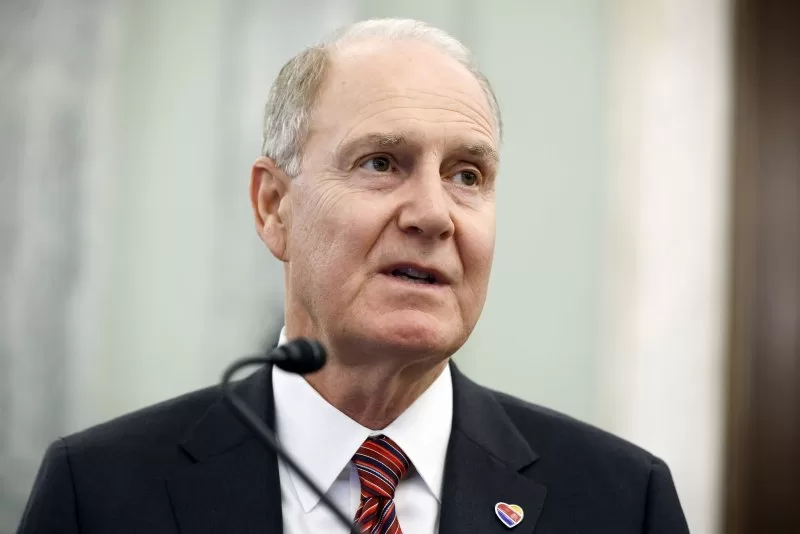

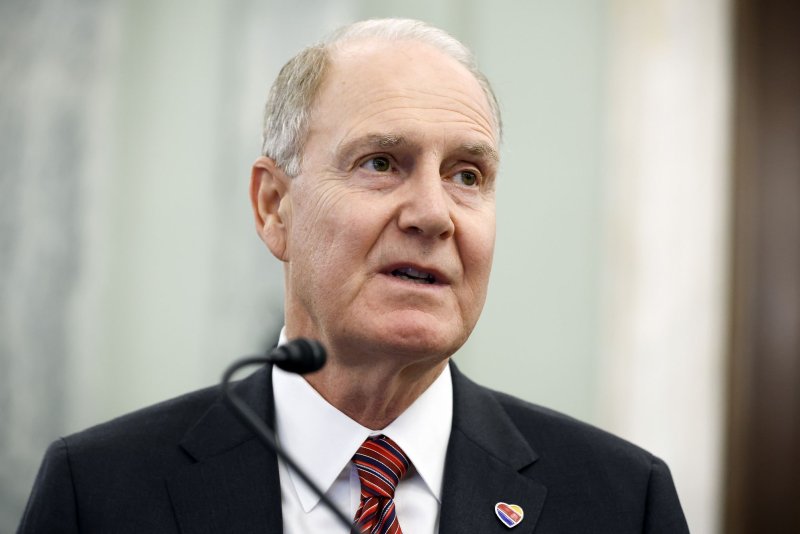

1 of 2 | Current Southwest Airlines executive chairman and former company CEO Gary Kelly says he will retire in 2025 from his board leadership role as outside investor Elliott Investment Management L.P. keeps up pressure to see business changes and new top company brass, according to new records. Pool File Photo by Chip Somodevilla/UPI |

License PhotoSept. 10 (UPI) — A longtime Southwest Airlines company executive said Tuesday amid a board shakeup and changes to the carrier by an activist investor group that he will retire next year after nearly 40 years with Southwest.

Current executive chairman and former Southwest Airlines CEO Gary Kelly said he will retire in 2025 from his board leadership role as outside investor Elliott Investment Management L.P. keeps up pressure to see business changes and new top company brass, according to new records, as Elliot last week crossed a 10% threshold to call for a special meeting with eyes on a possible hostile takeover.

“Now is the time for change. It’s time to shake things up, not just stir them a bit,” Kelly, who has served as chairman since 2008, wrote in a letter on Tuesday to shareholders after he met with Elliot management Monday. “The wisdom comes in knowing what to change and what not to change.”

It was also revealed on Tuesday that six Southwest board members will soon voluntarily resign and four new independent directors will step in “the near future, including due consideration of up to three of Elliott’s candidates,” according to Kelly.

David Biegler, Veronica Biggins, William Cunningham, Thomas Gilligan, Jill Soltau and former Sen. Roy Blunt., R-Miss., are expected to leave the current Southwest board after the company’s regular scheduled November board meeting, according to Southwest Airlines.

In his letter, Kelly added that Southwest Airlines’ current board and leaderships “unanimously support” Bob Jordan to remain as CEO.

Jordan, formerly Southwest’s executive vice president, took over as the new chief executive in 2022 after Southwest announced in summer 2021 the year prior that Jordan, who started working for the airliner as a programmer in 1988, would replace Kelly as CEO.

“Southwest Airlines’ Board is confident that there is no better leader than Bob Jordan to successfully execute Southwest Airlines’ robust strategy to evolve the airline and enhance sustainable Shareholder value,” the company says.

The investment firm has conducted other campaigns to assert more control over management at AT&T, Texas Instruments and Salesforce, but not an airline.

Nearly three months ago Elliot revealed its $2 billion financial stake in Southwest and prompted calls for a shakeup and new company leadership, adding its opinion Southwest saw “stunning underperformance” under Jordan and Kelly.

Elliott Investments on June 26 said “Southwest is led by a team that has proven unable to adapt to the modern airline industry.”

In response, Southwest adopted a year-long limited-duration shareholder rights plan in its effort to counter an attempt by Elliott Investment Management L.P. to acquire a controlling interest in the airline and to stop plans to replace Kelly and Jordan in their respective CEO and board leadership roles.

Southwest Airlines acknowledged at the time Elliott “has made regulatory filings with U.S. antitrust authorities that would provide it the flexibility to acquire a significantly greater percentage of Southwest Airlines’ voting power across two of its funds starting as early as July 11, 2024.”

Southwest, which has an upcoming Sept. 26 “investor day” scheduled, experienced financial losses that led in April to the suspension of service to four cities.

Like other airlines the Dallas, Texas-based Southwest has struggled with an oversupplied U.S. market, rising costs and issues with its sole aircraft supplier, Boeing. And in a sea of changes had also integrated AirTran and Spirit Airlines ex-CEO after AirTran had previously been acquired by Southwest, but Southwest resisted changes to its own business model which for years helped see decades of unbroken profit stream.

But in its biggest change in more than 50 years announced in July Southwest would offer extra legroom and get rid of its open seating policy with plans to offer overnight “redeye” flights sometime next year.