It’s crunch time in the NBA’s negotiations for a new media rights deal that could have a significant effect on the TV business.

The NBA has finalized the contracts for a new 11-year deal that will return its games to broadcast network NBC and bring the league to Amazon’s Prime Video streaming platform, according to a person familiar with the matter who was not authorized to comment.

The contracts, first reported by the New York Times, will pay the league $76 billion over its term and will go to team owners for approval next week, . Current NBA rights holder Warner Bros. Discovery’s TNT will have an opportunity to make a matching offer, most likely the $1.8-billion-a-year offer from Amazon.

If TNT does not match, it will lose the NBA after the 2024-25 season, depriving it of a cornerstone of its programming.

Representatives at NBC Sports, TNT and Amazon declined to comment on the negotiations. The NBA did not respond to requests for comment.

Another person familiar with the situation who was not authorized to comment said Warner Bros. Discovery had not been officially told by the league that the other contracts had been finalized.

The NBA’s departure from TNT would be the most significant loss of a TV sports property since CBS was outbid by Fox for the NFL’s National Football Conference package in 1993. The addition of the NFL transformed Fox into a full-fledged broadcast network, while CBS went into a tailspin, losing viewers and key affiliate stations.

The new NBA deal would also spell the end of “Inside the NBA,” TNT’s highly regarded studio show with Charles Barkley, Shaquille O’Neal, Kenny Smith and Ernie Johnson.

NBC parent company Comcast is expected to pay $2.5 billion a year in the new deal. NBC, which has the ability to reach nearly every household in the U.S., will carry an exclusive weekly prime time game and a piece of the conference finals in the new package. Comcast also gets some games for its streaming platform Peacock.

NBC last held NBA media rights from 1990 to 2002 during the championship reign of Michael Jordan’s Chicago Bulls. (Longtime fans are already anticipating the return of John Tesh’s “Roundball Rock,” the rhythmic theme music NBC used during its coverage.)

Warner Bros. Discovery Chief Executive David Zaslav may end up being haunted by comments he made at a 2022 investor conference where he said the company did not need the NBA. The remark was taken as a signal that Zaslav was unwilling to enter a deal that did not make financial sense for a company with around $40 billion in debt.

Barkley recently told sports talk host Dan Patrick that Zaslav’s remarks “probably p— off” NBA Commissioner Adam Silver.

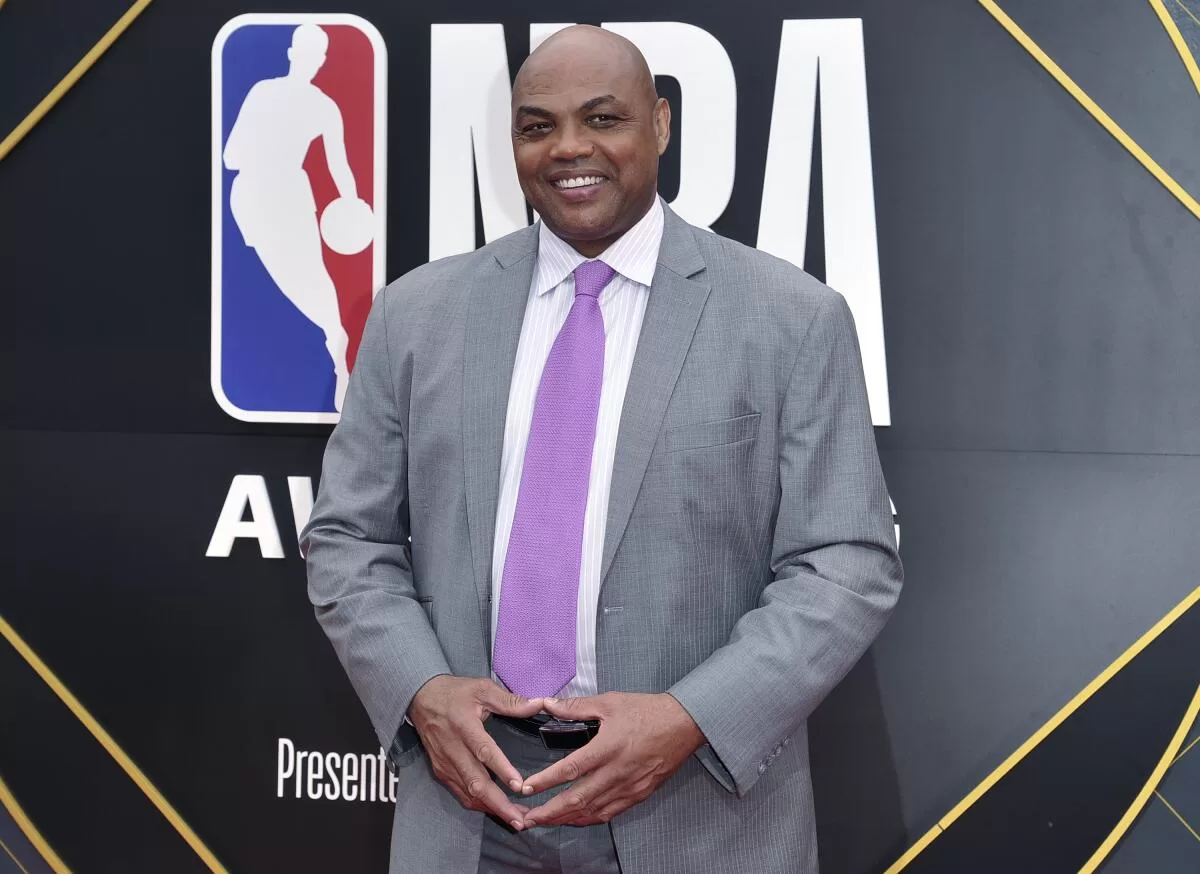

Charles Barkley arrives at the NBA Awards on June 24, 2019, at Barker Hangar in Santa Monica.

(Richard Shotwell / Invision / Associated Press )

Barkley, regarded as one of the top in-studio sports analysts, has been publicly critical of WBD’s handling of the negotiations and said he would retire from television after next season. But it’s likely his services will be coveted by one of the new partners in the new deal.

Zaslav’s stance on the NBA was ill-timed, as the demand for live sports escalated in recent years. They are considered the last reliable source of programming with the ability to attract mass audiences to live TV.

Traditional TV networks need live sports more than ever as they try to retain advertising dollars and negotiating leverage when dealing with pay TV carriers for carriage fees. Streaming services are also aggressively pushing into live sports as they seek to get a larger share of the TV ad market.

Amazon will pay $1.8 billion a year for a new package on Prime Video, the largest of its kind between one of the major U.S. sports leagues and a streaming service. (Amazon pays $1 billion a year to the NFL for the exclusive rights to “Thursday Night Football.”)

Prime Video will carry weekly regular season games and the NBA Cup, a mid-season tournament launched last year. The streaming service will also get the NBA’s play-in tournament, where the teams ranked between seventh and 10th over the regular season face off for the final two playoffs seeds in their conference. Playoff contests and some WNBA games are also included in the package.

Comcast will carry regular season contests, including prime time games on NBC and Peacock. Comcast hopes the NBA will attract new subscribers to the streaming service. Peacock currently has 34 million subscribers, well behind other streaming services such as Netflix, Max and Paramount+.

The Walt Disney Co. maintains the rights to the NBA Finals, which will continue to air on broadcast network ABC. Disney’s ESPN will also continue to carry regular season and playoff games. Disney will pay $2.8 billion per year, up from $1.4 billion in the current deal.

Warner Bros. Discovery will now have to negotiate its next round of deals without offering the NBA at a time when such talks are increasingly contentious. Pay TV distributors are battling to keep costs down as their customer bases continue to shrink .

Lower subscriber fees will also affect Warner Bros. Discovery’s role in Venu Sports, a planned joint venture with Disney and the Fox Corp. set to launch this fall.

Venu will carry linear channels such as ESPN, TNT and Fox and is aimed at sports fans who currently don’t have pay TV subscriptions. The revenues from Venu will be based on what the networks receive from pay TV carriers.

WBD still holds the rights to NHL, Major League Baseball and the NCAA men’s basketball tournament. Perhaps in anticipation of losing the NBA, Warner Bros. Discovery recently made a deal to sub-license some College Football Playoff games from ESPN and acquired the rights to the French Open tennis tournament.