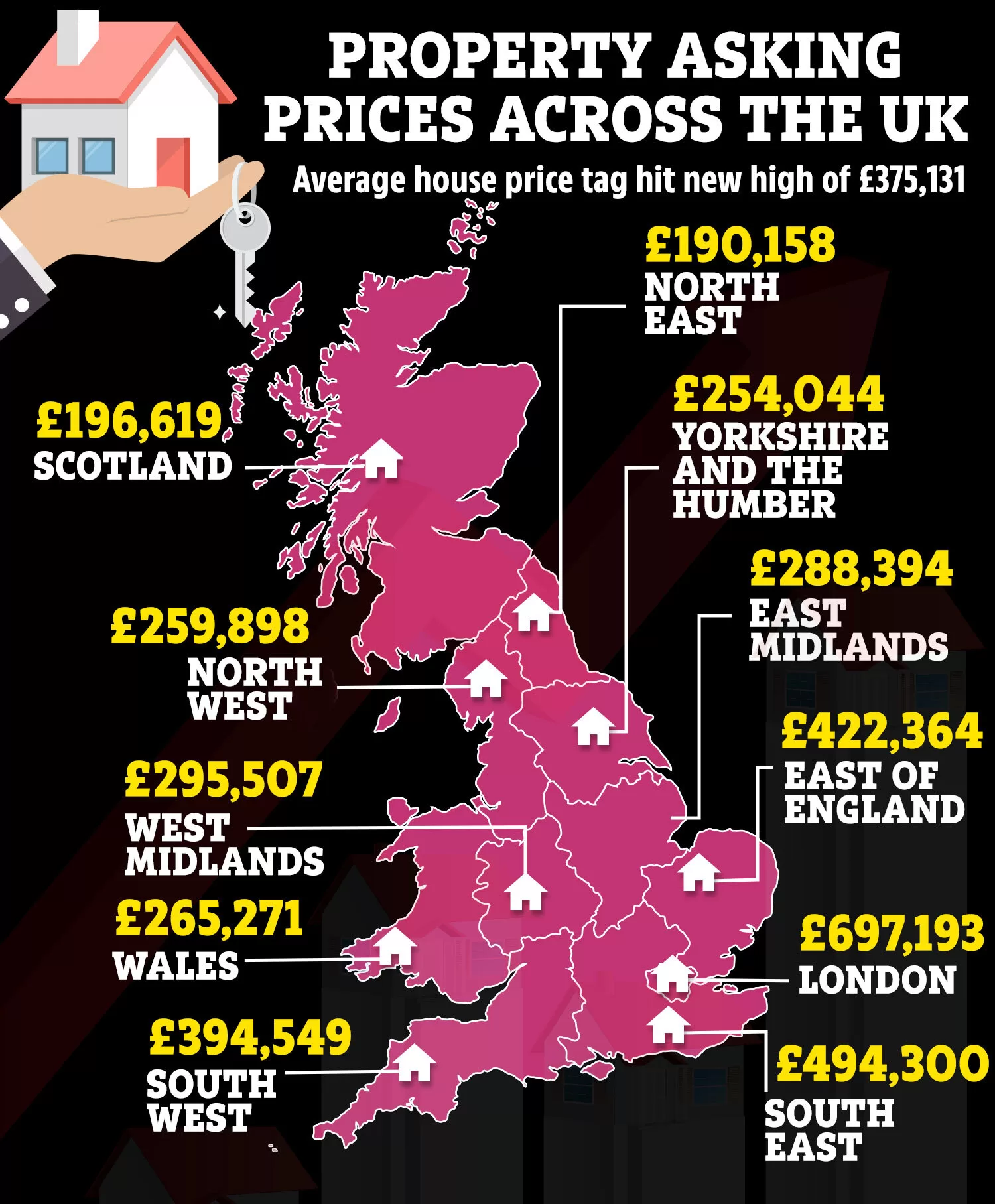

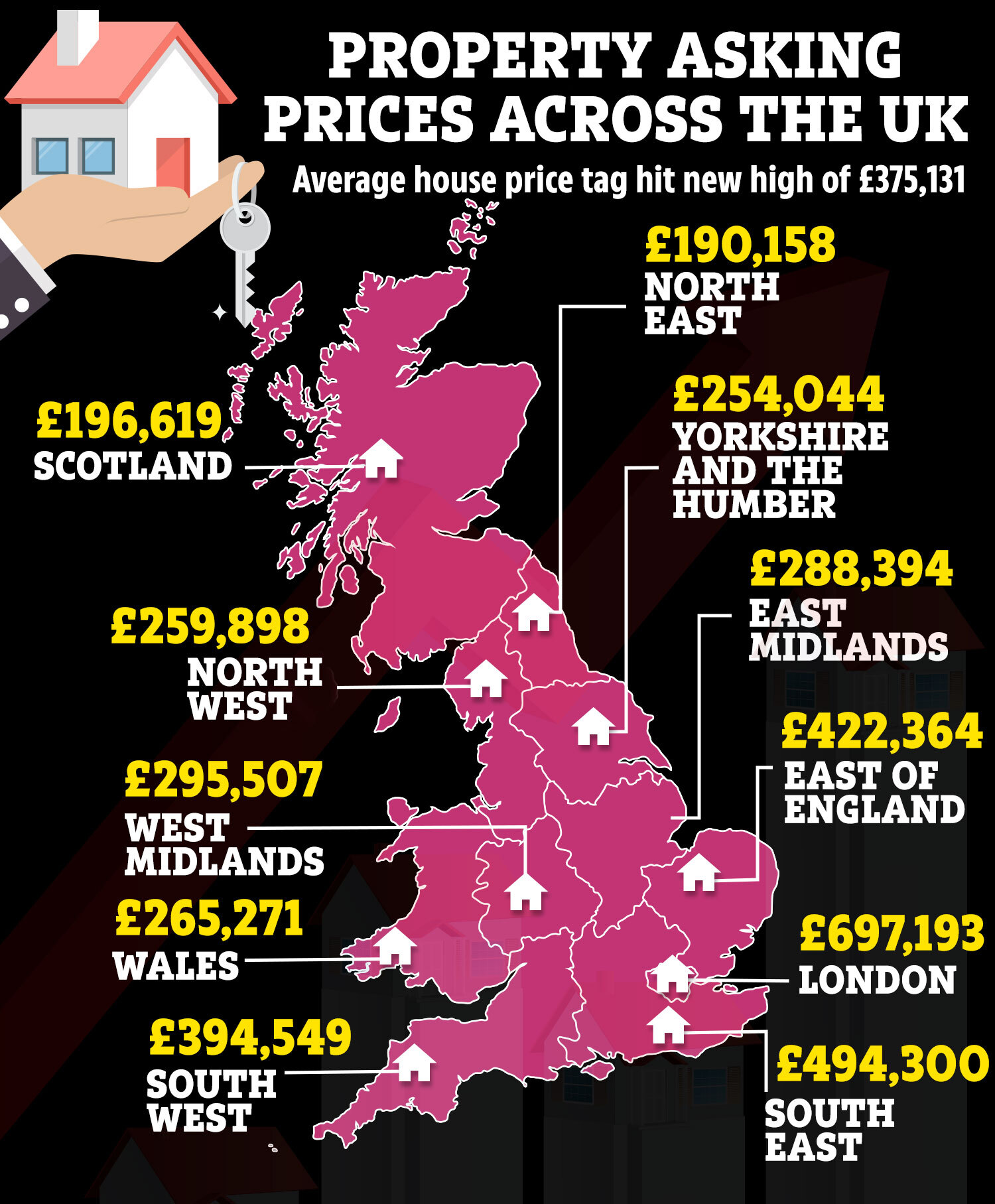

The average price tag on a home reached £375,131 in May, according to Rightmove.

Across Britain, the price of a property coming to market rose 0.8%, or £2,807, month-on-month.

Typically, you need enough money in the bank for a 10% deposit – at the very least – to buy a property.

This means first-time buyers will need to put down an average of at least £37,513 in the current market to afford their first home.

Pent-up demand from would-be buyers who paused their plans last year is a key driver behind increased home mover activity.

This is despite mortgage rates remaining higher for longer than anticipated, Rightmove said.

The number of sales being agreed during the first four months of the year is 17% higher than last year.

The North East, with the cheapest average prices in Great Britain, has seen the strongest price growth in the last year, rising by an average of 5.8% to £190,158.

A first-time buyer in this region would need a 10% deposit of £19,015, based on this average

Scotland came in second, with the average house price now standing at £196,169 having risen by 2.7% in the last year.

At the other end of the spectrum, in the East of England, house prices fell by 0.6% in the last year.

The average house price in the region now stands at £422,264 and a 10% deposit would be £42,226.

The average house price in the South East also fell by 0.1% with the average house price now standing at £494,300.

In some positive signs for the mortgage market, HSBC UK, Barclays and TSB cut their mortgage rates last Friday.

Tim Bannister, Rightmove’s director of property science, said: “The momentum of the spring selling season has exerted enough upwards price pressure to reach a new record asking price.”

Rightmove anticipates the number of completed house sales this year to reach around 1.1 million.

How to get the best deal on your mortgage

IF you’re looking for a traditional type of mortgage, getting the best rates depends entirely on what’s available at any given time.

There are several ways to land the best deal.

Usually the larger the deposit you have the lower the rate you can get.

If you’re remortgaging and your loan-to-value ratio (LTV) has changed, you’ll get access to better rates than before.

Your LTV will go down if your outstanding mortgage is lower and/or your home’s value is higher.

A change to your credit score or a better salary could also help you access better rates.

And if you’re nearing the end of a fixed deal soon it’s worth looking for new deals now.

You can lock in current deals sometimes up to six months before your current deal ends.

Leaving a fixed deal early will usually come with an early exit fee, so you want to avoid this extra cost.

But depending on the cost and how much you could save by switching versus sticking, it could be worth paying to leave the deal – but compare the costs first.

To find the best deal use a mortgage comparison tool to see what’s available.

You can also go to a mortgage broker who can compare a much larger range of deals for you.

Some will charge an extra fee but there are plenty who give advice for free and get paid only on commission from the lender.

You’ll also need to factor in fees for the mortgage, though some have no fees at all.

You can add the fee – sometimes more than £1,000 – to the cost of the mortgage, but be aware that means you’ll pay interest on it and so will cost more in the long term.

You can use a mortgage calculator to see how much you could borrow.

Remember you’ll have to pass the lender’s strict eligibility criteria too, which will include affordability checks and looking at your credit file.

You may also need to provide documents such as utility bills, proof of benefits, your last three month’s payslips, passports and bank statements.

But it said the lengthy time to complete a sale after finding a buyer remains a challenge for both agents and movers.

The average time between agreeing a sale and legal completion is five months.

In total, it is taking more than seven months on average from a seller coming to market to completing their move.

This means would-be sellers hoping to celebrate Christmas in a new home need to be coming to the market about now, the website said.

While the housing market may seem daunting, it is possible for first-time buyers to make their hard-earned cash go further and secure a mortgage they can afford to repay.

Below is a list of schemes that are available to help wanna homeowners get on the housing ladder.

The 100% mortgage

That’s why several of the big banks and building societies allow first-time buyers to borrow the full amount it costs to buy their home.

These deals are often referred to as 100% loan-to-value mortgages – because you don’t need any deposit to buy.

But in almost all cases, a family member will need to help out in some way.

Some deals need parents to agree to guarantee repayments, meaning the lender will need to check their income to make sure they can afford to.

The guarantee only kicks in if you can’t make a payment for any reason.

There are also a number of 100% family mortgages – some require a family member or close friend to deposit some savings with the lender for a fixed period.

Others will lend you 100% of the home’s purchase price but will want to take a “charge” on a family member’s home in place of a deposit.

This means that no cash changes hands, but should things go wrong, the lender will be able to get their money back from your relative.

Before that happens, your home would be sold and any money you still owed the lender would be taken from your family member’s home.

Either they would have to borrow money to pay back the lender, or they would, in the worst-case scenario, have to sell to cover any remaining debt.

There is a very serious warning that comes with taking a 100% mortgage.

If house prices fall, you could end up owing the bank more than your home is worth.

That only matters if you need to sell, or when you need to remortgage to a different lender.

But it can cause a major headache.

First Homes

If you’re a first-time buyer, you may be able buy a home for between 30% and 50% less than its market value through the government’s First Homes scheme.

You can buy a new build home from a developer or a property from someone who’s used the scheme before and is now selling.

The First Homes scheme is only available in England and to qualify you have to be 18 or older and a first-time buyer.

You’ll need to be able to get a mortgage for at least half the price of the home.

And you’ll only be able to use the scheme if your total household income is £80,000 or less.

If you’re in London, buyers’ joint income can be a maximum of £90,000.

Shared ownership

You can buy a home through the shared ownership scheme if you can’t afford all of the deposit and mortgage payments for a home that meets your needs.

You buy a share of the property and pay rent to a landlord on the rest.

England, Scotland, Northern Ireland and Wales all have slightly different rules, so check the details carefully.

You can buy a share between 10% and 75% of the home’s full market value and pay rent to the landlord on the rest.

There may also be ground rent and service charges to help maintain common areas shared between you and your neighbours, so factor these in.

You can take out a mortgage to buy your share or pay for it with savings.

You’ll also need to pay a deposit, usually between 5% and 10% of the share you’re buying.

You can buy more of the home later on, when you can afford to.

You’ll pay less rent to the landlord whose share will get smaller.

But watch out for the small print as sometimes you can only buy more of your home in £10,000 chunks.

You’re restricted to buying a new build or from a seller who also bought through shared ownership.

If you have a long-term disability, you may also be able to buy a home that suits your needs such as a ground floor flat.

Another thing you need to consider is that all shared ownership properties are leasehold.

You must check that your ground rents and service charges won’t be put up more than a fixed percentage plus or at the inflation rate.

Mortgage Guarantee Scheme

Available for first-time buyers and those who’ve owned a property before who have a minimum 5% deposit.

It can be used to buy any type of home so long as you don’t pay more than £600,000 for it.

By providing a guarantee that the government will cover some of a lender’s losses if a borrower can’t afford to repay their mortgage and the home is repossessed – more lenders are prepared to lend up to 95%.

There’s a clock ticking on this scheme – it’s due to end in June 2025.

Lifetime Isa

If you’re saving for a deposit to buy your first home then saving into a Lifetime Isa is a no brainer.

You can save up to £4,000 a year into it and the government will give you a free bonus worth 25% of whatever you save.

If you save the full allowance, that means you’ll get £1,000 a year, every year, for free from the government.

You have to be between 18 and 39 to open a Lisa and you can pay in and get the bonus until you’re 50.

You can have a cash or investment Lisa.

If you withdraw your money before you’re 60, it must be spent on buying your first home.

If you withdraw it for another reason, you will have to pay back 25% of your savings to the government.

Effectively you’re giving back the bonuses.

Help to Build

If you’ve decided to build a new home, you could be eligible to get a Help to Build equity loan from the government.

There are different rules in England, Wales and Scotland so check what’s available for you.

If you’re building a home in Northern Ireland you don’t have access to the scheme.

If you qualify, you can apply for the Help to Build equity loan to pay for land to build on or if you plan to build a new flat on top of an existing building.

If you buy a commercial property and convert it into a home you can also apply and when you knock a property down and build a new home in its place.

You can borrow between 5% and 20% of the land and building costs but you must be able to get a mortgage as well.

Buying the land and the estimated building costs must not be more than £600,000 with building costs capped at £400,000

You can only get an equity loan if you also have a mortgage offer for the home you want to build.

There’s a £1 monthly fee to Homes England to manage the loan and you’ll be charged yearly interest at 1.75% interest after five years.

After six years the amount of interest you pay will go up in line with the consumer price index, plus 2%.

Paying interest does not count towards paying back the equity loan.

Help to Buy – Wales

Help to Buy has ended in England but there is still a scheme in Wales.

You can apply for an equity loan from the government to buy a new build home from a registered builder.

You’ll have to put down at 5% deposit, can borrow up to 20% from the government and get a repayment mortgage for the rest of the purchase price.

Right to Buy

This scheme was famously brought in during the 1980s by then Prime Minister Maggie Thatcher.

It’s still running today and allows most council tenants the right to buy their council house at a discount.

There are different rules for Wales, Scotland and Northern Ireland.

You can make a joint application with up to three family members who’ve lived with you for the past 12 months.

If you rent from a Housing Association you may also have the right to buy it at a discount under the government’s Right to Acquire Scheme.

Deposit Unlock

This lets you buy a new build home from any developer registered with the scheme so long as you have a 5% deposit.

Newcastle Building Society, Nationwide and Accord Mortgages are the only lenders signed up to Deposit Unlock at the moment.

The scheme is only available if you apply through a mortgage broker.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories