Article content

(Bloomberg) — Asian shares are set to dip on Tuesday, following a listless US session where the main focus was the bond market’s sudden climb after weak data bolstered bets the Federal Reserve will cut interest rates this year.

Futures show benchmarks in Tokyo and Hong Kong will fall more than 0.5%, while equities in Sydney will also open lower. US stocks struggled to gain much traction on Monday, with the S&P 500 closing with a mere 0.1% gain. Treasuries rose across the curve after data showed US factory activity shrank at a faster pace as output came close to stagnating, with 10-year yields sinking 11 basis points to 4.39%.

Article content

The data indicated manufacturing is struggling to gain momentum due to high borrowing costs, restrained business investment in equipment and softer consumer spending. At the same time, producers are battling elevated input costs.

“The Manufacturing ISM data reaffirmed several prevailing economic trends: decelerating inflation, slowing growth, and a tight labor market,” said Gary Pzegeo at CIBC Private Wealth US. “We should see higher odds of a rate cut later this year priced into interest rate futures.”

Swap contracts tied to upcoming meetings continue to fully price in a quarter-point rate cut in December, with the odds of a move as soon as September edging up to around 50% and November also given high odds.

“There have been a few signs of stumbling in the real economy, albeit primarily on the consumption side,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “As a result, investors are on guard for indications that the downside trajectory is accelerating.”

The S&P 500 turned green in the final minutes of trading as a rally in big tech outweighed a plunge in energy producers. A technical issue at the New York Stock Exchange resulted in erroneous trading volatility halts earlier Monday.

Article content

Oil tumbled as OPEC+ rolled out a plan to restore some production to the market this year. Bitcoin briefly topped $70,000.

In Asia, two data releases on Monday from China may have encouraged investors that its moribund economy was finally starting to gain some post-pandemic traction. Shanghai and Shenzhen saw improvements in homebuyer sentiment last weekend after relaxing property restrictions, the first positive signs in months for the embattled real estate sector.

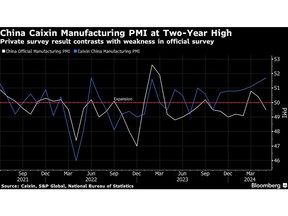

Meanwhile, a private survey showed China’s manufacturing activity expanded at the fastest pace in almost two years in May, contrasting with weak official data that dented the country’s growth outlook.

With the US earnings season mostly in the rearview mirror, traders will focus on whether inflation is cooling or is stuck in a loop that will leave interest rates in “higher-for-longer’ limbo,” according to Chris Larkin at E*Trade from Morgan Stanley. “This week’s jobs report represents the next big test.”

In fact, traders will also be focused on a slew of labor-market readings this week, including Friday’s payrolls figures.

Article content

“Additional cooling in job openings this week would also help to bring home the message that the labor market is no longer a meaningful threat for near-term inflation dynamics,” said Oscar Munoz at TD Securities.

Corporate Highlights:

- GameStop Corp. surged as the Reddit account that drove the meme-stock mania of 2021 posted what appeared to be a $116 million position in the video-game retailer.

- Nvidia Corp. and Advanced Micro Devices Inc.’s chiefs showcased new generations of the chips powering the global boom in AI development, deepening a rivalry that may decide the direction of artificial intelligence design and adoption.

- JetBlue Airways Corp.’s sales performance for this quarter will be somewhat better than expected as the carrier works to improve operations and capitalize on “healthy overall demand trends.”

- Skydance Media plans to offer $23 a share to investors in Paramount Global’s voting stock as part of its plan to merge with the film and TV giant, according to people with knowledge of the matter.

- Bill Ackman’s Pershing Square aims to raise $25 billion for a new closed-end fund targeting US retail investors, which would more than double the fee-paying assets the firm manages, according to people with direct knowledge of the plans.

- A.P. Moller-Maersk A/S, a bellwether for global trade, raised its full-year profit forecast, saying the congestion in the Red Sea is having a larger than previously expected impact on the world’s supply lines, which in turn is boosting freight rates.

Key events this week:

- US factory orders, JOLTS, Tuesday

- China Caixin services PMI, Wednesday

- Eurozone S&P Global Services PMI, PPI, Wednesday

- Canada rate decision, Wednesday

- US ISM services, Wednesday

- Eurozone retail sales, ECB rate decision, Thursday

- US initial jobless claims, trade, Thursday

- China trade, forex reserves, Friday

- Eurozone GDP, Friday

- US unemployment rate, nonfarm payrolls, Friday

Some of the main moves in markets:

Share this article in your social network