They will be offered discounts — and possibly even a free share — as the taxpayers’ stake is sold off 16 years after the bank was bailed out.

Sources say the conditions are right for a June launch.

The FTSE 100 has been trading at record highs and NatWest shares are up 46 per cent this year.

US investor Capital Group has been buying more shares.

NatWest said the Government’s stake has fallen below 27 per cent — down from 37 per cent in December and much less than the 84 per cent it took in 2008.

Sources say there is a narrow window for a sale.

It cannot be in July because of “close period” rules.

And it is unlikely to happen in August as there is little City activity during the holiday season.

The sale will focus on retail investors like the “Tell Sid” British Gas campaign did in 1986.

The Government is discussing a free bonus share that buyers would have to hold for a year to stop them cashing in too quickly.

Investors will also probably have to spend a minimum of £250.

The share sale will be the first of its kind since Royal Mail raised £3.3billion.

The Government has hired advertising group M&C Saatchi to promote awareness.

Retail brokers Hargreaves Lansdown and Aj Bell are also lined up.

The Government bought into NatWest in late 2008 at 502p a share, at a cost of £50billion to the taxpayer.

Shares are currently trading at around 319p, valuing the bank at £27.8billion — making the Government’s stake worth some £7billion.

A BIGGER PIZZA PIE

A PIZZA chain started 12 years ago by two brothers after a “pilgrimage” around Italy in a three-wheel van is now ramping up its expansion.

Despite the hospitality gloom, Pizza Pilgrims has announced plans to move into Scotland and Wales.

Thom and James Elliot already have 22 sites in England.

Last year sales grew by 37 per cent to a record £28.7million.

Its pre-tax profits doubled to £700,000.

The chain’s best-selling pizzas are the double pepperoni and hot honey, and the classic Margherita.

BUDGET DRAGON’S FIRING

THE new owners of Discount Dragons have set out ambitious plans for the business as bargain-hungry Brits drive sales higher.

The online retailer sells heavily discounted products by big brands that are close to the end of their shelf life.

Some, such as Dairy Milk bars and Body Shop moisturisers, sell for just 1p.

The firm was bought in October by Huddled Group Plc and bosses plan to open a bigger warehouse to grow the firm tenfold.

Huddled’s Martin Higginson said: “It was a tiny business starved of cash and expertise, but we see big potential.”

Discount Dragon posted a 21 per cent rise in revenues in the first quarter to £2.1million while orders rose by a third to 64,000.

MINE BID BY RIVAL ‘THE PITS’

ANGLO AMERICAN has rejected an improved £34billion takeover bid by BHP — saying it still “undervalues” the company.

The rival miner upped its offer by almost 15 per cent — equal to 0.8 of its shares for every Anglo share in the deal.

It would create the world’s biggest copper miner.

BHP still wants Anglo to spin off its South African businesses as part of the takeover.

The sweetened bid comes a day before Anglo is due to update investors about its own plans to improve the business.

BOOTS IN A BUYERS MARKET

BOOTS’ American owner has started sounding out potential buyers for the British health and beauty high street chain.

Walgreens revived talks last year about a potential £7billion stock market listing for Boots.

Its earlier attempt to flog the business to buyers — including Asda owners the Issa brothers — failed.

The US business is now working with advisers on early talks with bidders, according to Bloomberg.

It would mean the London Stock Exchange misses out on another float.

Boots, which has 2,000 stores across the UK, recently posted a 6 per cent rise in sales, with both online and store growth.

It has been trying to boost healthcare services, such as jabs, at its pharmacies.

HEATHROW is on track for its busiest year ever after 5.7million passengers travelled through in April.

The airport’s bosses yesterday criticised the Government for charging international passengers a £10 transit fee and scrapping tax-free shopping for tourists.

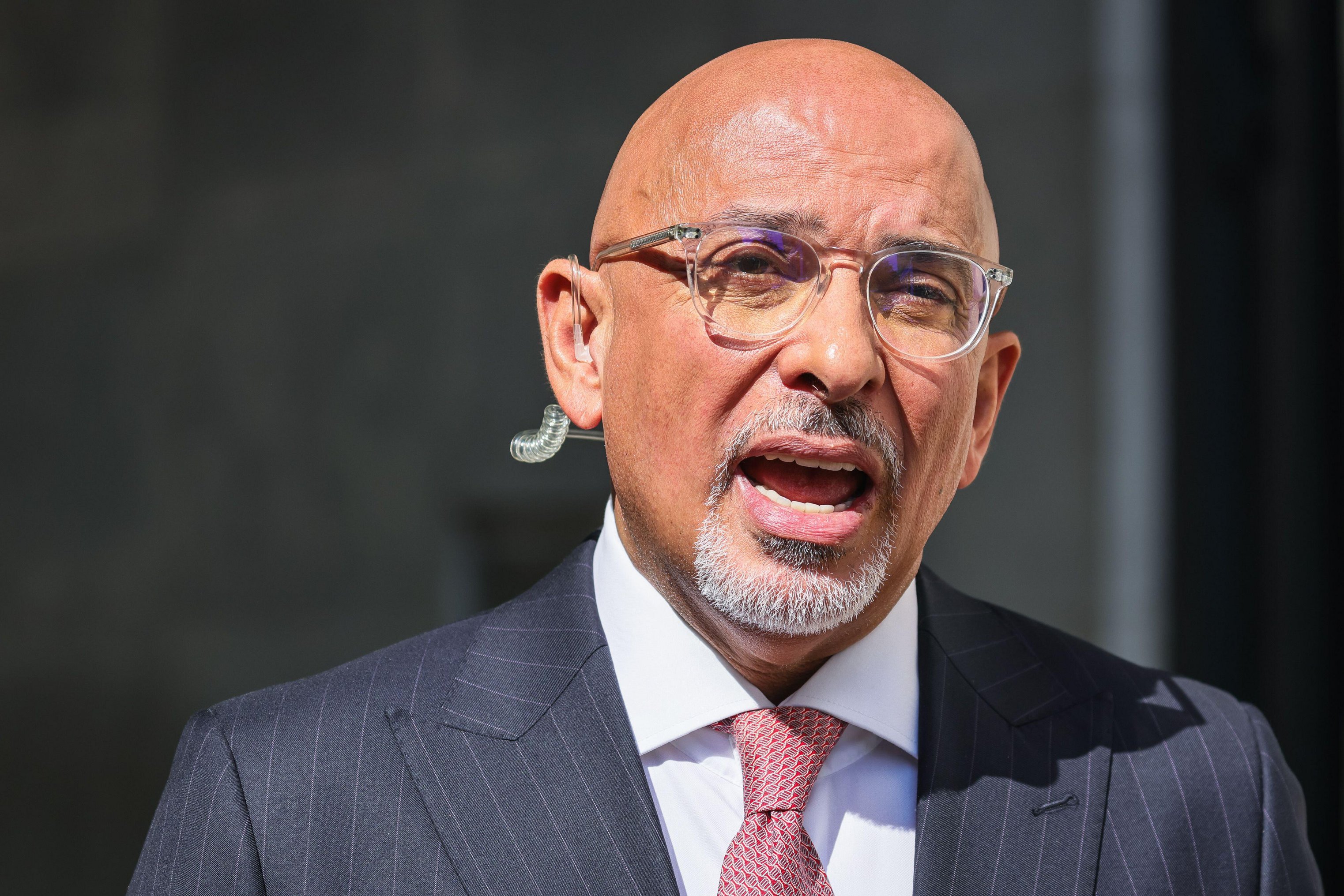

VERY BIG ROLE FOR ZAHAWI

FORMER Chancellor Nadhim Zahawi has a new job as chairman of Littlewoods owner Very Group, just days after announcing he would step down at the election.

Mr Zahawi will replace Aidan Barclay as chairman of Very, which is part of the Barclay family’s business empire.

The move places him once again at the centre of dealings between the family and Abu Dhabi-backed IMI.

IMI recently provided £40million of debt to Very Group and will be gaining a board seat.

IMI had also tried to buy The Telegraph newspaper from the Barclay family.

Mr Zahawi had been a key middleman in negotiations and was reportedly lined up to be the newspaper group’s chairman.

At the weekend Mr Zahawi admitted for the first time he paid a near £5million penalty to HMRC to settle his tax affairs, as first reported by The Sun on Sunday.

HOUSES IN STORE

ASDA is moving into house building with plans for a large development in the capital.

The UK’s third biggest supermarket yesterday announced a tie-up with Barratt to redevelop its ten-acre Park Royal site in North West London.

It will include a new town centre, a 60,000sqft Asda superstore and 1,500 homes.

Asda said around 500 of these properties will be designated as affordable.