Article content

(Bloomberg) — Chinese businesses from electric vehicles to infrastructure have much at stake from President Xi Jinping’s visit to Europe this week as trade tensions simmer.

The trip comes as the European Union joins the US to turn up its protectionist rhetoric and challenge China’s excess capacity, widening its probe into various industries. However, Europe faces a more complex battle as it also seeks to lure Chinese investment, with Hungary planning to sign agreements on expanding Xi’s Belt and Road Initiative in the country.

Article content

It’s also a crucial moment for the Chinese stock market. Shares have recently been climbing out of the doldrums as foreign investors revisit the once-shunned asset class, lured by valuations and signs of earnings improvement. Yet the unpredictability of geopolitical tensions remains a key deterrent for some.

“The main question is, where will it end? Solar panels, wind turbines and medical devices have also ‘recently’ caught Europe’s attention,” Maartje Wijffelaars, senior economist at Rabobank International, wrote in a note last week. Still, Europe needs China not only as an export market but “because it cannot afford to lose access to indispensable inputs for its desperately needed energy transition,” she added.

Here are some sectors to watch.

Electric Vehicles

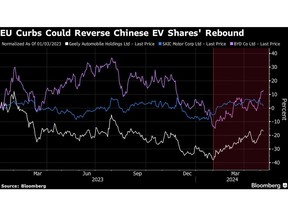

EVs have been at the center of the tensions. European Commission President Ursula von der Leyen said after talks with Xi in Paris this week that heavily-subsidized Chinese products are flooding the continent.

The commission is moving closer to imposing additional tariffs following its investigation into China’s subsidies and the outcome could be announced before July. Rhodium Group analysts have argued that duties need to be as high as 55% to make Europe an unattractive destination.

Article content

Surging Chinese auto exports to Europe suggest that without new protectionist measures, the EU may become a net importer, according to the Atlantic Council. EVs including those made by BYD Co. and SAIC Motor Corp.-owned MG Motor have contributed three-quarters of the growth since 2019, the report said. Geely Automobile Holdings Ltd. is another player, with Europe accounting for at least 13% of its revenues, according to Bloomberg-compiled data.

But the frictions can be a lose-lose game. The continent’s battery EV makers need China’s low-cost parts and processing before they can “start the assembly process” in Europe, while Chinese carmakers need the region for their expansion plans, said Trevor Allen, head of sustainability research at BNP Paribas SA.

The French government is seeking to balance a firmer approach to trade with an effort to secure Chinese investment. Speaking alongside representatives from the French auto sector, Finance Minister Bruno Le Maire said the government is in favor of BYD opening plants in France.

Renewables

EU’s anti-subsidy probes encompass Chinese suppliers to solar and wind projects, as regional firms grapple with low prices of solar modules and photovoltaic cells.

Article content

Read: China Clean Energy Stocks Drop as EU Launches Subsidy Probes

Among other firms, the German unit of Longi Green Energy Technology Co. is being investigated for bids of a Romanian solar park. Shares of Longi Green have fallen more than 6% since the probe was announced in early April versus a 2%-plus gain in China’s benchmark CSI 300 Index.

According to BloombergNEF, prices for Chinese-made wind turbines delivered outside mainland China are 20% lower than those of US and European companies.

Still, Goldwind Science & Technology Co., the world’s largest wind turbine supplier, is relatively cushioned from European probes because it doesn’t have a lot of generator exports to the region, Citigroup Inc. analysts Pierre Lau and Air Ma wrote in a note last week. The broker has a buy rating on the company.

Infrastructure, Medical Devices

Read: Hungary Plans At Least 16 Agreements With China During Xi Visit

Over in Serbia and Hungary — the last two legs of the trip — all eyes will be on announcements related to the Belt and Road Initiative.

Direct Chinese investment in the two central European nations already exceeds $15 billion, and both would want to woo Chinese capacity rather than complain over its excess. CRRC Corp. may benefit further after its unit won a high-speed train contract with Serbian authorities in October.

Chinese battery giant Contemporary Amperex Technology Co. has been charging ahead with a plan to build a facility in Hungary — which would be Europe’s biggest factory making batteries for electric vehicles.

Separately, medical device manufacturers may be under further pressure depending on the outcome of the EU’s probe, which kicked off last month. Stocks such as Shenzhen Mindray Bio-Medical Electronics Co. have since rebounded as their sales to Europe are still small.

Share this article in your social network