The parent company of Redbox — the onetime home entertainment powerhouse best known for its red self-service kiosks ubiquitously located at pharmacies, convenience stores and grocers across the country — recently filed for Chapter 11 bankruptcy protection. The filing lists debts totaling $970 million and assets worth $414 million.

The company’s financial peril was clearly coming to a head in recent days, with reports surfacing of employees going without compensation. Over the weekend, Redbox’s owner, Chicken Soup for the Soul Entertainment, requested the Delaware bankruptcy court’s authorization to pay millions in unmet wage and benefit obligations to its workers.

In some ways, Redbox’s story is unique. In others, though, it’s a microcosm within the entertainment business — a once-promising business wrecked by a combination of changing consumer preferences and a misbegotten corporate strategy.

Founded in 2002 as a McDonald’s experiment, Redbox quickly became a serious challenger to Blockbuster’s brick-and-mortar video business, leveraging the convenience and low cost of its automated pickup/drop-off kiosks. The Oakbrook Terrace, Ill.-based company came of age when physical home entertainment sales were a gold mine for Hollywood studios and Netflix was still mainly a DVD by mail business.

But while Netflix disrupted the film and television business by bringing streaming to the masses, Redbox struggled to pivot, despite various attempts to capture a more digitally savvy audience as the DVD business collapsed. By 2017, the U.S. market for cheap rentals from kiosks had declined to $1.27 billion in consumer spending, down by about a third compared with five years earlier, according to data from Digital Entertainment Group.

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Now, fast-forward to 2022, when the company was acquired by Chicken Soup for the Soul Entertainment, a subsidiary of the publisher behind the uplifting, inspirational book series of the same name. As public filings note, the larger operation also “produces super-premium pet food under the Chicken Soup for the Soul brand name.”

Which is a coincidence, because the entertainment arm’s finances are a dog’s breakfast.

According to regulatory filings, the operation lost a staggering $636.6 million last year, compared with a loss of $111.3 million in 2022. Its Class A shares closed at 12 cents Monday on the Nasdaq stock exchange, down 90% from a year ago, putting it at risk of delisting.

The Redbox acquisition was an odd one from the outset. The publicly traded Chicken Soup for the Soul Entertainment justified the deal as complementary to its other Hollywood and media-related assets, which include the advertising-supported streaming service Crackle.

Chicken Soup’s other show business assets include Screen Media, a distributor with titles such as the Morgan Freeman-Cole Hauser thriller “The Ritual Killer,” and Halcyon Television, which has a library spanning oldies such as “The Little Rascals” and “Laurel & Hardy,” along with miniseries including “Lonesome Dove” and “Dinotopia.” In 2022, Chicken Soup picked up the assets of 1091 Media, another film distribution company.

The idea was to use these film and TV libraries to boost Chicken Soup’s streaming and video on-demand operations, and vice versa. But for such a “flywheel” (business-speak for “virtuous cycle”) to take effect, companies need scale, and that’s something Chicken Soup lacks.

The company declined a request to make its Chief Executive Bart M. Schwartz or other officers available for interviews.

Chicken Soup for the Soul Entertainment says it took on some $360 million in debt as a result of the Redbox purchase.

The ability to pay down that debt, according to the company’s most recent annual report, was predicated on “a partial return to pre-COVID levels” in the number of recent theatrical releases that would be available to the company as studios got back into the business of releasing movies.

The resulting expected rebound in demand for physical kiosk rentals, along with cost savings from the merger, “would generate sufficient cash flows to cover the cash needs of the combined businesses,” the company said, explaining its reasoning at the time.

Bad bet, as it turned out.

The slower-than-anticipated recovery at the box office continues to this day, with studios releasing fewer blockbuster-level movies than they did before the COVID-19 pandemic.

The struggles were exacerbated by prolonged strikes by the writers and actors unions last year, which thinned out the 2024 movie slate just as theatrical moviegoing was starting to pick up momentum.

Domestic box office is down nearly 40% so far this year compared with pre-pandemic levels, according to David A. Gross, who runs a movie consultancy and publishes the FranchiseRe newsletter. That’s despite the success of blockbusters including “Inside Out 2” and “A Quiet Place: Day One.”

Those problems trickle down to the home video market.

Making matters worse, the company failed to secure a much-needed $40-million loan that would enable it to get its hands on all the new movies the studios were putting out that would fuel its bounce-back, according to a court declaration from Chicken Soup for the Soul Entertainment Chairman William J. Rouhana. Thus, it couldn’t pay the studios for new movies. And as with any entertainment company, without fresh content, you’re dead in the water.

Now the company is in bankruptcy and looking to sell off assets. Its list of unsecured creditors runs the gamut of major studios, including Universal Pictures, Sony Pictures, BBC Studios Americas, Paramount Pictures, Warner Bros. and MGM. The group also includes Walgreen Co. and Walmart, home of many red kiosks, of which 27,000 still exist, according to court filings.

Analysts have advanced the idea that the U.S. theatrical movie business is over-screened, meaning that there are too many cinema screens, considering declines in the demand for moviegoing. (According to the National Assn. of Theatre Owners, the number of screens stands at about 38,000.) If that’s the case, then can there be any doubt that the nation is over-kiosked?

Stuff we wrote

What’s in the new IATSE deal? Wage increases, AI rules and more. The crew members union has released a summary of its new tentative deal with the top Hollywood studios.

Blumhouse’s latest strategy to scare the hell out of you: video games. Studios like Blumhouse, Annapurna and Bad Robot have added gaming divisions. But while games can be lucrative, they aren’t a surefire win.

NFL ordered to pay billions in damages for ‘overcharged’ Sunday Ticket. An L.A. jury rules the NFL must pay nearly $4.8 billion in damages to fans and sports bars who were said to be overcharged to watch out-of-market games.

ICYMI:

Kevin Costner’s ‘Horizon’ wipes out at the box office

Netflix adds stages to New Mexico production hub

Hunter Biden sues Fox News over ‘mock trial’

Al Michaels? More like ‘A.I. Michaels’!

Will Barry Diller make a play for Paramount?

Number of the week

CNN’s highly anticipated Biden-Trump presidential debate drew 51.3 million viewers, down significantly from the audience levels achieved by the duo’s first matchup in 2020.

The significance of the face-off was obvious: Biden’s performance was a disaster, overshadowing Trump’s numerous falsehoods.

As a business story, this was largely a branding exercise for Warner Bros. Discovery-owned CNN, which had hoped to burnish its reputation as a straight-down-the-middle source of news and analysis. The question is whether cable audiences are looking for that kind of thing in today’s polarized political and media environment.

How successful that effort was remains to be seen, considering the attacks the network and its moderators, Jake Tapper and Dana Bash, are facing for not even trying to fact-check in real time.

Fewer people tuned in on TV this time. That’s cord-cutting for you! Millions of people probably caught up by watching clips on social media. Maybe some viewers passed out from overdoing it with the drinking games.

The other Hollywood angle: the debate came just after a glitzy Los Angeles event raised tens of millions for Biden’s campaign (co-chaired by Jeffrey Katzenberg), with significant dollar amounts likely coming from entertainment industry figures. They must be hoping this doesn’t become the “Heaven’s Gate” of candidacies.

Film shoots

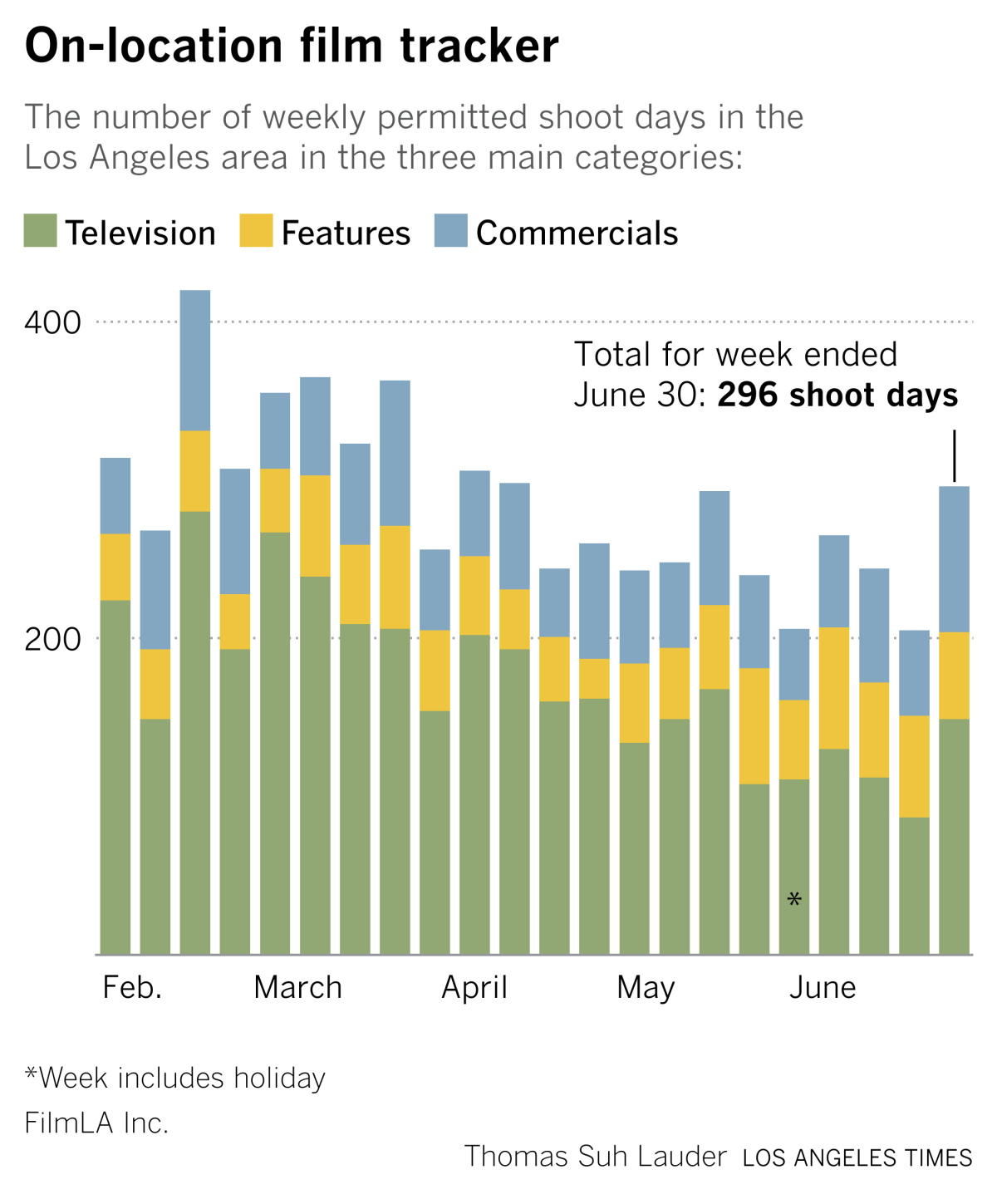

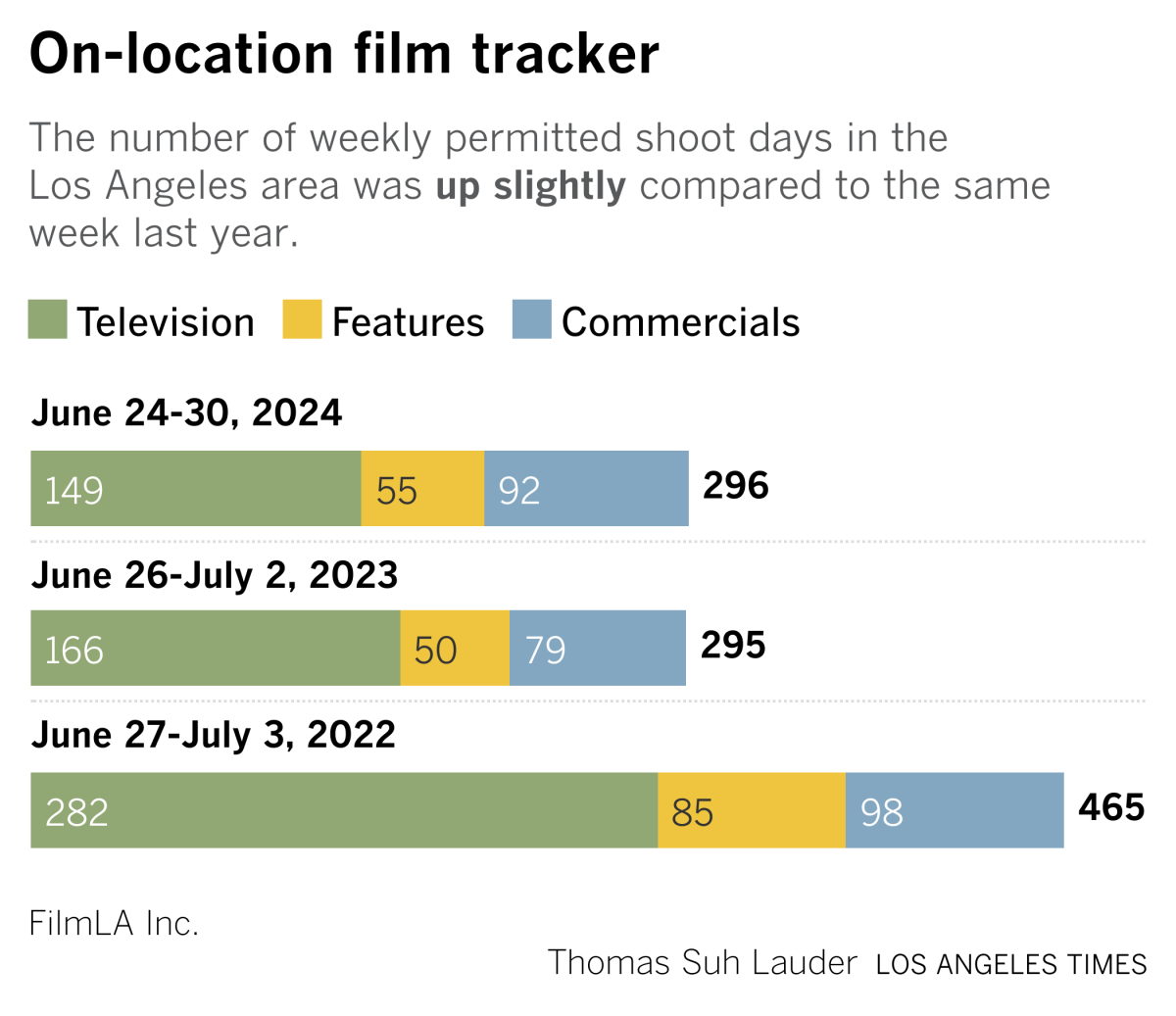

Shoot days in the Los Angeles area were up last week compared with the previous week, and on par with a year ago, according to FilmLA.

Finally …

I finally caught up with the documentary “MoviePass, MovieCrash” on HBO/Max. It’s fun! It doesn’t move the ball forward much, and it relies heavily on the point of view of co-founder Stacy Spikes, who was pushed out of the company and is now trying to lead its comeback. But if nothing else, it’s a fascinating artifact of the so-called millennial lifestyle subsidy.