Remember the metaverse? It was just a couple of years ago when it seemed as if every technology, media and entertainment company was scrambling to adapt to a future in which regular people would live parallel digital lives online, walking around as virtual reality avatars in 3D computerized worlds.

That hype hasn’t amounted to much so far, perhaps because audiences have watched movies like “Ready Player One” and “The Matrix” and absorbed their dystopian lessons.

And, besides, there was a new shiny object. With the emergence of ChatGPT, big tech moved on to a much more immediate and seemingly concrete futuristic subject: artificial intelligence. Studio heads — from Sony Pictures’ Tony Vinciquerra to Paramount’s soon-to-be owner David Ellison — are banking on AI models to streamline production and save money. Even Mark Zuckerberg’s Meta, the parent company of Facebook, which sunk billions of dollars into its metaverse dream, has, like many others, turned more of its focus to AI.

Suffice to say that much has changed in the two years since author and investor Matthew Ball wrote the book “The Metaverse: And How It Will Revolutionize Everything.” Ball, whose essays are highly influential in the spheres of media and tech, has revised and expanded his opus, even giving it a new subtitle: “Building the Spatial Internet.”

When I talked with Ball last week, he certainly hadn’t given up on his ideas about the web of the future, even though AI has clearly eaten the metaverse’s lunch in terms of tech industry enthusiasm and consumer anxiety. Apple’s Vision Pro has made some progress toward growing the market for headsets, despite its $3,500 price tag and the lingering stigma against wearing a computer on your face. Meanwhile, crypto currencies and other blockchain technologies, which feature prominently in plans for the metaverse, have quietly rebounded after a bumpy period, he said.

Ball also has been writing a bit about the state of the theatrical box office, which of course is a favorite subject of this newsletter.

This conversation is edited for length and clarity.

What are the biggest changes you’ve seen in the space since you published your original metaverse book a couple of years ago?

The three most substantial shifts are in head-mounted displays, inclusive of wearable glasses, as well as goggles; blockchains; and then artificial intelligence. Each of those three categories seems to have experienced decades of development just in the last two and a half years.

Let’s take ’em one by one, starting with headset computers. Apple comes out with its Vision Pro, and suddenly people are talking about VR and AR goggles again. What happened?

That’s a great example. We saw the category’s most high-profile and probably most important product launch, bringing massive validation of this as a category from a company with unprecedented experience disrupting stale, stagnant or unsuccessful categories and being able to overcome the stigma. Seeing all of those things come together — Apple’s investment, Apple’s brand, Apple’s retail footprint and their attendant ability to communicate value proposition — is a remarkable case study.

It does feel like the Apple Vision Pro was a chance to take the technology more mainstream. Did it work?

Look, I don’t believe in citing anecdotes as though they’re data, but my followers on Twitter should be as over-indexed to the Vision Pro and head-mounted displays as anyone. I regularly ask those who own one, how many of you used the device within the last 48 hours, and how many of you haven’t used it in the last 30 days? And the result usually shows that only about 20% of people have used it within the last 48 hours, and two-thirds haven’t touched it in a month. And if you have my followers as an example, who spent $4,000 on a device and after owning it for five or fewer months haven’t touched it for 30 or more days, it’s clear that it’s missing the mark, at least thus far.

Is it a content problem that’s keeping these devices from reaching the masses? Or is it a technology or hardware problem?

The consensus answer is that it’s three different things. It’s the price, it’s the form factor and it’s the applications or content. And right now, all three of those things are limitations, and they’re also interconnected. One of the reasons why the device is uncomfortable and heavy is because it’s high-powered. It’s high-powered so it can run better content experiences. But that also means it’s expensive. If you trade off on the power, the price comes down, but the experiences become diminished.

OK, what about blockchain?

Blockchain has probably gone through puberty over the last two and a half years. Of course, we’ve had the combined market value of cryptocurrencies fall from $3 trillion to $800 billion and then nearly reclaim its all-time high. And along that path, you had the decline of FTX and many others.

That is to say, we have a much larger sample size and better understanding of the technological limitations, the culture around these products and the extent to which they were often confused with financial speculation and, in some cases, regulatory arbitrage. You’ll find that there are many constituents who still believe that crypto is an essential aspect of the future of the internet, but we certainly can better understand the shortfalls.

Well, this technology also has one of the worst branding problems possible, to the point where the biggest laugh line of the Tom Brady roast was Nikki Glaser making fun of him for pitching crypto.

I agree that it has a stigma problem. That’s certainly true. And NFTs have not really recovered in any way, shape or form. But crypto overall has seen a resurgence. There’s greater legal clarity, there’s greater institutional adoption and it’s back to about 85% of its all-time high, even though we’ve gone from a zero-interest-rate period to a 45-year high in interest rates.

Where does AI come into your theory of the future of the internet?

It is absolutely true that artificial intelligence has taken marginal dollars away from investment into AR, VR and the metaverse. It has changed the narrative around the metaverse hype cycle. I do think that there’s not enough appreciation of how intertwined these topics have always been, and the essential ways in which everything that the metaverse requires and all of the technologies around it are fundamentally reliant on AI.

The CEO of Roblox has said that he believes that within a few years, it will be possible to speak entire worlds into existence. Disney’s ability to create a virtual space even a shred of the size of Disneyland is incredibly cost-prohibitive. If you wanted to actually create something equivalent to Galaxy’s Edge in a virtual world, it’s actually not clear that that would be cheaper than constructing the actual Galaxy’s Edge as it exists today.

Through artificial intelligence, we are actually seeing those costs start to come down extraordinarily, and that’s transforming what’s possible. At the end of the day, the dream of going to a virtual Disney theme park is not just to walk through the Avengers Campus, it’s actually to go there and interact with Iron Man, as played by Robert Downey Jr.

You recently wrote about the long-term declines in theatrical movie attendance per capita. Do you see the broader adoption of these digital technologies further disrupting traditional entertainment consumption?

Yeah. As I detail in the piece, there’s kind of a misconception as to what has caused the decline in theatrical moviegoing. It’s essentially limited to 2- to 24-year-olds, who are going less than ever.

Among that younger demographic, we often hear the argument that no matter how much you play Roblox or Fortnite or Call of Duty, that doesn’t displace going to the movies one more time per year, right?

And yet, we do see that social media platforms, social video platforms such as TikTok and social gaming experiences have substantially displaced typical behaviors, whether it’s going to the movies, babysitting or going to the mall with friends. And this is consistent with broader measures that show that we spend more time by ourselves than ever before.

This trend has been going for long enough that it’s hard to argue it’s going to slow down. The question is, of course, where is the floor?

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Shari and David got their deal

David Ellison finally got the prize.

On Sunday night, Paramount and Skydance announced their plans to merge through a complicated transaction that has been in the works for months. The deal marked a dramatic turn from just weeks earlier when Redstone told Ellison — and by extension, his tech-billionaire dad, Larry Ellison — as well as his private equity backers to take a hike.

The agreement announced this week is similar to the one that almost got to the finish line in June. Skydance and RedBird Capital Partners will pay $2.4 billion for the Redstone family holding company National Amusements Inc., which holds 77% of Paramount’s voting stock and also a chain of movie theaters. The pact allocates $4.5 billion to buy out Paramount shareholders and a $1.5-billion cash infusion to ease the company’s balance-sheet issues.

So all told, this deal involves an investment of about $8.4 billion. Skydance will merge into Paramount, valuing Ellison’s Santa Monica-based film, TV and video game operation at $4.75 billion. There’s a 45-day go-shop period when other bidders can emerge, but also a hefty $400-million breakup fee if the Skydance-Paramount pairing falls apart.

The question is, where does Paramount go from here? Next year, when the deal is closed, Ellison will have taken the reins as the new company’s chief executive and former NBCUniversal boss Jeff Shell will be serving as president. But the combined company will be facing the same problems as before: a deteriorating linear TV business, a lagging film studio and a second-tier, money-losing streaming service.

Shell, speaking by phone Monday afternoon, said that a key part of the plan is to solidify Paramount’s financial footing, while not falling into the unhealthy patterns of past regimes: underinvestment in its business and underutilizing its franchises.

“[Paramount] has always been on the edge of not having enough capital, and that’s why during this whole process we were insisting on putting capital on the balance sheet as part of the deal,” Shell said. “We’re putting a billion and a half [dollars] on the balance sheet to give the company some flexibility to make smarter, long-term decisions.

“In Hollywood, you really make money when you have big franchises and are able to monetize them, and they really have not done that very effectively at Paramount,” he continued. “For example, there’s no ‘Top Gun’ theme park ride anywhere in the world, which is about the most insane thing you could ever think about, right?”

TD Cowen media analyst Doug Creutz called the arrangement a “mild positive” for Paramount’s long-term prospects, but added, “We don’t think the deal significantly impacts competitive positioning or changes exposure to industry headwinds.”

Ellison said on a conference call Monday morning that this version of Paramount will have to “expand its technological prowess to be both a media and technology enterprise.” Explaining a bit of what he meant, he cited the use of cloud computing and artificial intelligence technology as examples of ways to streamline (i.e., make less expensive) the production process. Technology also is key for improving recommendation algorithms for streaming and even figuring out how to schedule movie releases.

“I do think it’s a different mind-set,” said RedBird Capital founder Gerry Cardinale. “The challenge is, Hollywood and tech aren’t really talking to each other. This should be the pace car for that coming together.”

Of course, being a media company that uses technology is not the same thing as becoming a “media and technology enterprise.” Investors appear to be unenthusiastic so far. Paramount’s stock fell 5% on Monday.

Other stuff we wrote

Alec Baldwin is on trial for ‘Rust’ shooting: How did we get here? Baldwin has long said he didn’t pull the trigger the day Halyna Hutchins was killed. He’ll soon meet the jury that will decide whether he’s guilty of involuntary manslaughter.

‘Despicable Me 4’ notches another win for family films at the box office. Universal Pictures and Illumination Entertainment’s “Despicable Me 4” brought in $122 million in the U.S. and Canada this weekend, marking another strong weekend for family films following the success of “Inside Out 2.”

The Hollywood power players turning on the Biden campaign: ‘It’s about the ability to WIN.’ Biden’s debate performance has Hollywood insiders wringing their hands about his presidential candidacy and what to do next.

R.I.P., Jon Landau. The Oscar-winning producer who worked closely with director James Cameron on three of the biggest blockbusters of all time, “Titanic” and two “Avatar” films, has died. He was 63.

Film shoots

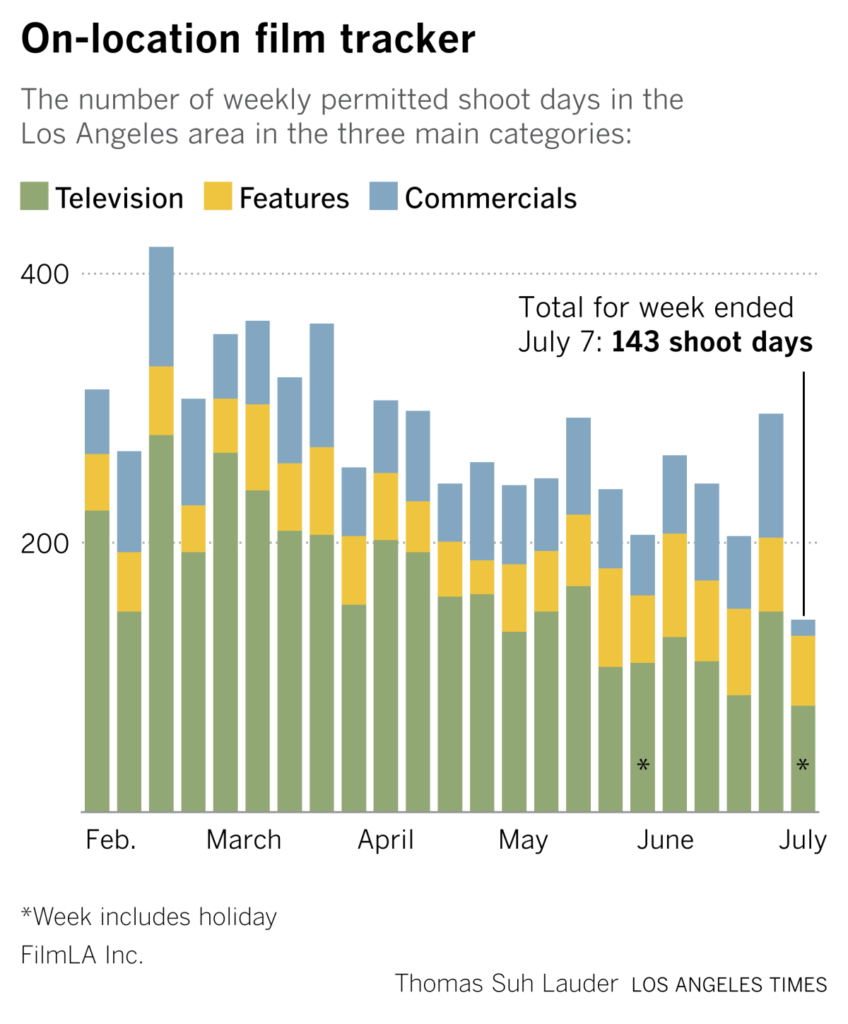

Shoot days in the Los Angeles area were down during the Fourth of July holiday week compared with the previous week, according to FilmLA.

Finally …

I was in a hotel on Saturday night and managed to catch TBS as the network was pregaming for sister channel Discovery’s “Shark Week” with back-to-back showings of “Deep Blue Sea” and “The Meg.” Both are fun movies, but there’s still only one shark movie that’s actually good, in my book.

Lastly, the Times’ L.A. Influential series — profiling the Los Angeles area’s most powerful people — is complete. It’s a great snapshot of the centers of influence that shape this sprawling town. Please check it out.