Article content

(Bloomberg) — London Metal Exchange’s annual LME Week gathering is underway, bringing together traders and analysts amid copper’s latest upswing. Sugar futures are on track for their best month since January. And US utilities are outshining other industry groups in the S&P 500, thanks in part to AI demand.

Here are five notable charts to consider in global commodity markets as the week gets underway.

Article content

Copper

Copper has been on a roller-coaster ride this year, with a surge of investment and a major short squeeze in New York driving prices to a record in May. Investors then pulled in their horns as doubts about the Chinese economy rose to the fore. The latest positioning data signals that they’re not chasing the rally as hard as they did last time around.

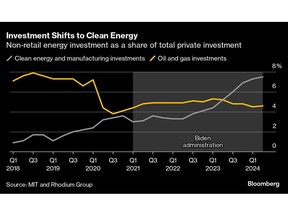

Energy Investments

The US is mobilizing so much investment into clean energy that it now tops even the peak of America’s fracking revolution in the 2010s. The wave of spending triggered by Joe Biden’s signature climate law is set to be the president’s biggest and most-enduring domestic achievement. His policies helped drive about $493 billion of new investment into the manufacturing and widespread deployment of solar panels, electric vehicles and other emission-cutting technology since mid-2022, according to data analyzed by the Massachusetts Institute for Technology and research firm Rhodium Group.

Natural Gas

Europe enters its heating season this week with a massive natural gas stockpile to shield itself from unexpected supply outages. The continent’s sites are about 94% full — above historic averages, but slightly below last year’s levels — enough to keep some traders watchful as they closely monitor continuing storage build-up before the freezing weather spreads.

Article content

Power Providers

The utilities sector is outshining other industries on the S&P 500 Index in the last three months. Stocks of US power providers racked up big gains in the third quarter on market giddiness over prospects of surging electricity demand from artificial intelligence-focused data centers. Utilities are on pace to top the 11 industry groups of the S&P Index as the quarter draws to a close, with gains driven by plant operators Vistra Corp. and Constellation Energy Corp., which just inked a power supply deal with Microsoft Corp. Vistra is noteworthy because it’s also holding its ranking as the best performing stock in the broader S&P 500 for the year, after shares more than tripled.

Sugar

Sugar has been on a tear in September due to a poor outlook from Brazil, the world’s top exporter. While promising production forecasts in India and Thailand cut short last week’s rally on Friday, sugar futures are still on pace for the biggest monthly gain since January. Severe drought in Brazil has been hurting sugar-cane yields, raising fears of further cuts to production estimates. Traders will be closely watching the flow of vessels shipping sugar from the South American nation in October, since any easing of exports means global buyers may struggle to find supplies in the final months of 2024.

—With assistance from Geoffrey Morgan, Doug Alexander, Dayanne Sousa and Alex Tribou.

Share this article in your social network