not just your earnings.

But there are also some tax-free allowances on top of the personal allowance for these other sources of income.

If you are self-employed, you don’t have to pay tax on savings interest, dividends and the first £1,000 of income.

INCOME TAX RATES

You currently pay no income tax if you earn £12,570 or less.

On earnings between £12,570 and up to £50,270, you pay the basic income tax rate of 20%.

Wages of £50,271 and above are taxed at the higher rate of 40%.

The additional income tax rate, which applies to earnings above £150,000, is 45%.

The income tax thresholds generally rise yearly so that people can earn more without paying more tax.

These thresholds will rise again in now frozen until 2030.

What is National Insurance?

NATIONAL Insurance is a tax on your earnings, or profits if you’re self-employed.

These contributions make you eligible for things like the state pension and certain benefits.

You’ll usually pay National Insurance Contributions (NICs) when you’re over the age of 16 and earning a certain amount.

You can see the amount of NICs you pay on your payslip.

If you’re employed, the company you work for deducts the tax and pays it to HMRC for you.

Self-employed individuals generally have to pay NICs themselves when completing a self-assessment tax return.

NATIONAL INSURANCE RATES

Most people now pay 8% NICs on any earnings between £242 and £967 a week.

This means if you earn more than £12,570 a year, you’ll start paying NICs.

You pay mandatory National Insurance if you’re 16 or over and are either:

- An employee earning more than £242 per week from one job

- Self-employed and making a profit of more than £12,570 a year

Plus, you have to pay 2% on anything you earn over £967 a week – or £4,189 per month.

The exact amount you pay will depend on how much you earn, as it’s a percentage of earnings between these amounts.

You can check how much National Insurance you’ve paid by visiting gov.uk/check-national-insurance-record.

WATCH RACHEL REEVES ON NEVER MIND THE BALLOTS