The finding follows years of dissatisfaction with crushing housing costs and is threatening the city’s future as young adults and renters are the most likely to contemplate leaving.

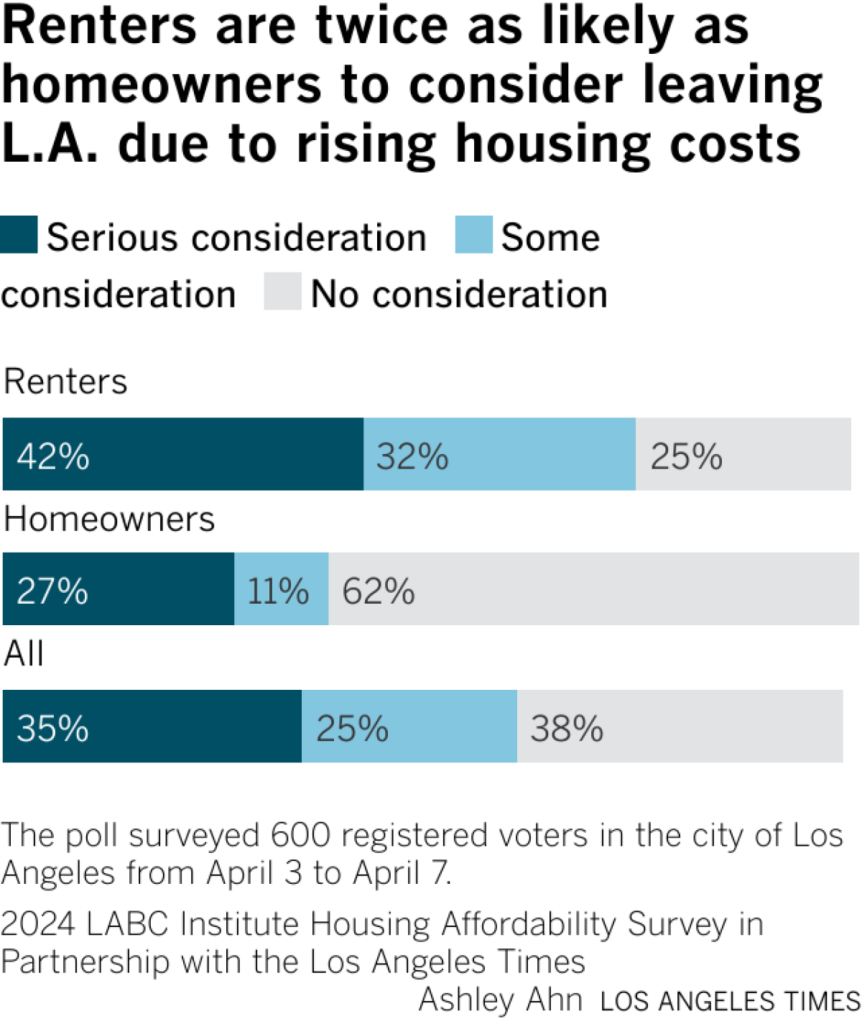

Nearly three-quarters of renters and those under 35 have given consideration to moving out of Los Angeles compared with 37% of homeowners and 26% of those 65 or older, according to the poll, which was conducted for the Los Angeles Business Council Institute in partnership with the Los Angeles Times.

Overall, the poll found that 60% of Angelenos have debated leaving the city due to the rising cost of housing, with 35% saying they’ve given “serious consideration” to doing so.

The results reflect what voters believe to be “foundational unfairness” when it comes to housing, said Aileen Cardona-Arroyo, a senior vice president at Hart Research, the Washington, D.C., polling firm that administered the survey. Angelenos, she said, think they are working hard but still find themselves failing to keep pace with rising costs.

“People feel like, ‘I’m doing the right thing. I have a job. I do my part. So why is it that I’m struggling to pay my bills when it comes to housing?’” Cardona-Arroyo said. “It’s so easy to understand and identify what makes it unsustainable for people.”

The poll, known as the 2024 LABC Institute Housing Affordability Survey in Partnership with the Los Angeles Times, surveyed 600 registered voters in the city of Los Angeles between April 3 and April 7.

The findings on housing were striking compared with the positive feelings expressed by those surveyed on other issues.

A narrow majority of Angelenos said they were very or somewhat satisfied with the quality of life in the city, a figure that rose to 7 in 10 when voters were asked about their own neighborhood. A similar number reported satisfaction with safety and security in their communities, and large majorities were satisfied with the accessibility of grocery stores, parks and transportation. Almost three-quarters of renters said they aspired to become homeowners in Los Angeles.

“I feel like I live in paradise,” said Ron Allen, a 46-year-old homeowner in Playa Vista who was participating in a focus group as part of the poll. “But my bank account is screaming at me.”

Allen and other focus group participants cited housing problems as dominating their concerns, which was broadly reflected in the poll. Seven out of 10 surveyed said they personally found it difficult to afford housing in the city, including 84% of renters and 85% of those under 35.

“You can figure out food. You can figure out medical care. If you’re born and raised here, you get used to driving,” said Justice Allen, a 28-year-old renter from the San Fernando Valley. “But the idea of housing, for the most basic of shelter, is probably where 95% of my stress goes to.”

More than 40% of those surveyed said they had to find additional sources of income to afford housing in the last five years. About one-fifth said they added new roommates or renters to cover costs or had fallen behind on their rent or mortgage payments. An additional 6% said they’ve lived in cars or trucks or were otherwise homeless during that time.

The poll mirrors others in recent years on the challenges of high housing costs, particularly for renters. A recent survey from UCLA’s Luskin School of Public Affairs found that nearly 4 in 10 renters in L.A. County have worried about losing their homes and becoming homeless in the last few years.

The LABC-Times survey also found remarkable persistence in Angelenos’ concerns about homelessness and housing affordability.

Of those polled, 93% and 87% believed that homelessness and housing affordability, respectively, were serious problems in Los Angeles. That’s compared with 97% for homelessness and 86% for housing affordability in a similar LABC-Times survey from 2019.

Voter attitudes reflect how ingrained housing challenges have become in Los Angeles, with data showing the problem worsening since 2019.

Average rents for new listings in the city have increased by nearly $400 a month to about $2,800, according to data from Zillow, though the rate of the increase has been lower than inflation. Home values have skyrocketed by more than a third to $974,000, per the firm’s data. The city’s homeless population on any given night has grown by 30% to 46,260, according to official surveys.

More than half of renters countywide pay more than 30% of their income on rent, an amount the federal government considers cost-burdened, with 28% spending more than half their income, according to a recent UCLA analysis.

“You can only see high numbers on a concern for an issue for so long before something happens and people become fed up with it,” Cardona-Arroyo said.

The findings were especially worrying for young adults who were the most likely to say they are considering moving due to high housing costs despite their interest in buying a home here, she said.

“People like L.A.,” Cardona-Arroyo said. “They very much want to stay. I wouldn’t say that we’re at a point where people have lost all hope to resolve this issue. But things are boiling up. We’re at a pressure point on this.”

Frustrations emerged during the focus group sessions, where young renters lamented that they were being priced out of the communities where they’re most familiar.

“The people that grew up here can’t afford to live here,” said Bryanna Coleman, 22, a renter who lives on the Westside. “I’m about to be a recent college grad. Why can’t I afford to live in areas that I know personally?”

Any exodus of young adults from Los Angeles would hurt the city’s dynamism and competitiveness with other regions in the country, especially if there’s a “brain drain” of students who’ve attended the region’s world-class universities, said Mary Leslie, president of the Los Angeles Business Council.

Elected officials should want young people to feel they can invest in the city and build their lives here, she said. Without that spirit, she said, the city’s long-term health is at risk.

“It’s a pretty serious wake-up call,” Leslie said.

The poll found concerns among homeowners as well. Three in 10 of those surveyed say they’re cost-burdened, spending more than 30% of their income on housing.

As mortgage interest rates have risen, some focus group participants who saw themselves moving into larger homes or wealthier neighborhoods said they could no longer afford to do so.

“This wasn’t supposed to be our forever house, but I guess we’re dying here,” said Cathy Donabedian, a 43-year-old homeowner in the San Fernando Valley. “Anything else we’re looking at, our mortgage is going to go from 30% of our income to 80%. You can’t afford to do that.”

The poll surveyed registered voters in Los Angeles over the phone and via text message to the web. The margin of error is plus or minus 4 percentage points for city voters overall and higher for subgroups. Hart Research on April 9 conducted two focus group sessions, one of renters and one of homeowners, who both came from a mix of city neighborhoods.