Article content

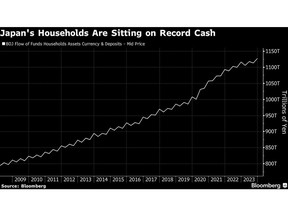

(Bloomberg) — Private credit funds are trying to scoop up more of Japan’s ¥4.5 quadrillion ($28.7 trillion) of financial assets to lend globally, betting that inflation will prompt investors to channel more of that money into riskier overseas investments.

Ares Management, which has about $428 billion of assets under management, plans to open a Tokyo office this year, while peer Blue Owl Capital established a base in the Japanese capital last August. At least four other firms including New York-based Siguler Guff have made hires in Japan over the past year for key positions with responsibilities including selling private debt products.

Article content

The increase in interest in Japan is being fueled by signs that local investors are moving more money into higher-paying assets including alternative funds, as expectations for inflation have climbed to their highest in decades. That shift is getting a boost from government measures that include expanded tax breaks for individual investors and efforts by authorities to attract more asset managers to Japan.

“A lot of people say that Japanese people, they’re conservative, that’s why they’re invested in cash. I’m like no,” said Matt Michelini, head of Asia-Pacific at Apollo Global Management, which increased hiring for product distribution in Japan in the last two years. “You had the collapse in 1990, there was deflation and they did the rational thing.”

That’s now changing with just a little bit of inflation, Michelini said.

One area where that’s showing up is in retail investor accounts called Nippon Individual Savings Accounts, or NISA. Authorities boosted incentives on them earlier this year, causing the number to climb around 30% to 14.56 million by March from the year-earlier period.

Article content

Reflecting the importance of retail investors, the world’s largest alternative asset manager Blackstone partnered with Daiwa Securities Group in 2023 to launch the first publicly-offered private credit fund in Japan that invests in US loans. That fund had net assets of $525 million in April, on par with some of the nation’s largest retail trusts that buy overseas high-yield bonds.

Inflation has already fueled some of the biggest moves in Japanese markets in decades in 2024, with the Bank of Japan scrapping the world’s last negative-rates policy in March and the Nikkei 225 Stock Average hitting a record high.

While global private credit firms are mainly focused on selling overseas debt products to local investors, the fledgling market for domestic private debt deals is also attracting more local investors. The amount of domestic private debt assets under management rose to $8.1 billion as of September, the highest in at least six years, according to data from industry research firm Preqin Ltd.

Read More: Schwarzman Bullish on Private Credit, Citing 0.3% Default Rate

Article content

Canada’s Fiera Capital and the US’s Deerpath Capital Management are among overseas private credit firms that have been hiring in Japan.

Of course, distribution opportunities in Japan aren’t the only thing attracting more alternative asset managers to the nation. Many of the players in private credit such as Blackstone and Ares also have large private equity and real estate businesses, where there are increasing opportunities in local buyouts, as more domestic companies shed non-core operations.

“The financing need for those is also going to be pretty significant,” said Edwin Wong, head of Ares Asia.

While investing in speculative-grade US debt is far from a new phenomenon in Japan, the $1.7 trillion private credit market offers investors the potential to lock in even higher returns with less volatility.

But the opaque nature of the private credit market and its rapid growth are also attracting greater scrutiny from global regulators, as higher interest rates weigh on weaker borrowers and trigger more bad loans. If the performance of private debt funds deteriorates, the global financial system could come under stress as more financial institutions have entered into alliances with fund operators, according to a report in April by BOJ researchers.

For now, such risks aren’t hurting.

“The structural shift from deflation to inflation is an absolutely crucial part of the Japan story,” said CJ Morrell, who took up the newly created role as head of Japan at Fiera Capital in April.

Share this article in your social network