MILLIONS are using delivery apps such as Uber Eats and Deliveroo to buy supermarket groceries.

But you could be paying up to three quarters more compared to getting an online shopping home delivery.

Despite inflation slowing, grocery prices are still hitting customers in the pocket.

This week, Rosie Taylor investigates how much more you are forking out for a quick-delivery food shop.

COMPARING BASKETS

SHOPPERS are increasingly using delivery apps to order groceries from supermarkets.

The number of people turning to Uber Eats to get their shopping from stores such as Sainsbury’s, Co-Op and Waitrose has nearly doubled over the last two years.

Deliveroo has seen “strong growth” in the number of people ordering medium-sized baskets through the app, from stores including Asda, Morrisons, Sainsbury’s, Co-Op and Waitrose.

Many find it quicker and easier than ordering online directly with supermarkets as there is no need to book a delivery slot and the groceries usually arrive within an hour.

But apps often charge delivery and service fees, and supermarkets are also hiking the prices of their products if you order them this way.

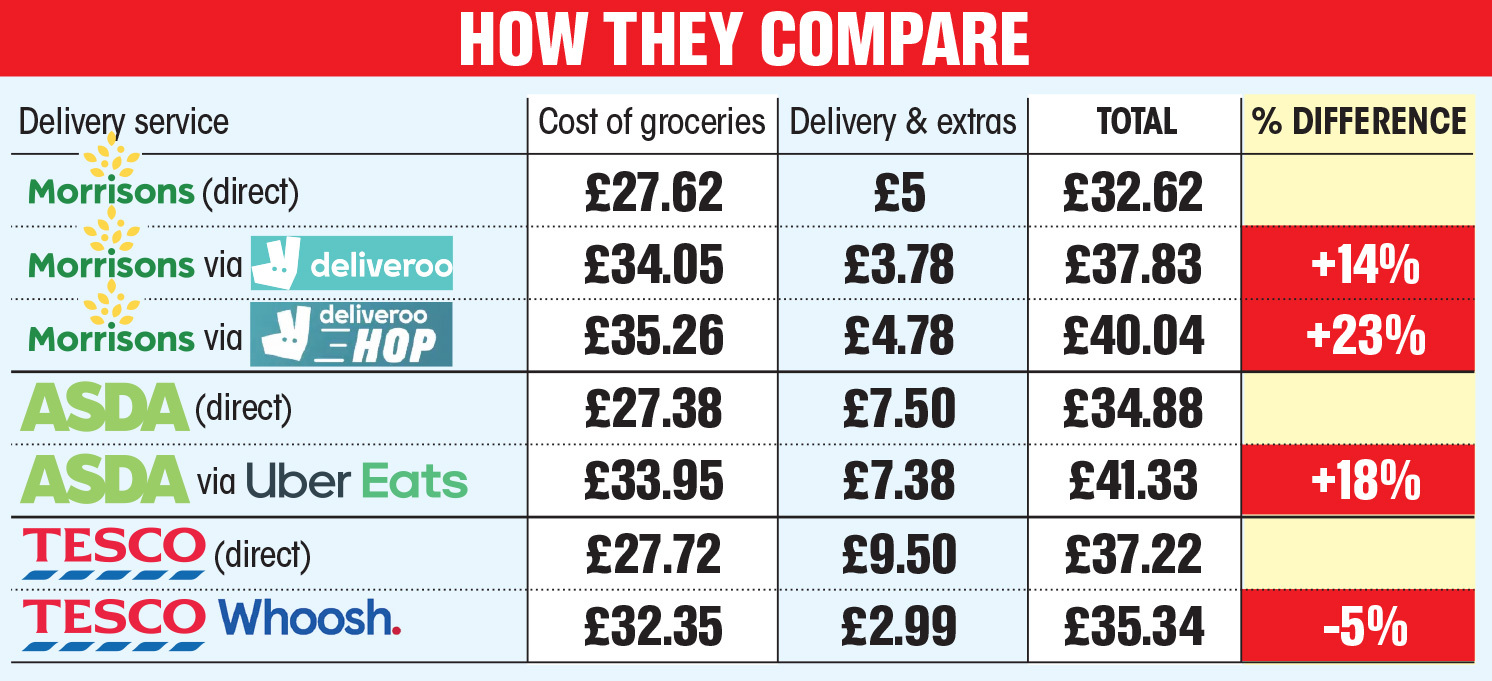

To see how grocery costs compared, we first ordered a basket of 11 everyday items — milk, bread, eggs, cheese, tomatoes, bananas, pizza, bacon, lager, loo roll and shampoo — from Asda through Uber Eats, Morrisons through Deliveroo, and via Tesco’s instant delivery Whoosh service.

We then compared this with costs of ordering a home delivery directly from the super-markets’ websites, including any delivery and service fees charged.

For home deliveries, we included the price of the soonest available delivery slot.

EXTRA COSTS

Although we expected some prices to be higher when ordered through apps, we were shocked to find some popular supermarket products cost up to three quarters more through apps such as Uber Eats and Deliveroo, compared with ordering a home delivery direct from the supermarket.

Overall, shoppers are paying around a quarter more — up to around £7.42 extra per basket — for exactly the same goods if ordered through a delivery app.

Buying the basket cost £27.62 direct from Morrisons, plus a £5 charge for a home delivery — a total of £32.62.

But the exact same items cost £34.05 if ordered from Morrisons via Deliveroo, plus £3.78 in service and delivery fees and charges, which took the total to £37.83.

It was even more expensive to order Morrisons groceries via Deliveroo HOP, where drivers pick up items direct from a Deliveroo warehouse instead of the store.

The groceries cost £35.26 — 28 per cent more than the in-store price — and the fees and charges added £4.78, taking it to a total of £40.04.

It was then a similar picture with Asda.

In total, ordering the basket of groceries through Asda’s website cost £27.38, plus a home delivery charge of £4.50 and a £3 fee for ordering less than £40 worth of shopping. In total, it cost £34.88.

But exactly the same products cost £33.95 when ordered through the Uber Eats app, which was £6.57 more — a price increase of 24 per cent.

Including service and delivery fees and charges of £7.38, our shopping cost £41.33 on the app — 18 per cent more overall.

EXTREME PRICE HIKES

The prices of several popular products were set much higher on the delivery apps than on supermarket websites.

We found Morrisons’ stonebaked pizza, which costs £2.29 on its website, was £3.99 through Deliveroo HOP — a 74 per cent increase.

And a 350g pack of Cathedral City mature Cheddar cost £2.75 through Morrisons’ website, but £4.20 through both Deliveroo and Deliveroo HOP.

We also found that almost all items cost 24 per cent more through the Uber Eats app than ordering directly from the Asda website.

But a pack of four bottles of Peroni lager was a third more, at £8.98 on the app, when compared with £6.75 through Asda’s website.

Only bread and milk cost the same on both.

Tesco has its own instant delivery service, Tesco Whoosh, where drivers pick up orders at Tesco Express stores.

Shoppers can order Whoosh through the Tesco app or website.

Like other instant delivery services, it costs significantly more than standard prices.

Ordering five bananas cost 78p through the regular home delivery service, but £1.35 through Whoosh — a 73 per cent increase.

And two pints of semi-skimmed milk cost £1.20 through the standard website — but set us back an extra 25p, at £1.45, through Whoosh.

Overall, our basket of goods cost £27.72 when ordered through Tesco’s regular online shopping website.

But we had to cough up £32.35 for the same basket through Whoosh — a 17 per cent increase.

‘At the very least, shops should be transparent about the premiums that they are charging’

CONSUMER experts said it was “not reasonable” for super-markets to raise prices by so much, and that they need to be “transparent” with shoppers.

James Daley, at fairerfinance.com, said: “Ordering groceries from delivery apps is much quicker than booking an online supermarket shop.

“But while it’s right you pay a premium for that service, it’s less justifiable for shops to mark up their products and exploit their customers.

“If they need to charge a fee for servicing the delivery, then fine. But it’s not reasonable to increase the price of products by as much as 75 per cent.

“At the very least, shops should be transparent about the premiums they are charging for these convenience services.”

In response, Deliveroo said grocery prices were set by retailers and it “regularly reviewed” its prices.

A spokesman for Deliveroo and Morrisons said: “Deliveroo always seeks to offer great choice, availability and value for money to our customers.”

A Tesco spokesman said the Whoosh rapid delivery service was “an easy option aiming to deliver to your door within an hour”.

They did not comment on pricing.

Asda and Uber Eats did not respond to requests for comment.

Whoosh can be cheaper than Tesco if order is under £50

ALTHOUGH the groceries cost more through Whoosh than the standard Tesco service, if you are buying fewer items it could work out cheaper.

This is because Tesco charges a hefty £5 fee if you order less than £50 worth of groceries through its regular website, on top of its home delivery charges.

There is no such penalty charge for Whoosh.

So although the groceries were much cheaper through Tesco online delivery, the £5 minimum basket charge and £4.50 delivery fee took the total home delivery price to £37.32.

In contrast, Whoosh only charged £2.99 for delivery on the £32.35 basket, making the total price £35.34 – or five per cent cheaper than home delivery.

‘EE told me scammer had my iPhone…and billed me’

Q: I POSTED an iPhone back to EE in April after they sent me the wrong model, but I am now being chased by debt collectors for £1,076 related to a contract for that phone.

I had taken out a new contract for an iPhone 15, but was sent an iPhone 14 instead, so I returned it and got confirmation that it had been delivered.

But then I received a bill for the phone and, when I contacted EE, they said I had mistakenly returned the phone to a scammer.

We went round in circles until eventually they admitted they had received it, but they still haven’t wiped my debt.

Can you help?

Keiran Grant South London

A: WHAT a mess you ended up in after opening a phone contract with EE in April – and through no fault of your own.

You ordered a contract for an iPhone 15, but when your parcel arrived you realised it was an iPhone 14 instead.

After calling EE, you were told to post the phone back to its offices in Darlington so it could investigate, which you did the very same day.

You received confirmation it had been delivered a few days later and you even called EE to double check.

But at the start of July, you received a bill for £1,076, and then received a letter from debt collectors chasing the money.

When you contacted EE to ask what the bill was for, you were told you had been a victim of fraud and you had sent the phone to a fraudster’s address.

The call handler also advised you to close your bank accounts in case they were compromised, which left you very stressed and unable to sleep.

But it later turned out none of this was true. You had sent the phone to the right place.

In fact, it had been sitting unopened on a desk in EE’s office for three months.

But despite this, you are still being hassled about the debt and you are worried this will impact your credit score.

When I spoke with EE, it apologised for the error and said it has wiped the £1,076 charge and has applied an additional £125 to your account as a goodwill gesture.

Laura Purkess

How to pay less credit interest

HALF of credit card customers are paying interest on their balances each month, warn experts.

Millions are being urged to shift debt and save money.

Here, James Flanders explains how to cut your rate and get out of debt . . .

RISING RATES: Ten years ago, in April 2014, the typical credit card representative APR was 17.9 per cent.

Fast-forward to April 2024 and the average rate has climbed to 24.8 per cent, a 6.9 per cent rise.

Some lenders have hiked rates even more.

For example, John Lewis has increased the representative APR on its credit cards from 16.9 per cent to 27.9 per cent, an 11 per cent rise.

HOW TO CUT YOUR REPAYMENTS: Credit card customers can escape interest payments for up to 29 months by shifting debt to a balance transfer card for a small processing fee of two to four per cent.

Alastair Douglas, chief executive of TotallyMoney, said: “If you’re paying interest on your credit card each month, consider a balance transfer. It’ll stop you paying interest so you can focus on repaying debt. You could save hundreds if not thousands of pounds.”

With the market leading offer, customers can save £1,417 on the typical interest-bearing credit card balance of £2,901, according to TotallyMoney.

Those with less perfect credit scores might be eligible for a 16-month card, saving £736, while those with poor credit scores might still save £370 over nine months.

HOW DO THESE CARDS WORK? A balance transfer credit card can be a useful option if you have debt across several cards or are facing high interest rates.

They allow you to move the balance from other cards to a new one, where you pay no interest for a set period.

This makes debt easier to pay off as the money saved on interest can be used to reduce the principal.

Note that you can’t transfer a balance between cards from the same bank.

FIND THE BEST DEAL: Before applying for a new credit card, always use an eligibility calculator, since every credit application affects your credit score.

Some of the best cards currently available include Tesco Bank’s, which is offering a 29-month zero interest deal with a 3.49 per cent transfer fee.

To assess all cards, visit price comparison websites like MoneySavingExpert’s Cheap Credit Club or Compare the Market.

Once you’ve found a card, make a formal application.

If your application is approved, transfer the balances within a set period, usually around 60 or 90 days.

Your old balance will be cleared and you can start interest-free repayments on your new card.

GET FREE DEBT HELP: Several organisations can help with debt problems for free.

Call Citizens Advice on 0800 144 8848 (England) or 0800 702 2020, (Wales), or StepChange on 0800 138 1111.