Article content

(Bloomberg) — President Xi Jinping will unveil his long-term vision for China’s economy as he wraps up a twice-a-decade conclave on reform, days after unexpectedly weak growth figures piled pressure on Beijing to act urgently to reinvigorate domestic demand.

The ruling Communist Party is set to publish a document on Thursday — typically written in cryptic and sweeping language — offering the first glimpse of what some 400 officials discussed behind closed doors during the four-day meeting in Beijing. Normally, that communique is fleshed out days later by a more detailed report.

Article content

Policies are likely to be centered around the Chinese leader’s twin quests for technology-driven “high-quality growth” and “Chinese-style modernization” — vague slogans that signal Xi’s desire to build a more equitable society driven by advanced manufacturing that gives Beijing resilience against US trade curbs.

“Advancing Chinese modernization requires staying independent and maintaining self-reliance,” Xi said, according to a collection of quotes by the Chinese leader published by party magazine Qiushi this week. “We must develop our country and our nation with our own strength, and maintain a firm grasp on the future of China’s development and progress.”

The Third Plenum of the party’s 20th Central Committee will mark the first such meeting since 2013 to be focused on reform, after Xi skipped using the huddle for major policy moves in 2018. The summit comes as China battles a years-long real estate crisis, which has prompted the longest deflationary streak since 1999, and as leaders contend with a shrinking population.

While overhauling China’s consumption tax to expand local authorities’ income through levies on luxury goods, reforming the local registration system known as hukou, and boosting support for artificial intelligence have all been floated as possible outcomes, the detailed agenda of the event — like most things in Beijing’s opaque system — has been a mystery to outsiders.

Article content

Measures to propel Beijing’s electric car and green energy sectors will be closely watched at home and abroad, where trade partners are complaining a flood of cheap exports is threatening jobs. The European Union is imposing tariffs on electric vehicle exports from the world’s No. 2 economy, while former US President Donald Trump has pledged a 60% tax on goods from China, if reelected in November.

Economists have listed the real estate downturn, technology self-sufficiency, and local fiscal strains as the top three economic issues Chinese leaders should tackle in the medium-to-long term. Expectations are low for the plenum revealing the kind of major policy pivot seen in the past, such as when paramount leader Deng Xiaoping paved the way to open China’s economy in 1978.

At the same meeting in 2013, Xi outlined ambitious reforms that included further loosening the one-child policy and encouraging private investment into state businesses. Since then, rising geopolitical tensions have changed the priorities of China’s top leaders who are putting greater emphasis on national security.

Article content

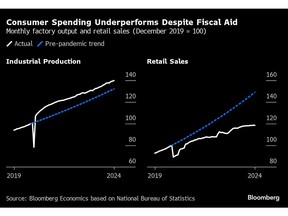

Chinese leaders are betting on the factory engine to propel growth in the post-pandemic era, rebuffing widespread calls from economists to rebalance the economy by boosting domestic spending. Stimulating consumers has proved hard as the property crisis hits Chinese citizens’ primary store of wealth, making it easier for policymakers to focus on corporate investment.

A $41 billion property rescue package for local authorities to buy existing new units and convert them into affordable housing has been hailed as a step toward putting the property market on firmer ground. Ending the slump will likely require a much larger cash injection — something that could cause financial markets to rally if surprisingly hinted at by the plenum.

Specific policies taking cues from the plenum are more likely to come from this month’s huddle of China’s 24-man Politburo, which typically focuses on economic issues for the rest of the year in July.

“Comprehensive reforms require a coherent direction among policy areas — from fiscal, housing and financial to industrial development,” Australia & New Zealand Banking Group Ltd. economists including Raymond Yeung wrote in a note last week. “The Third Plenum is an opportunity to overcome piecemeal measures.”

Share this article in your social network