STRUGGLING households could be missing out on an extra £300 this winter by not claiming benefits that they are entitled to.

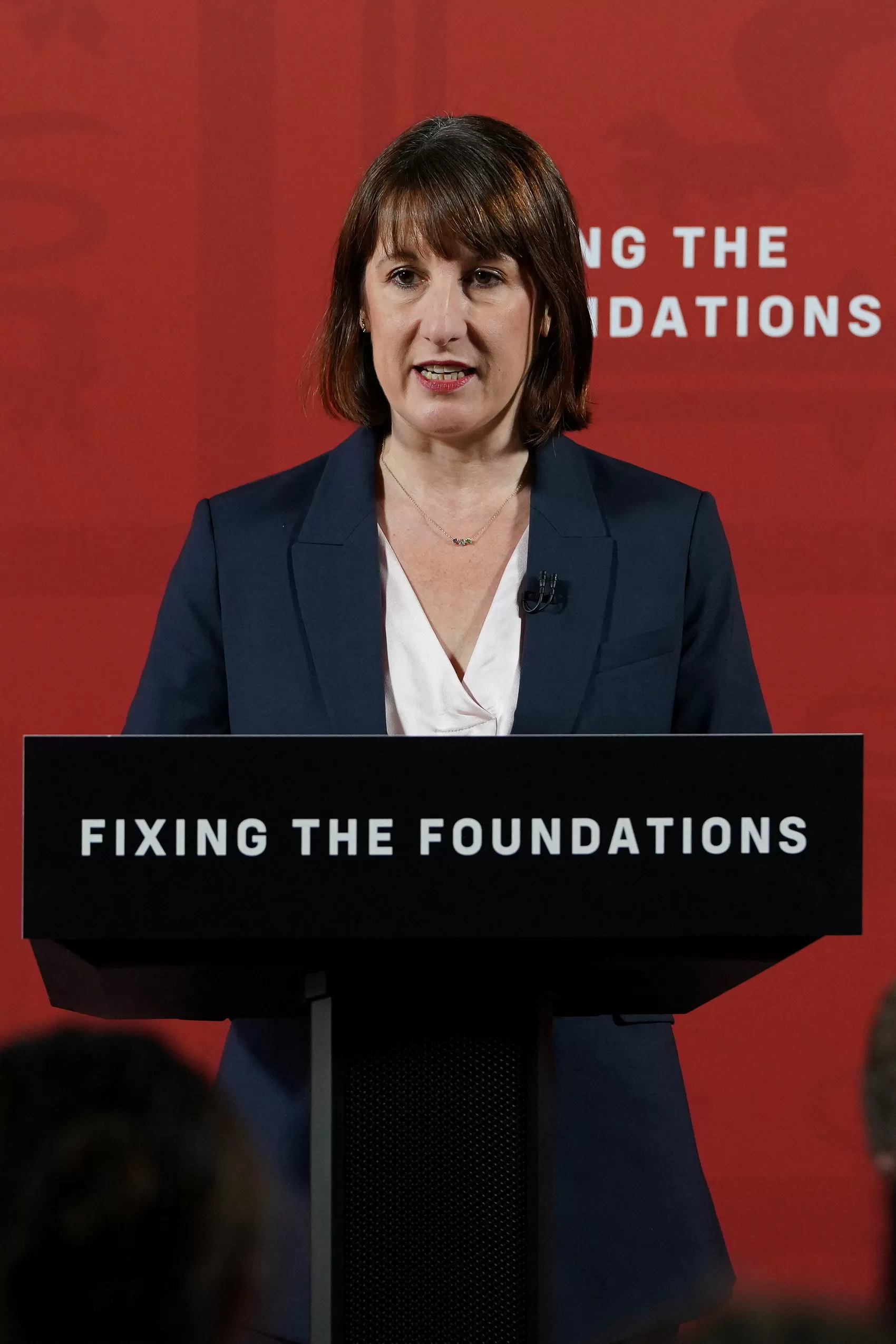

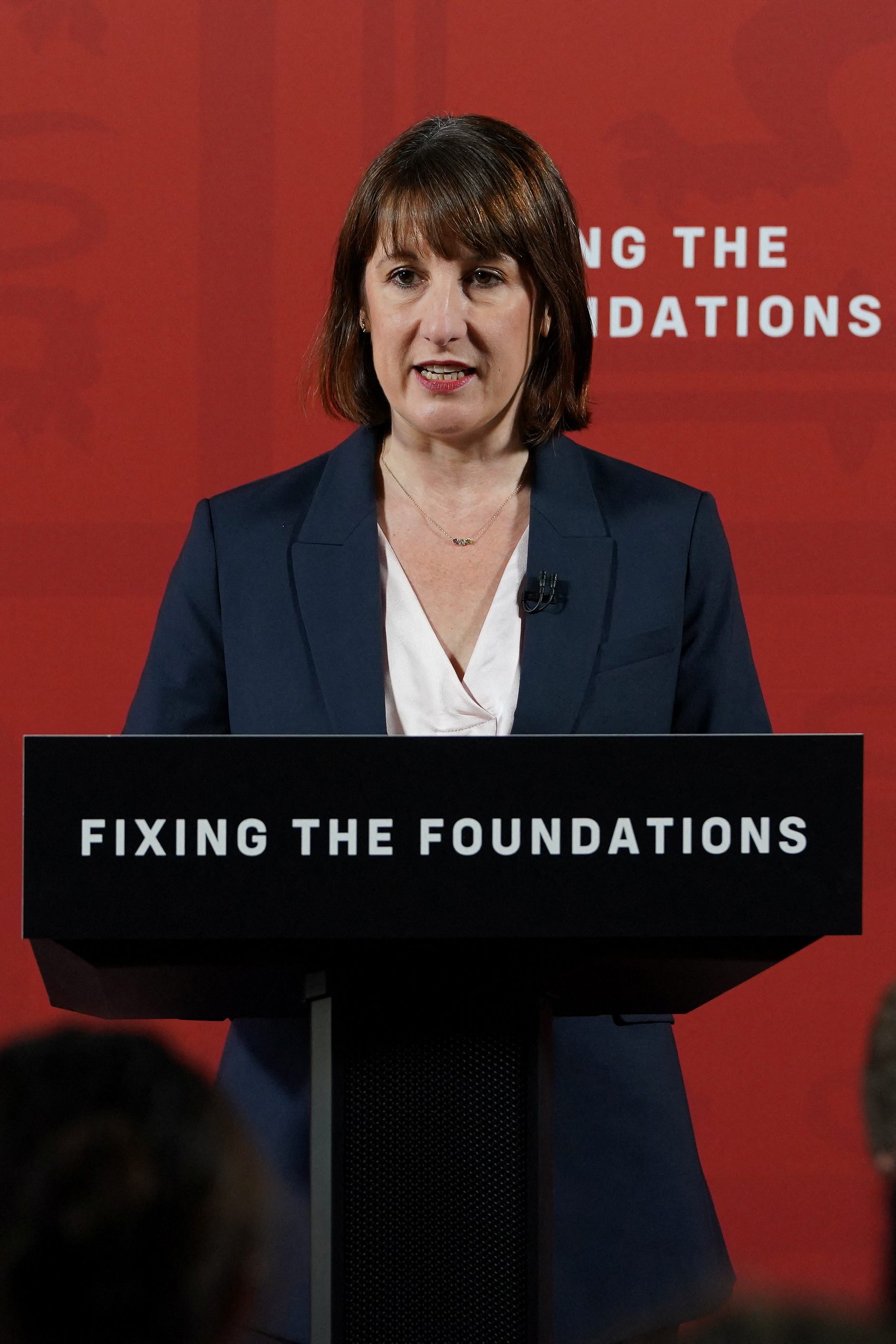

It comes as chancellor Rachel Reeves slashed the amount of pensioners who are now entitled to the Winter Fuel Payment.

Only those on Pension Credit, or other means-tested benefits, will qualify for the £300 energy bill help starting this year.

The government’s chief financial minister made the decision to help plug a £22bn black hole in the public purse – but thousands have been left fearful over how they will pay their fuel bill as a result.

A report released this week by Policy in Practice found that 850,000 pensioners could get access to the cash boost if they checked their eligibility for Pension Credit.

The state benefit also gives you extra money to help with your living costs if you’re over the state pension age and on a low income.

You can get up to £3.900 a year from claiming the help.

There are many tools online which allow you to check if you are entitled to benefits such as Pension Credit and the Winter Fuel Payment.

How to check what you’re entitled to

You can find free-to-use online benefits calculators to work out what you’re entitled to.

We’ve narrowed down some easy ones you can use.

Before using the tools, make sure you have key financial information to hand, such as bank and savings statements, and information on pensions and existing benefits.

If you live with a partner or family, get their basic financial information together too as this could affect your claim.

Once you’ve used the tools you can use the contact information on Gov.uk to get the ball rolling and apply for what you’re owed.

Of course, the tools only provide an indicator of what benefits you can claim, so in some cases you may be entitled to even more.

For example, you will qualify for extra financial help if you have disabled child or you’re a carer.

Age UK’s Benefit Calculator

Age UK is a charity in the UK which supports older people.

The website also has an online calculator which helps you work out what benefits you could be entitled to including the Winter Fuel Payment and Pension Credit.

According to the site it takes 10 minutes to complete and you will need the following information:

- Your savings

- Your income, including your partner’s if you have one

- Any benefits or pensions you’re already claiming, including anyone you’re living with.

The calculator is free to use and confidential.

If you run out of time, you can save your calculation and come back to it later, and pick up right where you left off.

Entitledto’s benefits calculator

Entitledto’s free calculator works out whether you qualify for various benefits, tax credits and Universal Credit.

If you run out of time to complete the form in one go you can save your results and come back later but you will need to sign in or register.

You can do this using Facebook, Google or by setting up an Entitledto account.

If you don’t want to register, consumer group MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data that let you save your results without logging in.

Instead, you’re provided with a unique code to note down and use when you want to revisit the questionnaire.

Turn2Us’ benefits calculator

Charity Turn2Us’ benefits calculator works out what means-tested benefits you might be entitled to, as well as whether you qualify for carers allowance.

It points out that it doesn’t calculate non-means tested benefits and contributory benefits, but it will include these in your results if you’re already getting them.

What’s handy about this calculator is you can save your answers and come back to them at a later date – but you will need to input your email address to do this.

You’ll also be given a unique calculation reference code so make sure you note it down in case you need to contact the charity about any problems with your results.

Other options

If you do not want to use an online calculator there are other options available.

For example, you can also check with a local benefits adviser to find out what you could be entitled to.

The website advicelocal.uk lets you enter your post code and informs you of your nearest adviser and how you can contact them.

For example if you enter on the website that you live in Wandsworth, London they give you the details of the nearest support in the area.

In this instance, it was the borough’s local Age UK and Citizens Advice.

You should be aware that many organisations do not offer an open-door service.

If you are planning to contact an organisation for help or advice you might want to check their website for more information before doing so.

If you are worried about fuel payments this winter, it is worth having getting informed about all the support you could be eligible for.

The Sun recently published a guide unveiling the full list of financial worth £5,810 that you can check out.

Changes to the winter fuel allowance

Following last month’s announcement, only those in receipt of pension credit, or other means-tested benefits, will receive the winter fuel payment from this year onwards.

The benefits that will entitle you for the payment are as follows:

- Pension Credit

- Universal Credit

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment

- Support Allowance

In most cases, under the old rules, you would get a winter fuel payment if you were born before September 25, 1957.

You needed to live in the UK, but you may have also qualifed if you moved to a specific country before January 1, 2021, and have a link to the UK.

This includes having lived or worked in the UK or having family in the UK. The list of eligible countries was as follows:

- Austria

- Belgium

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- Germany

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Netherlands

- Norway

- Poland

- Romania

- Slovakia

- Slovenia

- Sweden

- Switzerland

In some circumstances, you wouldn’t be eligible for the winter fuel payment, even if you were born before September 25, 1957.

You wouldn’t qualify if:

- you have been in hospital getting free treatment for more than a year

- you need permission to enter the UK and your granted leave says that you cannot claim public funds

- you were in prison for the whole of the week of 18 to 24 September 2023

Those living in a care home were also not eligible for a winter fuel payment, if both of the following applied:

- you get pension credit, income support, income-based jobseeker’s allowance (JSA) or income-related employment and support allowance (ESA)

- you lived in a care home for the whole time from June 26 to September 24, 2023

Do I need to apply for the payment?

It isn’t known if under the new rules, you will need to apply for the payment, or if it will be made automatically.

Under the old system, you didn’t have to apply to claim the winter fuel payment, say for example if you receive any of the following benefits:

- state pension

- pension credit

- attendance allowance

- personal independence payment (PIP)

- carers allowance

- disability living allowance (DLA)

- income support

- income-related employment and support allowance (ESA)

- income-based Jobseeker’s allowance (JSA)

- awards from the war pensions scheme

- industrial injuries disablement benefit

- incapacity benefit

- industrial death benefit

How much is the winter fuel payment?

Payments last year were worth between £300 and £600, depending on your specific circumstances.

This is because the amount included a “Pensioner Cost of Living Payment” – between £150 and £300.

However this year, it will be worth £200 for eligible households, or £300 for eligible households with someone aged over 80.

That means depending on your circumstances you could receive up to £300 in free cash.

How do I apply for pension credit?

YOU can start your application up to four months before you reach state pension age.

Applications for pension credit can be made on the government website or by ringing the pension credit claim line on 0800 99 1234.

You can get a friend or family member to ring for you, but you’ll need to be with them when they do.

You’ll need the following information about you and your partner if you have one:

- National Insurance number

- Information about any income, savings and investments you have

- Information about your income, savings and investments on the date you want to backdate your application to (usually three months ago or the date you reached state pension age)

If you claim after you reach pension age, you can backdate your claim for up to three months.