Article content

(Bloomberg) — The Riksbank will either cut borrowing costs this week to aid the economy or else shirk from a move to avoid weakening the krona, in one of its most suspenseful decisions in years.

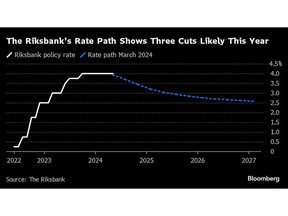

A quarter-point reduction of the benchmark interest rate to 3.75%, as predicted by two thirds of the 20 economists surveyed by Bloomberg, would mark the first clear instance this century when Swedish officials started easing before the European Central Bank and the US Federal Reserve.

Article content

Keeping the policy stance unchanged on Wednesday, as the remainder of forecasters anticipate, might help shore up the currency and avert any inflation setback through import-price increases — but at the cost of further constricting an economy that has shrunk for four consecutive quarters.

The quandary illustrates how advanced-world central banks must weigh their options at a time when the largely synchronized easing that once seemed likely in rich economies has been derailed by the Fed’s need to keep rates high amid stubborn inflation pressures.

Governor Erik Thedeen set the scene for Sweden’s close-run outcome at the last decision in March, when he anticipated a cut either in May or in June. With inflation data having since come in lower than expected, Nordea Bank Abp Chief Economist Annika Winsth reckons policymakers needn’t hesitate.

“Looking at domestic factors, everything speaks in favor of a rate cut,” she said. “Our forecasts show that inflation will be at 1% in June, and keeping the rate at a restrictive level in that situation would be very odd. Why should you then increase unemployment and curtail growth?”

Article content

What Bloomberg Economics Says…

“A move next month would prevent unwanted pressure on the struggling currency as it would place the Riksbank’s first step closer to those from the ECB and Fed, which we expect in June and July, respectively.”

—Selva Bahar Baziki, economist. For full preview, click here

A Riksbank cut would be only the second among advanced-world peers this cycle after the Swiss National Bank’s pioneering move in March. It would be a “novelty” for officials to do that when US and euro-zone colleagues haven’t, Swedbank Chief Rate Strategist Par Magnusson said in a report last week.

“That this is done in a situation where core inflation is above 2% makes it even more unique,” he said, citing the underlying consumer-price gauge that strips out energy.

Lowering borrowing costs would be welcome for households struggling with the highest debt costs in years, in an economy whose frailty has made it stand out. The European Commission predicted in February that Sweden would see the weakest growth in the European Union this year. It will release new projections next week.

Article content

But the prospect that easing could stoke import prices is a concern for policymakers. The krona has weakened by about 1.5% against the euro since the Riksbank’s March meeting. That’s the worst performance in the group of 10 most-traded currencies.

In neighboring Norway, the central bank last week signaled that it may delay plans to start cutting rates after its krone weakened more than forecast.

For Nordea’s Winsth, such worries shouldn’t stop a move as inflation is set to undershoot the Riksbank’s 2% target and the lower exchange rate is mainly a function of dollar strength.

“There is a limit to how much their policy can diverge from the ECB’s, but I don’t think one or two cuts would be a large problem,” she said. “Also, I don’t think the krona weakness is a Swedish problem at the moment. The Norwegian krone is in the same situation, and Norges Bank’s hawkishness isn’t really paying off.”

The quandary could lead to a split among officials after 12 months of unanimity. Last time round, Deputy Governor Per Jansson warned that delays in easing elsewhere could lead to further krona weakening. Martin Floden, who will leave the Riksbank after this week’s decision, stressed that a cautious approach after any initial move could support the currency.

Whatever happens, Winsth cautions that expectations for relief for the economy are probably excessive — even if the three reductions in borrowing costs that officials signaled in March do materialize.

“Many households who hear about rate cuts probably haven’t quite calculated what it will mean in monetary terms,” she said. “I think people will be disappointed.”

—With assistance from Zoe Schneeweiss and Harumi Ichikura.

Share this article in your social network