Article content

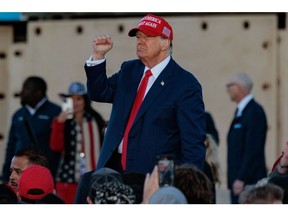

(Bloomberg) — An anti-tax advocacy group with ties to billionaire Jeff Yass and shipping magnate Richard Uihlein is jockeying for a fresh round of corporate levy cuts should Donald Trump win a second term in the White House.

The Club for Growth Foundation, whose members have sparred with Trump advisers on economic policies, says its corporate tax cut plan — as well as a corresponding push for deregulation — are aimed at bolstering US manufacturing, according to a policy proposal obtained by Bloomberg News. The plan calls for generous deductions for business investments and introducing a 20% flat tax on distributed profits.

Article content

Club for Growth’s operation has recently come back into Trump’s good graces after spending millions of dollars on advertisements last year trying to persuade voters that the former president is unelectable.

With a debate over renewing tax cuts poised to consume Congress and the White House next year, the group is seeking to appeal to the former president with their wish list of levy reduction ideas. Trump in March reportedly said that he and Club for Growth President David McIntosh are now “back in love” after the negative advertising they launched at him.

“We are developing the best freedom agenda from our friends in the conservative movement and promoting it to the next generation of America’s leaders. American families do not benefit from big-government, national populist policies and we look forward to a robust debate,” McIntosh said in a statement.

Club for Growth, whose operation includes an advocacy group, a non-profit foundation and allied political action committees, is a key player in conservatives economic policy circles. The plan is an opening salvo for a robust debate over tax policy set for next year with expiration of key portions of Trump’s 2017 cuts, including personal rate reductions, business deductions and estate tax limitations.

Article content

Yass and Uihlein are the two biggest contributors in recent years to Club for Growth Action, a super PAC allied with the main advocacy group.

The policy plan includes some ideas that don’t align squarely with Trump’s worldview, stating that tax cuts are a preferable option to tariffs to boost US businesses. McIntosh has pushed back against economic populists who support higher tariffs and a bigger role for the federal government in directing investment. The plan criticizes government grants to US chipmakers and trade barriers to protect favored US industries.

Earlier: Trump’s Economic Confidants Battle for Sway on Tax, Fed Policy

Trump’s embrace — or not — of the free-market group’s policies could have consequences in the November election.

As Trump and President Joe Biden compete for blue-collar voters in key battleground states like Pennsylvania, Michigan and Wisconsin, both have both portrayed themselves as protectionists against China. Trump has proposed 60% tariffs on China while Biden this week announced a 100% tariff on Chinese electric vehicles among other sanctions.

Article content

Trump’s populist allies include Senators JD Vance of Ohio and Marco Rubio of Florida, who have pushed for policies to counter China’s rise and bolster US manufacturing. Both men are in the mix to be Trump’s running mate.

The foundation’s paper contends that certain tax cuts — like immediate expensing of corporate investments and a rewrite of the corporate tax code — would be better for the economy than government subsidies, tariffs and mandates. The document projects that $697 billion in tax cuts would mostly be offset by higher growth in the first decade and pay for themselves in future decades.

The proposal, which includes positions on education and energy, is a compilation of work from scholars and economists at conservative think tanks like the Tax Foundation and The Heritage Foundation.

Share this article in your social network