Article content

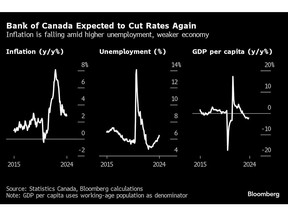

(Bloomberg) — The Bank of Canada is likely to cut interest rates for a second straight meeting as it aims to steer clear of a recession while avoiding an inflation flare-up.

Governor Tiff Macklem has said he sees a soft landing — a slowdown that cools price pressures but doesn’t trigger mass job losses — on the horizon. He became the first Group of Seven central banker to lower borrowing costs last month, and economists and markets widely expect another cut to the key policy rate on Wednesday, to 4.5% from 4.75%.

Article content

Macklem’s task will be assuring Canadians the bank is on the right track despite obstacles ahead. On one side, there is inflation risk: though the headline figure slowed in June, core measures are sticky. On the other, there is economic danger: half of mortgage-holders still need to renew their contracts at higher rates, and government efforts to curb temporary migration will remove an artificial sweetener that has masked souring consumer sentiment.

“So long as disinflation continues, the Bank of Canada has a narrow path to a soft landing — but that requires them to keep cutting rates,” Dominique Lapointe, an economist with Manulife, said by email.

The stakes are high for Macklem, who faced criticism for promising Canadians in 2020 that rates would stay low for “a long time” — and then for delaying the pivot to rate hikes as inflation surged. But the governor appeared confident leading his central bank peers last month and will likely reiterate on Wednesday that further cuts are possible as long as price pressures keep waning.

The bank will also release a fresh batch of economic forecasts, which are likely to match the muted optimism of analysts in a Bloomberg survey. They see headline inflation decelerating from its current 2.7% annual pace to hit the central bank’s 2% target by the end of 2025, when the economy will also be expanding at a 2% yearly clip.

Article content

Macklem and his officials are unlikely to provide explicit forward guidance on Wednesday, instead repeating that they’ll take decisions one meeting at a time as they weigh incoming data. They’ve said they expect the path to lower borrowing costs to be “gradual,” and economists predict the key rate will reach 3% by the end of next year.

Still, cutting twice in a row — and well ahead of others including the Federal Reserve — will raise questions about how quickly the Bank of Canada plans to normalize borrowing costs.

Moving more swiftly would allow policymakers to get ahead of coming mortgage renewals, reducing the payment shock for homebuyers who signed on at rock-bottom rates during the pandemic. But cutting too fast has the potential to reignite cost pressures or the country’s supply-squeezed housing market.

After the June rate decision, one inflation report surprised to the upside. Though the next print showed a slowing headline figure, a three-month moving average of core measures accelerated to 2.91%. That’s likely to give some policymakers pause – a summary of deliberations from last month’s meeting showed they debated whether more disinflation proof was needed before easing.

Article content

Still, Canada’s labor market is loosening, with the unemployment rate up a full percentage point from a year ago to 6.4%. Job gains have failed to keep pace with explosive population growth, driven by temporary residents such as foreign workers and international students. Prime Minister Justin Trudeau’s government has already taken measures to curb the growth of those migrants and plans an overall cap on the cohort in the coming months.

While wage growth remains elevated — an inflation risk amid the country’s poor productivity, a measure of gross domestic product per worker – labor shortages have mostly disappeared, which officials will likely say lessens their concerns about compensation pressures.

Last week, the bank’s quarterly business and consumer surveys showed subdued inflation expectations and normalizing of firms’ pricing behaviors, two indicators the central bank is watching closely.

“All these things seem to be pointing in the right direction,” Dawn Desjardins, chief economist at Deloitte, said in an interview. “I think it does tip the scale toward them easing.”

—With assistance from Jay Zhao-Murray.

Share this article in your social network