Article content

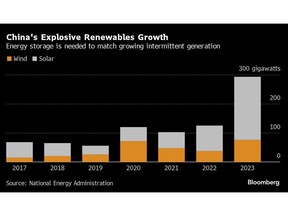

(Bloomberg) — China is rushing to build battery-storage systems to allow electricity grids to cope with rapid increases in intermittent power generation from wind and solar farms. But to truly capitalize on the technology, it needs to ensure they’re used more frequently.

China’s new-energy storage capacity, a segment dominated by lithium-ion batteries, jumped to 44 gigawatts at the end of June, a 40% increase from the start of the year, according to National Energy Administration data. That’s already surpassed the nation’s 2025 target and helped fuel a global boom, with energy storage overtaking electric vehicles last year as the fastest growing market for batteries.

Article content

Costs, meanwhile, have fallen to the point where the combined expense of generating solar and storing it is almost cheap as coal, according to SooChow Securities Ltd.

But the capacity is going largely unused. In the area served by State Grid Corp. of China, which covers more than 80% of the country, the average system was in use 390 hours and had 93 charge-and-discharge cycles in the first six months of the year, according to the NEA. While those numbers represent a near-doubling from the previous year, they still mean that the average system operated only once every other day and sat idle 91% of the time.

The big problem is incentives. Most of China’s energy storage is developed because of provincial requirements that large wind and solar farms either build or rent storage space in order to get permitted. That gives companies a reason to construct systems in order to deliver profitable renewables plants, but little motivation to make sure they’re used.

To create incentives to use the storage, China will need further power market reforms, according to BloombergNEF. Having electricity prices that change at different hours of the day, which many provinces are testing out, can create power trading arbitrage that storage systems can tap into.

Article content

China is in the midst of a clean energy boom, with new wind and solar additions keeping pace in 2024 with last year’s record levels. And so far, the grid has managed to make use of most of that power. Solar and wind curtailments both rose in the first half of the year, but are at relatively manageable levels of 3% and 3.9% respectively, according to the NEA.

Eventually, though, generating so much power that’s only available for a few hours a day will cause major problems for a grid designed to distribute it around the clock. To make sure that doesn’t happen, China needs to lean more heavily on its fleet of batteries.

On the Wire

China’s unpasteurized milk prices have plunged below the cost for the first time on record as production capacity continues to surpass demand, Securities Daily reported.

China’s activity data for July will probably show the recovery stuck in low gear at the start of the third quarter, said Bloomberg Economics.

China aims to make significant progress in reducing pollution and carbon emissions by 2035, state-run Xinhua news agency reported.

This Week’s Diary

Article content

(All times Beijing unless noted.)

Monday, Aug. 12:

- China to release July aggregate financing & money supply by Aug. 15

- China’s monthly CASDE crop supply-demand report

Tuesday, Aug. 13:

- EARNINGS: WH Group, MMG, HK Electric

Wednesday, Aug. 14:

- CCTD’s weekly online briefing on Chinese coal, 15:00

- EARNINGS: Power Assets

Thursday, Aug. 15:

- China sets monthly medium-term lending rate, 09:20

- China home prices for July, 09:30

- China industrial output for July, including steel & aluminum; coal, gas & power generation; and crude oil & refining. 10:00

- Retail sales, fixed assets investment, property investment, residential sales, jobless rate

Friday, Aug. 16:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:00

- EARNINGS: Hongqiao

Share this article in your social network