Article content

(Bloomberg) — China’s recent stimulus measures to revive the economy will set the tone for third-quarter earnings from major Chinese lenders including Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd.

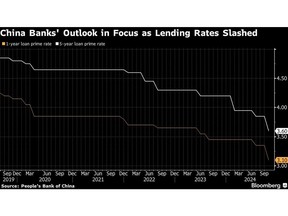

The attention will be on their longer-term outlook after benchmark lending rates and deposit rates were lowered in the wake of central bank easing. That’s as net interest margins in the sector had declined to record-low levels at the end of June, squeezing profits.

Article content

The impact of the banks’ deposit rate cut cycle that started in September 2022 should become more evident this quarter, Bloomberg Intelligence’s Francis Chan said.

Home prices in China also continued to slump as investors remained underwhelmed by recent policy measures to stabilize the property sector. China Vanke Co.’s liquidity remains under pressure as measures introduced since September may not spark a sustainable recovery in new home sales, said BI’s Kristy Hung and Monica Si.

Investors will want to hear more from HSBC Holdings Plc’s new Chief Executive Officer Georges Elhedery about his plans to reduce costs. He already signaled that senior manager roles are likely to be cut. Standard Chartered Plc may also provide an update on its $5 billion capital return plan.

Highlights to look out for:

Saturday: ICICI Bank’s (ICICIBC IN) margin compression should lead to a slowdown in net income growth. Still, analysts at Nomura expect ICICI Bank to fare better than peers as it faces less pressure for deposit-led growth. It has one of the lowest loan-deposit ratios among large private sector banks, giving it more headroom for loan growth.

Article content

Tuesday: HSBC’s (HSBA LN) third-quarter pretax profit was probably little changed from a year ealier, though all the attention will be on Elhedery’s overhaul of the lender to save money. The lender just named Pam Kaur as chief financial officer. Analysts at Morgan Stanley said HSBC is likely to announce another $3 billion buyback.

Wednesday: Standard Chartered’s (STAN LN) net interest income in the third-quarter likely jumped 27% after several quarters of declines, estimates show. Prospects for credit growth, particularly in its corporate segment, will be scrutinized as lower rates squeeze margins, BI said. Management may say revenue guidance in 2025 and 2026 is achievable even in a slightly softer rate environment, according to Morgan Stanley.

- Chinese banks including ICBC (1398 HK), CCB (939 HK), AgBank (1288 HK) and Bank of China (3988 HK) may see loan yields fall more than 50 basis points next year as they reel from this year’s loan prime rate cuts, BI said.

- China Vanke’s (2202 HK) declining contracted sales probably brought more liquidity pressures in the third quarter, BI said. A continued slump in home sales could extend declines in the developer’s revenue and gross margin through 2026, BI added.

- BYD’s (1211 HK) third-quarter net income likely rose thanks to record new electric vehicle sales, said BI. Higher tariffs from the European Union may impact exports, through domestic demand grew stronger with government subsidies to promote the replacement of older vehicles.

- GoTo (GOTO IJ) is expected to post a narrower net loss in its third quarter, helped by higher contributions in on-demand, and financial tech services, estimates show. GoTo’s sale of three-quarters of its e-commerce business to ByteDance Ltd.’s TikTok may relieve significant pressure on its profit, but it could lose a substantial amount of potential revenue, BI said.

- Midea Group’s (000333 CH) third-quarter sales probably rose 7.4%, as China’s ongoing home appliance trade-in program probably stimulated demand for energy-efficient equipment, BI said.

Article content

Friday: Nomura’s (8604 JP) second-quarter net income likely grew. Its credit profit and ratings may improve further with better earnings consistency, BI said. Watch out for any commentary on the fallout from its market manipulation scandal, which has led some of Japan’s largest financial institutions to stop trading securities with the firm, according to people familiar with the matter.

- Macquarie Group’s (MQG AU) first-half adjusted net income may rise around 15%, based on two estimates. The company’s business conditions have improved with a rebound in trading profit in the first quarter, BI said, adding that its price-to-earnings ratio of 21 tops its 14.5 five-year mean.

- Advanced Info’s (ADVANC TB) third-quarter earnings could rise on higher overall revenue contributions from its core service segment, which includes mobile and fixed broadband services. Bualuang Securities expects higher expenses in the second half of the year on greater marketing spending.

Share this article in your social network