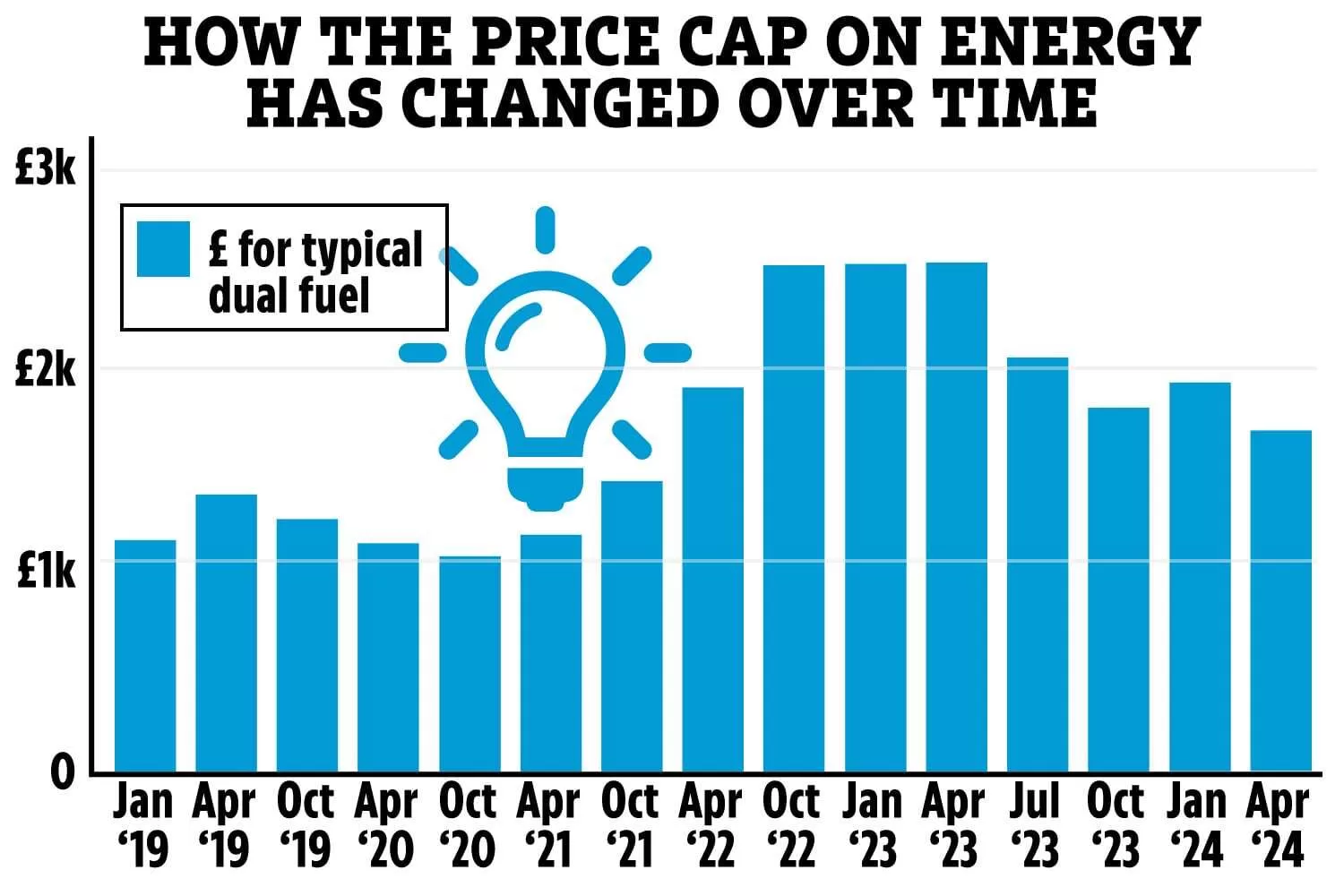

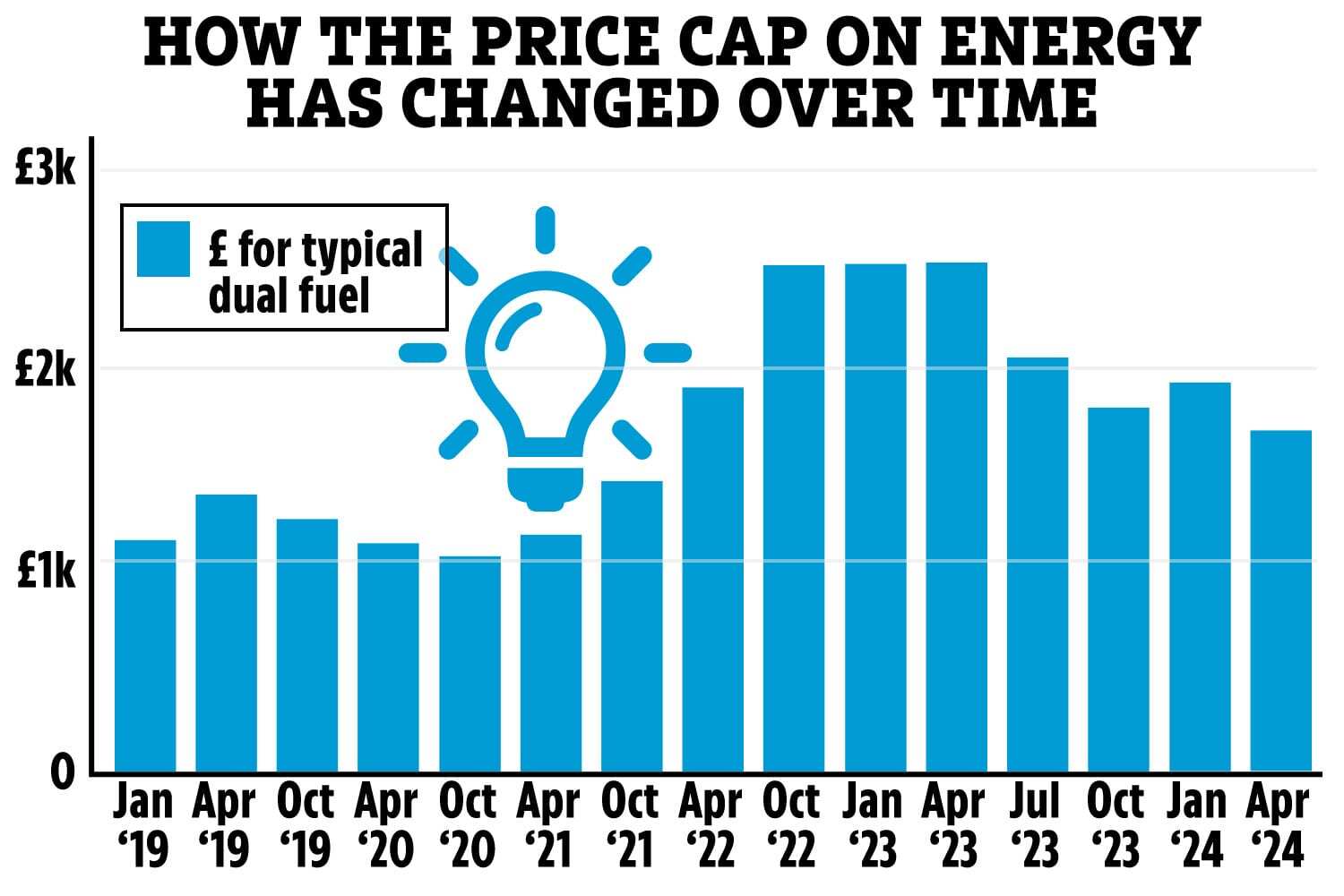

The energy regulator Ofgem has confirmed the new price cap, which comes into effect on July 1.

The cap will fall from the current rate of £1,690 to just £1,568, the fresh figures show.

It means the average household could see their annual bill drop by £122 – a 7% fall.

But bear in mind that the price cap is reviewed every three months, so your annual bill could still change.

The energy regulator said it will cut the price that a supplier can charge for gas from 6.04p per kWh today to 5.48p from July 1.

The price of electricity will fall from 24.50p per kWh to 22.36p, Ofgem said.

Today’s announcement comes after the experts at Cornwall Insight predicted a drop to £1,574 a year.

The move will see energy prices reach their lowest level since Russia’s invasion of Ukraine in February 2022.

The invasion caused a spike in an already turbulent wholesale energy market, driving up costs for suppliers and customers.

It’s important to note though that the price cap is not a limit on the overall amount people will pay for their energy.

Instead, it caps the amount that they pay per kilowatt hour, or unit, of gas and electricity.

The figure is calculated based on what Ofgem thinks an average household will use.

This is calculated assuming that a typical household uses 2,900 kWh of electricity and 12,000 kWh of gas across a 12-month period.

Those who use less will pay less, and those who use more will pay more.

Be aware that the exact unit rates and standing charges you pay will vary slightly based on your supplier, where you live and how you pay for your gas and electricity costs.

How do I calculate my energy bill?

BELOW we reveal how you can calculate your own energy bill.

To calculate how much you pay for your energy bill, you must find out your unit rate for gas and electricity and the standing charge for each fuel type.

The unit rate will usually be shown on your bill in p/kWh.The standing charge is a daily charge that is paid 365 days of the year – irrespective of whether or not you use any gas or electricity.

You will then need to note down your own annual energy usage from a previous bill.

Once you have these details, you can work out your gas and electricity costs separately.

Multiply your usage in kWh by the unit rate cost in p/kWh for the corresponding fuel type – this will give you your usage costs.

You’ll then need to multiply each standing charge by 365 and add this figure to the totals for your usage – this will then give you your annual costs.

Divide this figure by 12, and you’ll be able to determine how much you should expect to pay each month from April 1.

The energy price cap is adjusted every three months to reflect changes in underlying costs, as well as inflation, and only impacts UK households on default or variable tariffs.

This still accounts for roughly 29million customers, according to Ofgem.

The fall in prices in the spring comes as a result of a mild winter and high levels of gas storage in Europe.

But Cornwall Insight is forecasting that the cap will see a small rise in October.

What can you do now?

The price cap dictates the price of standard tariffs, so the standard tariff will drop on July 1.

The main alternative tariffs being offered are fixes where you lock in – their price is not affected by the price cap.

Fixes move up and down based on the current supply that energy firms can get based on the current wholesale rates.

Looking ahead over the next year based on the current predictions, on average we would pay 3% less than now if you stay on the price cap – if the predictions are right.

While the cheapest fixes on the market are 9% cheaper right now.

For that reason, customers might want to lock in on the cheapest fix – but you should make sure you do a comparison.

That way you can lock in now at 9% cheaper and get guaranteed rates for the next year.

Something to bear in mind though is that most comparison sites just give you the current price cap, while you need to look at the price cap over the next year to get the best view.

Of course, you should only switch to the cheapest fixes though, not all of them are bargains and some of them have hefty exit fees.

BEST FIXED DEALS

Martin Lewis‘ MSE has revealed several of the cheap deals available right now.

The 9% fix is among the best and it comes from Ecotricity’s

Green one-year fix.

Although it does have £75 dual-fuel exit fees – plus you’ll need a smart meter and must pay by fixed or variable monthly Direct Debit.

Outfox the Market’s Fix’d Dual May24 is also a good option according to MSE.

It’s 8% less than the current price cap, plus it doesn’t have any exit fees.

The deal is available as dual-fuel only and you must manage your account online, but smart meters are not required.

OTHER ALTERNATIVES

If you don’t want to commit to a fixed tariff it’s always worth considering a variable tariff.

Kara Gammell, personal finance expert at comparison site Money Supermarket Group, previously told The Sun: “These will almost always be at or below the price cap.”

For example, E.ON Next’s Pledge variable tariff offers a fixed discount of around three per cent on the price cap rates for 12 months.

It will save the average household around £50 a year but comes with a £50 exit fee if you switch before the year ends.

The deal is available to both new and existing customers.

For a bigger reward but at a higher risk, Octopus Energy offers two variable tariffs which track wholesale gas and electricity costs.

Customers on the Octopus Tracker see their prices change daily, but unit rates have remained consistently lower than the price cap in recent months.

The Agile Octopus tariff works similarly to the Octopus Tracker, the main difference is the former’s prices change every half hour.

Remember that those wishing to switch to any of these tracker tariffs must have a smart meter.

Below we’ve listed some handy ways you can cut your energy costs.

WHEN DOES THE PRICE CAP CHANGE?

OFGEM reviews the cap on unit rates for those on the default tariff every three months.

This means the energy price cap can move up or down at four different points in the year.

Price cap rates are updated on the following dates:

- January 1

- April 1

- July 1

- October 1

1. Take a meter reading

Energy suppliers usually require you to take regular meter readings from your gas and electricity meter to work out how much they should charge you.

Customers who don’t do this are billed on estimated usage and will likely pay more.

So if you don’t have a smart meter, ensure that you regularly submit meter readings to your supplier.

Those with smart meters don’t need to send a manual reading because they’re sent to suppliers automatically.

Submitting a meter reading just before the rates change will ensure you’re charged the correct amount for the energy you’ve used.

We’ve previously explained how to take a reading from different types of electricity and gas meters.

2. Check your direct debit

If you pay your energy bill by direct debit, this monthly amount should be “fair and reasonable”.

If you don’t think it is, you should complain directly to your supplier in the first instance.

If you’re not happy with the outcome you can take it to the independent Energy Ombudsman to dispute, but there are a few steps before you get to that stage.

Your supplier must clearly explain why it’s chosen that amount for your direct debit.

If you’ve got credit on your account, you have every right to get it back – although some experts recommend keeping it there through the summer, so your bills don’t go up in the winter when you use more energy.

Your supplier must refund you or explain exactly why not otherwise and the regulator, Ofgem, can fine suppliers if they don’t.

If you are disputing a bill, taking a meter reading is a must.

If it’s lower than your estimate, you can ask your provider to lower your monthly direct debit to a more suitable amount.

But beware so you don’t end up in debt later on with a bigger catch-up bill at the end of the year from underpayments racking up.

If you don’t have success in negotiating a lower payment then you can put in a complaint to the Energy Ombudsman.

3. Check for any new energy deals

There are currently fixed deals on offer that are priced close to or slightly higher than standard variable tariffs, but they offer peace of mind that your rates will not change for 12 months.

But you could end up being stuck paying more if prices fall in future so it’s important to assess the real value of these offers.

Run a comparison at Uswitch.com to see personalised options based on your usage and region.

4. Check if you qualify for support

Households should check whether they qualify for energy support schemes or grants.

The government runs the Warm Home Discount scheme, which provides £150 in energy credit to help with bills during the winter and has recently introduced the Great British Insulation Scheme.

Councils also offer the Household Support Fund.

Many suppliers have customer support funds offering home insulation, energy-efficient white goods and cash grants.

Here’s a list of schemes open right now:

- British Gas Energy Trust Individuals and Family Fund

- British Gas Energy Trust

- EDF Customer Support Fund

- E.ON and E.ON Next Grants

- Octopus Energy Assist Fund

- OVO Energy

- Scottish Power Hardship Fund

5. Change your thermostat and boiler settings

Check the temperature on your thermostat and adjust it if required.

The World Health Organisation suggests most healthy people should heat their homes to 18 degrees Celsius.

Reducing the flow rate on combination boilers to around 60 degrees Celsius can cut heating bills, and you won’t notice the difference.

It should save you around £112 per year, depending on the type of boiler you have.

6. Change your radiator settings

Get ahead of the first cold spell by checking if your radiators are up to scratch.

Bleeding your radiators will prevent cold spots, and you may want to consider turning radiator valves down – or off – in the rooms you use less often.

The average household can also save up to £75 every year if they have thermostatic radiator valves fitted on all their radiators, according to British Gas.

Valves can be picked up for less than £10 and they’re easy to replace yourself if some of yours are not working.

We’ve previously explained what the numbers on these valves mean and how to adjust them for optimum efficiency.

It’s also important to keep your radiators free from obstructions, like furniture, for maximum heat.

7. Change the way you use your appliances

Tracking your usage may help you see how changing some habits can make a difference in your home.

Whether that’s setting your wash cycle at a lower temperature or eco mode, ditching the tumble dryer, or running the dishwasher only with a full load, small changes may have a big impact on your next meter reading.

For example, Which? says that washing clothes at 30°C is generally fine for clothes that aren’t dirty – this could cut energy use by 38% on average compared to a 40°C wash.

And a 20°C wash will use 62% less energy.

Here are some ways to cut dishwasher costs too.

8. Check for draughts

Draught-proofing is a quick and cost-effective way to prevent heat escaping, which could save you around £50 a year.

Fitting door seals between doors and frames, attaching brushes under draughty external doors and using chimney balloons all keep the heat in.

Thermal and lined curtains also prevent heat loss.

Check out seven ways you can instantly draught-proof your house this winter.

Meanwhile, we reveal exactly what the energy price cap is.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories