SAVERS have just days to go before the last free cash offer from a major bank is pulled.

TSB‘s latest switching offer will close on September 10, giving customers just four days to get their hands on up to £190 in free cash.

As part of the deal, switchers receive £100 in upfront money just for making the switch.

They can also receive up between £5 and £15 cashback each month for the first six months.

However, you must make at least 20 debit card payments to earn monthly cashback.

You can apply for the switch on TSB’s website, in branch or via the bank’s app.

You must also set up at least two direct debits, use the card at least once and log into the TSB mobile app by September 27.

Once you have done this, TSB will pay £125 into the new account between October 15 and October 25.

Bear in mind that the TSB Spend & Save card doesn’t have a monthly fee, but the Spend & Save Plus account will charge you £3 a month.

New customers who meet the terms for the £100 payment will be also offered a free reward if they make 20 or more payments using their new TSB debit card in March 2025.

They can choose from:

- A night away for two at a choice of leading hotels

- Two Odeon cinema tickets every month for 3 months (6 tickets in total)

- A Now TV entertainment 6-month subscription

Although the offer is enticing, it always pays to read through the full terms and conditions and ensure the available accounts match your banking needs.

Are other banks offering switching bonuses?

Several current account providers have pulled their free cash offers over the past five weeks.

Last week, Barclays Bank pulled its £175 incentive, which launched on July 8.

Meanwhile, on August 9, The Co-operative Bank withdrew its £100 incentive, which launched 17 July.

In the same month First Direct pulled its £175 incentive, which launched 7 May.

Elsewhere at the end of July, Lloyds Bank removed its £175 incentive, which launched May 28.

Free cash has fizzeld

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, explains why lenders are putting a pause on their free cash incentives

The summertime of free cash incentives on current accounts fizzled out over recent weeks.

These changes were largely expected, as many of the free cash offers had a set window for consumers to take advantage. It’s not all bad news though, as consumers will see these types of incentives come and go throughout the year when banks decide to compete for new business.

However, those customers who have not made time to explore the variety of offers and switch using the Current Account Switch Service (CASS) would have missed out on free cash from some of the biggest banking brands last month.

This should not deter customers from ditching and switching to an account that works harder for them, as there are still some decent packages available to suit different circumstances. It’s vital that customers choose an account based on its overall value, and not just for a free cash incentive.

TSB’s switching offer which ends on September 10 is the last offer of this kind on the market.

So if you are keen to try out an offer like this, TSB’s deal will be your last chance for the foreseeable.

However, there are plenty of other banking offers on the market which may suit your needs.

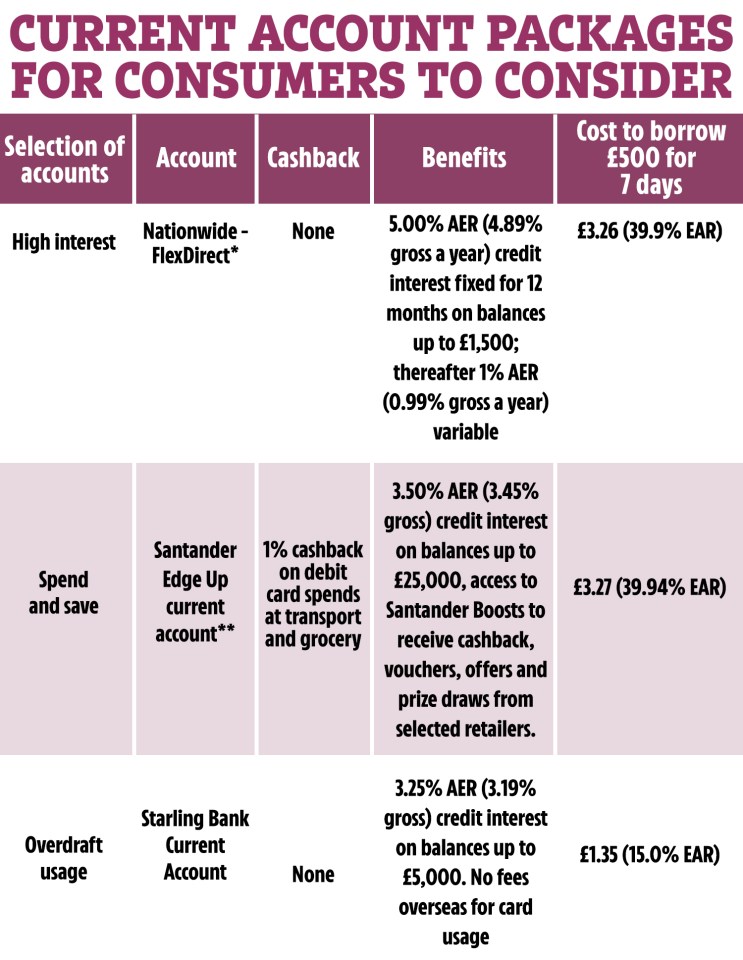

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, has explained some of the most attractive current account packages for consumers to consider.

She said: “Consumers who want to earn a bit of interest on their current account will find Nationwide offering the highest in-credit interest rate of 5.00% AER on its FlexDirect account.

“Customers will need to make a note that the credit interest rate will fall after 12 months to 1% AER. “

She added: “Those who spend and save will find Santander’s Edge Up current account appealing; savers can earn 3.50% AER interest on balances up to £25,000 and spenders can earn cashback on debit card transactions and monthly bills. “

“Those who sign up to Santander Boosts can also get entry into prize draws, earn cashback or vouchers.”

How you can find the best savings rates

If you are trying to find the best savings rate there are websites you can use that can show you the best rates available.

Doing some research on websites such as MoneyFacts and price comparison sites including Compare the Market and Go Compare will quickly show you what’s out there.

These websites let you tailor your searches to an account type that suits you.

There are three types of savings accounts fixed, easy access, and regular saver.

A fixed-rate savings account offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw but it comes with a hefty fee.

An easy-access account does what it says on the tin and usually allow unlimited cash withdrawals.

These accounts do tend to come with lower returns but are a good option if you want the freedom to move your money without being charged a penalty fee.

Lastly is a regular saver account, these accounts generate decent returns but only on the basis that you pay a set amount in each month.