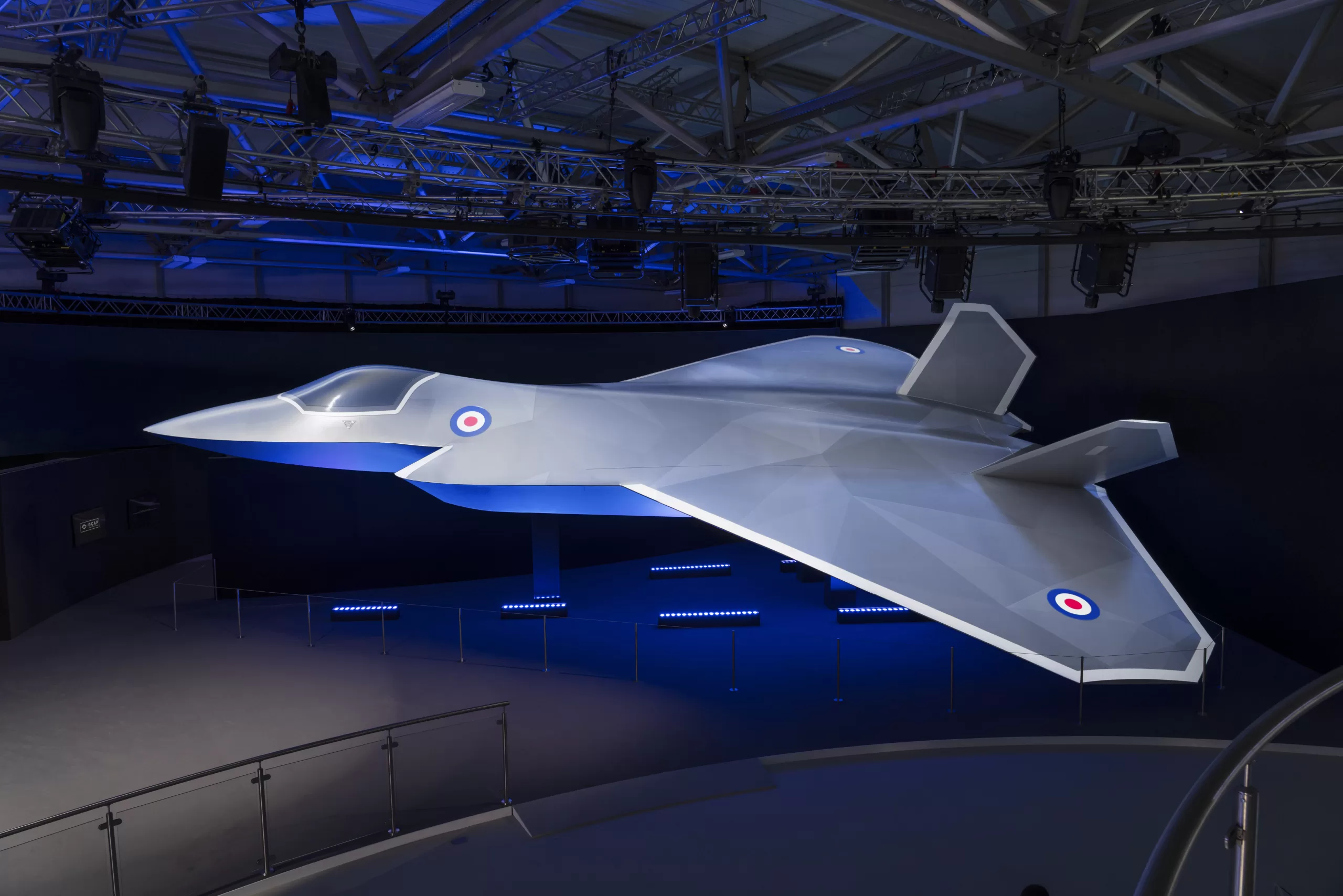

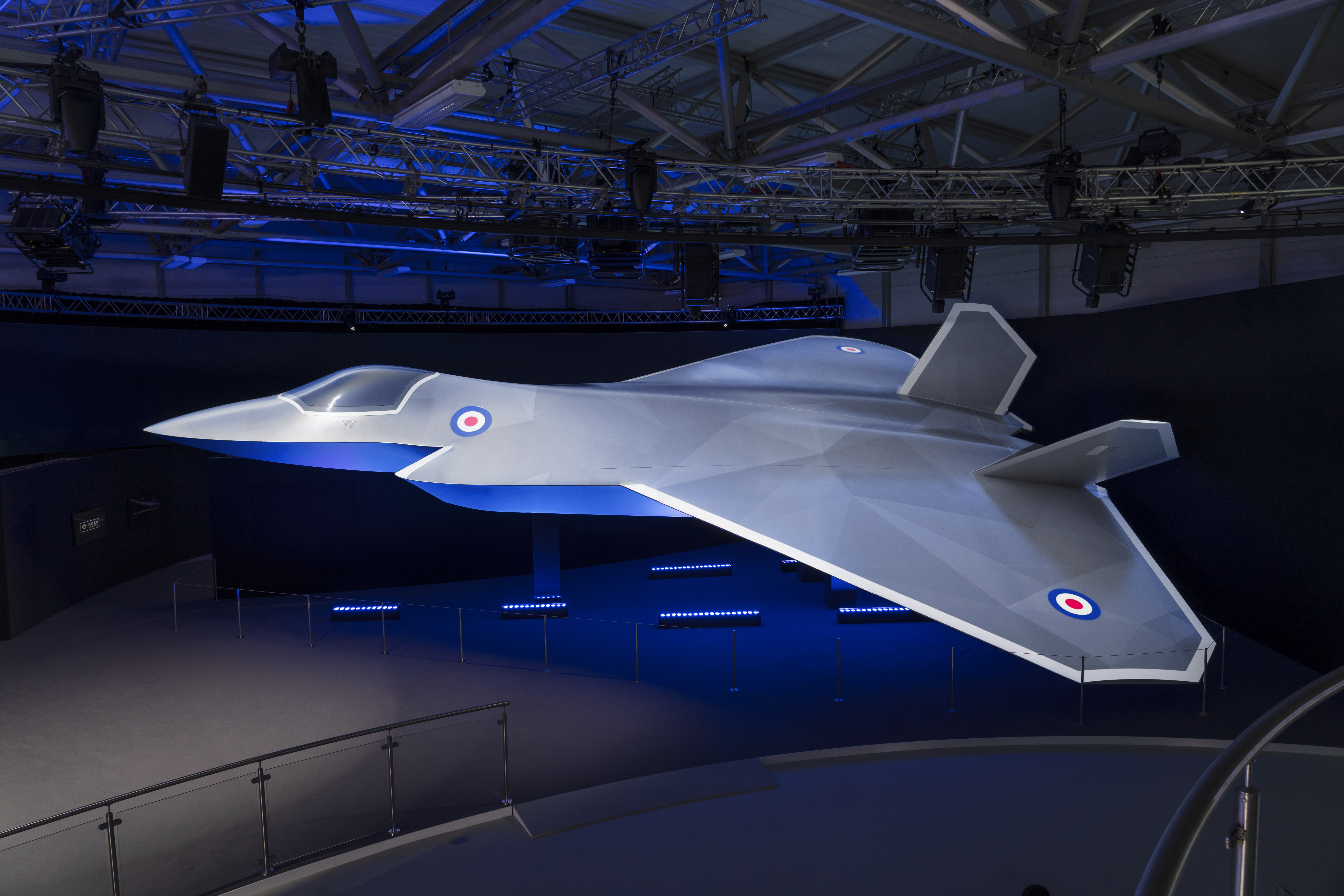

DEFENCE giant Bae Systems has opened the door to more “like-minded” countries joining the UK-led Tempest project amid speculation about the fighter jet scheme.

BAE has the lead on the development of the Global Combat Air Programme (GCAP) alongside Japan and Italy.

Sir Keir Starmer last week called the £12billion initiative “important” but stopped short of committing to its funding.

Concerns are mounting that Labour’s strategic defence review could see it axed to save cash.

Some have suggested the UK could, instead, buy F-35s, made by US firm Lockheed Martin.

They would be ready earlier than the 2035 schedule for Tempest’s first aircraft.

Charles Woodburn, chief executive of BAE, told The Sun: “As with any defence review it’s a bit pointless trying to speculate at early stages.

“Everyone is jockeying for positions and commentators have different perspectives.

“We have a very strong case for GCAP.”

He said the stealth fighter scheme — the key project in BAE’s 50,000-staff combat air division — was predicted to inject £37billion into the UK.

Mr Woodburn added that the government recognised that defence spending was a “driver for economic growth”.

He said partnering with other countries was the best option for Tempest.

He went on: “We’ve always said we want the strongest team possible and with Italy and Japan we have a strong team.

“It would take our other partners to also agree to [an extension of that partnership].

“We and the company are very happy to see that partnership expand with like-minded partners. I am not going to speculate as to who.”

Europe’s Airbus is working on a French, German and Spanish fighter jet and has signalled it would be willing to collaborate with Tempest, particularly sharing technologies on weapons.

Saudi Arabia has also signalled interest in joining the project but it has deepening military ties with China, which could pose security concerns for the UK and Japan.

BAE, meanwhile, yesterday boosted its profit forecasts for the full year after winning £15billion of new orders in the last six months.

The firm said it was benefitting from the “elevated threat” environment since Russia invaded Ukraine and the ongoing conflict in Gaza.

MORTAGE WOE

FIRST time buyers are spending almost 40 per cent of their salary on mortgage payments, Nationwide said.

The building society also revealed house prices rose last month at their fastest rate since December 2022.

A 0.3 per cent increase in July on the previous month saw the average price hit £266,334.

The lift is also 2.1 per cent higher than last year, meaning homes cost on average £10,000 more than in 2023.

Prices are set to continue to rise, after yesterday’s Bank of England rate cut to 5 per cent.

BANK THANKS

THE boss of Barclays has praised Wimbledon organisers for “resisting pressures” to drop the bank’s sponsorship of the tennis tournament.

CS Venkatakrishnan thanked institutions for their support in the face “ultimately misguided” protesters.

Pro-Palestinian and climate activists have accused the bank of having financial interests in weapons and fossil fuels.

Barclays denies this.

The comments came as Barclays announced a £1.2billion award for investors after £1.9billion profits for the last quarter.

PLANE engine maker Rolls-Royce will start paying dividends again for the first time since the pandemic.

The engineering giant hailed its recovery yesterday with a 70 per cent jump in operating profits to £1.1billion.

WIZZ BILL SENDS IT PLUNGING

SHARES in Wizz Air were sent in a tailspin yesterday when the budget airline posted a sharp drop in profits after it had to pay for replacement planes.

Profits nosedived from £51million to £1million in the last three months, sending shares plunging by as much as 18 per cent.

It comes after the airline grounded a fifth of its planes because of engine problems.

In a bid to keep airport slots and flight routes, Wizz had to lease eight stand-in planes and crew, costing £32million.

Despite the disruption, it still carried 15.3million passengers over the last three months, 0.5 per cent more than last year.

Boss Jozsef Varadi said it will prioritise investment in Eastern Europe over the UK as demand was softening from British holidaymakers.

The carrier said it expects to return to growth next summer and still plans to double its fleet of planes by 2030.

ENERGY PAIN ‘END’

WAEL Sawan, the boss of Shell, has claimed the energy crisis is at an end — as the price of oil, electricity and gas has fallen back to levels before Russia’s invasion of Ukraine.

He told The Financial Times it was “moving back to a normalised price and [profit] margin level that is pre-2022”.

It came as Shell reported adjusted profits had risen by almost a quarter to £4.9billion over the last three months.

It is handing a further £2.7billion to investors in buybacks.

NEXT IS ON FIRE

FASHION retailer Next is enjoying its time in the sun, upgrading its profit guidance for the eighth time in a row.

The high street giant, which also owns Fat Face, Reiss and Joules, said it now expects to make £980million this financial year — £20million more than forecast.

Analysts at Shore Capital said they believed “£1billion of profits is touching distance away”.

The boost to forecasts came on the back of better than expected recent trading.

Next, modelled by Myleene Klass, said full-price sales in the UK were slightly ahead of forecasts, up by 0.4 per cent.

But in warmer climes business has boomed.

Next’s online overseas sales rocketed by 22 per cent.