BORROWERS who rely on balance transfer to help pay off debt have been warned that providers are pulling top deals.

The longest introductory zero interest periods on the credit cards have significantly shrunk over the past 12 months, according to data from comparison site Moneyfactscompare.co.uk

The cards are a crucial tool for people who have racked up spending and are trying to repay, as they don’t charge any interest on sums moved for set period of time.

But the zero interest time periods available has rapidly shrunk.

In August 2023 the longest interest-free period on a balance transfer card was 30 months.

Now, it’s fallen to 28 months.

Read more on credit cards

Rachel Springall, from comparison site Moneyfactscompare.co.uk, said: “Interest-free offers have unfortunately worsened in terms of the time given to borrowers to pay back their debt before interest applies.

“Those who do use these deals will usually have to pay a balance transfer fee, so it’s wise to keep this in mind if debts are going to be moved around often over the short-term.

“Some of the longest interest-free balance transfer offers carry higher transfer fees, but there are still some fee-free offers for borrowers to consider instead.

She added: “Borrowers should always aim to make more than the minimum repayment each month and have a plan in mind to clear the debt before their 0% offer ends.”

At the same time, the APR on purchase credit cards has jumped to a record high of 35.6%.

This means that borrowers who don’t move their balance could pay more in interest making it more difficult and longer to repay debt.

Rachel explained: “If someone borrowed £1,000 on a credit card that charges 35.6%, but made £100 in fixed repayments, it would cost them around £170 in interest and take a year to repay.

“However, if they stuck to repaying £50 per month, it would take more than twice as long to repay and cost around £421 in interest.”

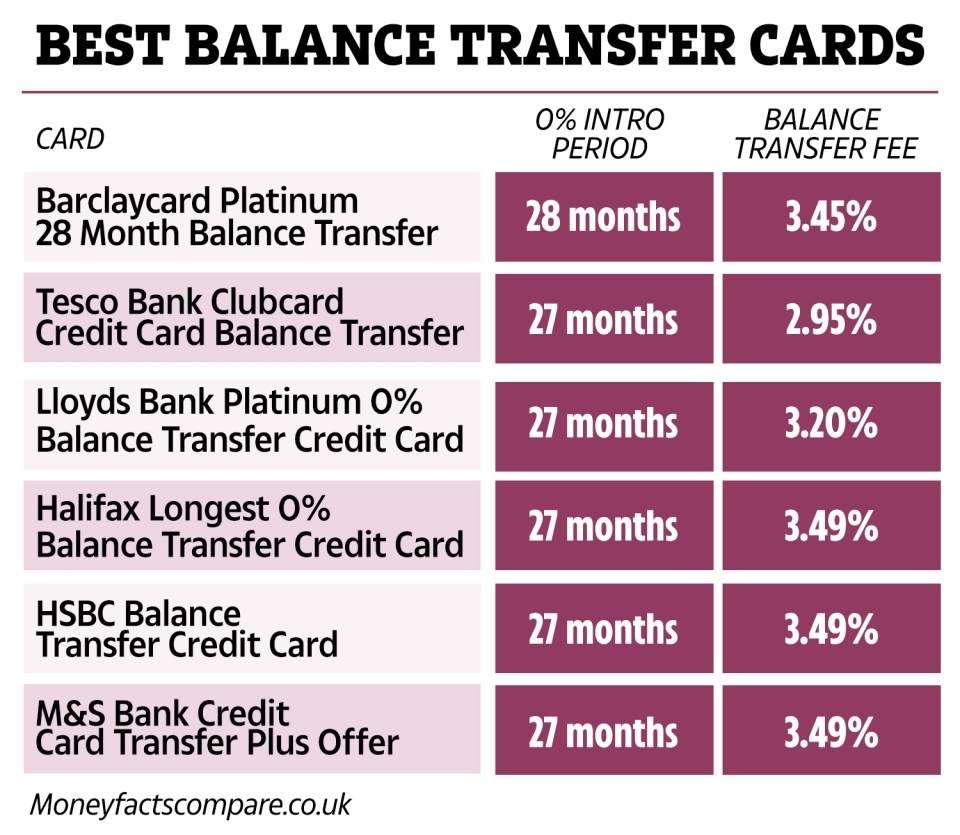

Borrowers hoping to get the longest possible 0% interest free balance transfer period of 28 months will have to apply for Barclaycard Platinum Balance Transfer.

The card comes with with a balance transfer free of 3.45%.

If you think can pay off debt in a slightly smaller time period of 27 months, you may be better off opting for Tesco Bank Clubcard Credit Card Balance Transfer. This card comes with a smaller fee of 2.95%.

Or Lloyds Bank Platinum 0% Balance Transfer Credit Card, which also offers 27 months with a fee of 3.2%.

You can get 27 months interest free with Halifax’s Longest 0% Balance Transfer Credit Card, as well as HSBC Balance Transfer Credit Card, and M&S Bank Credit Card Transfer Plus Offer.

However, the fee on all these cards is a fairly high 3.49%.

How to pay off debts with a balance transfer card

Balance transfer cards can be one of the best ways to pay off debt.

The 0% period means you can use cash to pay back the underlying debt rather than spending it on interest.

This means you can chip away at your balance faster.

Ideally, you should pay off the balance within the zero interest period or you will need to move the balance again to avoid high interest charges.

Each time you move you pay a balance transfer free, however.

To find the best deal for you, work out how much you can afford in repayments each month.

Then divide the debt by your monthly repayment figure to work out how many months it will take to repay in full.

Find the card with enough time to pay off your debt at the lowest possible fee.

You can compare credit card deals on comparison sites such as Moneysupermarket.com and moneyfactscompare.co.uk.

These sites can also show if you’re likely to be accepted for a credit card before you apply, to help avoid being rejected which can damage your credit rating.

Don’t fall into the trap of building debt back up on the credit card you have made the balance transfer from.

If you think that’s a possibility, it may be a good idea to close the original credit card or keep it hidden away to use for emergencies only.

Is a loan better?

In some cases, it could be better to get a loan to pay off your credit card, especially if the amount of time you will take to repay the balance is longer than the interest-free period.

If you get a loan, the interest rate is usually lower than a credit card’s APR, which is the rate you pay after the 0% interest-free period ends.

The typical interest charged on a £50,000 personal loan paid back over five year is 10.6% in 2024, figures from Moneyfactscompare.co.uk show.

You may pay more in interest overall without an interest-free period, however, so do the sums to work out the best option for you.

Loan repayments are set for the duration of the term so you will pay off the entire sum by the end, which could be better for someone who is worried they may be less disciplined with repaying the entire balance on a balance transfer card.

Maxiumum loan sizes have also increased in recent month so you could borrow more than in the past.

However, it is important to make sure you can afford to make repayments before you commit to a loan.

It’s usually a good idea to close the original credit card where you built up debt so that you don’t get temped to rack up a new balance.

If you are struggling with debt, get free help and advice from group and charities including:

- Citizens Advice – 0800 144 8848 (England) 0800 702 2020 (Wales)

- StepChange – 0800138 1111

- National Debtline – 0808 808 4000

Are there other options?

There are many ways to tap into interest-free borrowing, which in some cases could be better than another credit card.

Nationwide’s FlexDirect current account has an introductory offer and won’t charge any interest for the first 12 months.

If you can repay it within the year, it could be a better option than switching cards.

You should also check if your local council can help.

Some offer interest-free loans to people on a low income but the exact criteria and circumstances vary.

For example, Brent Council has teamed up with the local credit union to offer interest free loans for debt consolidation.

Or Ryedale District Council, Citizens Advice North Yorkshire and Community First Credit Union have also teamed up to offer a Hardship Grant Fund for locals in need.

People can borrow as much as £500 interest-free, subject to availability and affordability.

How to shift your credit card debt quickly

By James Flanders, Consumer Reporter

UK Finance reports that we spend a whopping £2 billion a month using our credit cards.

While that little strip of plastic makes everyday spending easy peasy, it comes at a huge cost.

According to The Money Charity, the average credit card debt sits at £2,485 per household or £1,312 per adult.

And if you’re stuck on a credit card with a high APR and only making the minimum repayments, you could be forking out hundreds of pounds extra in interest charges.

For example, if you owe £1,312 on your credit card and are charged 24.8% APR.

If you don’t make any more transactions and pay £100 a month in repayments, you will pay off the card by September 2025 but at £207 in interest.

However, by hunting around for a better deal elsewhere and switching to a balance transfer credit card with a lengthy interest-free period, you can save yourself £162.

If the same person was accepted for a 28-month-long zero-interest credit card with a 3.4% balance transfer fee and made the same £100 repayments each month.

They would pay off the debt sooner, in July 2025, and only fork out £45 towards the 3.4% balance transfer fee.

Before taking out a new credit card or increasing the amount you borrow, it’s vital to consider the consequences.

You should only borrow money if you can afford to pay it back.

It’s always vital to ask yourself if you need to borrow before committing to a new credit card, personal loan or overdraft.

If you use a credit card, I’d recommend that you always pay off your balance in full at the end of each statement period.

Lenders have a responsibility to help customers who are in debt.

If you’re in a debt crisis, your first point of call should be your lender.

They might help you out by offering you a reduced interest rate or a temporary payment holiday – so check in with your lender if you’re struggling.