Article content

(Bloomberg) — Australia’s central bank held its key interest rate at a 12-year high on Tuesday as it struggles to subdue stubborn price pressures that are holding it back from joining a global easing cycle.

The Reserve Bank — as expected — kept its cash rate at 4.35% for a seventh straight meeting and restated it isn’t “ruling anything in or out” on policy. The RBA has sought to hold onto significant post-Covid job gains and as a result inflation is taking longer to come down.

Article content

“The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome,” the rate-setting board said in a statement. “Policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range.”

Investors trimmed near-term expectations of an RBA rate cut, with policy sensitive three-year notes erasing an earlier loss to be little changed at 3.55%. The currency rose to be near its highest since July 2023. Swaps traders are pricing a roughly even chance of a rate cut at the December meeting.

“The RBA used the word ‘sustainably’ four times in the statement to hammer the point that near term declines in inflation won’t be enough to convince them to cut rates,” said Stephen Spratt, a rates strategist at Societe Generale in Hong Kong. “This seems to be a signal to markets not to read too much into tomorrow’s August CPI data, which is forecast to drop back into the target range.”

Monthly inflation data on Wednesday is expected to show prices came in under 3% for the first time since August 2021, reflecting government energy subsidies and other measures.

Article content

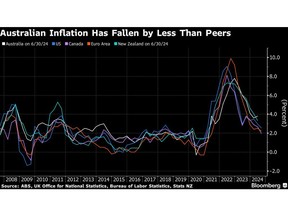

The RBA’s decision highlights its outlier status compared with peers. Last week, Federal Reserve Chair Jerome Powell led his colleagues to an outsize rate cut designed to preserve the strength of the US economy.

Economists generally expect the RBA’s rate-cutting cycle to begin in February while financial markets see a two-in-three chance of the first easing coming in December.

Governor Bullock has repeatedly pushed back against talk of near-term easing, reflecting forecasts that inflation will only return to the 2-3% target in late 2025. That’s brought her into the political firing line from members of the ruling Labor party and minority parties that are pushing for a rate cut.

Bullock says the board wants to be confident that price growth is moving sustainably back to the bank’s goal.

Subscribe to the Bloomberg Australia Podcast on Apple, Spotify or wherever you listen.

At 3.9%, core prices remain well above target, driven largely by non-discretionary spending such as insurance, education and housing. Australia’s job market remains in good shape with unemployment at a still-low 4.2%.

Article content

The RBA’s hawkish policy position combined with political jockeying over a pending reform of its board structure has spurred local criticism of the bank.

The left-wing Greens party is demanding the government use its reserve powers to order the RBA to cut rates as a condition to support legislation that would split the board in two — one for monetary policy and the other for governance. The government dismissed the Greens’ suggestion as “crazy.”

In Tuesday’s statement, the RBA’s board highlighted instability abroad, saying “geopolitical uncertainties remain pronounced.” That reflects the intensified fighting between Israel and Hezbollah as the conflict in the Middle East shows signs of expanding.

One of the factors behind persistent price pressures in Australia is a monetary-fiscal policy mismatch, economists say. While government largess has helped keep Australia out of recession and boosted the labor market, it is also making the RBA’s job harder.

The government has rejected suggestions that its policies are helping fuel price growth.

Westpac Banking Corp. this week released research showing new public demand rose to a record 27.3% of the real economy in the June quarter from a pre-pandemic average of around 22.5%. Economist Pat Bustamante reckons the share will hit 28% by the end of next year.

“The increase in new public spending as a share of the real economy is unprecedented in speed and scale,” he said.

—With assistance from Toby Alder, Matthew Burgess and Georgina McKay.

(Adds comment from analyst, updates markets)

Share this article in your social network