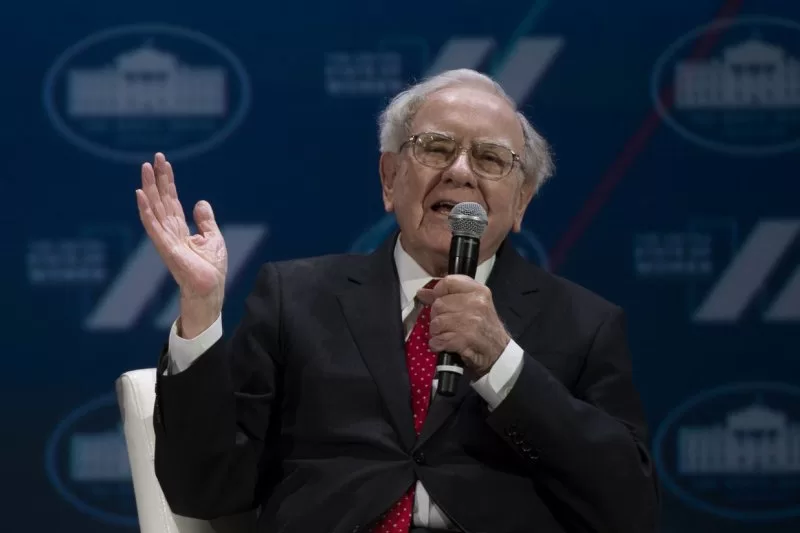

Aug. 28 (UPI) — Billionaire Warren Buffett‘s Berkshire Hathaway market capitalization surpassed the $1 trillion level for the first time Wednesday, according to Dow Jones Market Data.

Berkeshire joins just eight other companies at that level and is the only non-tech $1 trillion and above private-sector company.

The other companies to have reached a $1 trillion market cap include Apple, Amazon, Microsoft, Tesla, Google parent company Alphabet, Meta, Nvidia and Saudi Aramco, owned by the Saudi Arabia government

Cathy Seifert, Berkshire analyst at CFRA Research, said the $1 trillion achievement “is a testament to the firm’s financial strength and franchise value.”

Buffett’s company had a record $277 billion in cash in June, most of it invested in U..S. Treasury bonds. Berkshire owns more of those bonds than the U.S. Federal Reserve.

Unlike the tech companies in that $1 trillion club, Berkshire’s focus is on older economy holdings like BNSF Railway, Geico Insurance and Dairy Queen.

When Buffett took control the company was a textile business in the 1960s. He expanded holdings to include railroad, energy, insurance and retail.

Recently Buffett sold off about half of Berkshire’s Apple investments.

Berkshire Class A shares have increased more than 28% since the first of the year. Class B shares have grown 30%.

The Class A shares were trading Wednesday at $696,442, according to FactSet data. Class B shares were at $464.33 Wednesday.