May 11 (UPI) — A Texas judge has blocked President Joe Biden‘s attempts to implement a rule that would cap credit card late fees at $8.

The rule was set to take effect Tuesday and would have cut fees from an average of $32, according to the U.S. Consumer Financial Protection Bureau.

“The credit card lobby’s lawsuit is an attempt to derail a rule that will save families $10 billion each year in order to continue making tens of billions of dollars in profits by charging borrowers late fees that far exceed their actual costs,” a CFPB spokesperson told CNN in a statement.

The right-leaning U.S. Chamber of Commerce called Friday’s decision by U.S. District Court for the Northern District of Texas Judge Mark Pittman a “major win.”

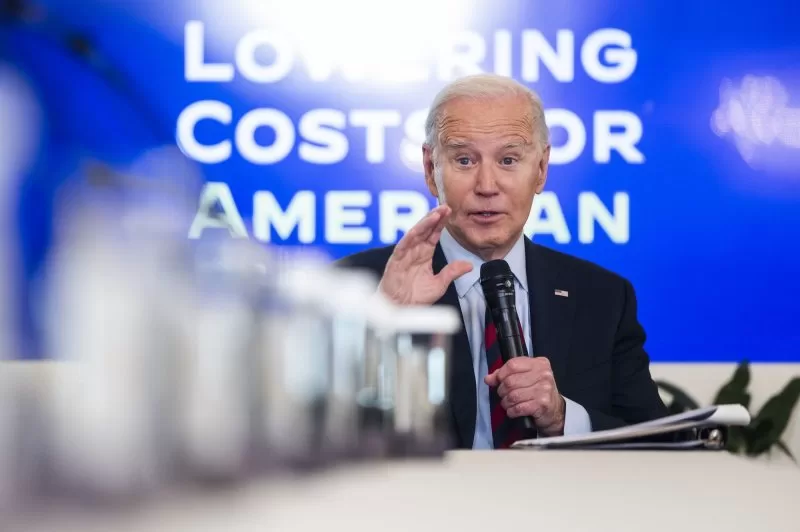

The CFPB finalized the rule in March, a month after Biden announced a larger initiative to curb so-called “junk fees” for credit cards, travel and cable.

The Chamber of Commerce and other groups then filed a lawsuit to block the rule’s implementation, contending it violates state laws.

If passed, the rule would apply to credit card issuers with more than 1 million accounts.

The large companies represent more than 95% of total outstanding credit card debt, according to the CFPB.

The CFPB said in March the rule was designed to close a 2010 loophole “exploited by credit card giants.”

The Chamber of Commerce applauded Pittman’s ruling Friday.

“This ruling is a major win for responsible consumers who pay their credit card bills on time and businesses that want to provide affordable credit,” Chamber of Commerce Litigation Center counsel Maria Monaghan said in a statement on its website.

“The CFPB’s attempted micromanagement would have raised costs for most credit card users and made it harder for businesses to meet consumers’ needs. The U.S. Chamber will continue to hold the CFPB accountable in court.”