The low-cost retailer yesterday said it would expand its click and collect service across its 184 UK stores, and include menswear and homewares.

But its boss said there is “no evidence we are losing shoppers because we don’t deliver to home”.

George Weston, chief executive of Primark’s owner Associated British Foods, said “click and collect works very well”.

Asked if he would offer home deliveries, he added: “No, no, it’s a completely different business, requiring different skills.”

ABF came under intense pressure during the Covid pandemic to launch online shopping, particularly when its stores were shut during lockdowns.

However, since restrictions eased, shoppers have flooded back to its stores and it has grown market share.

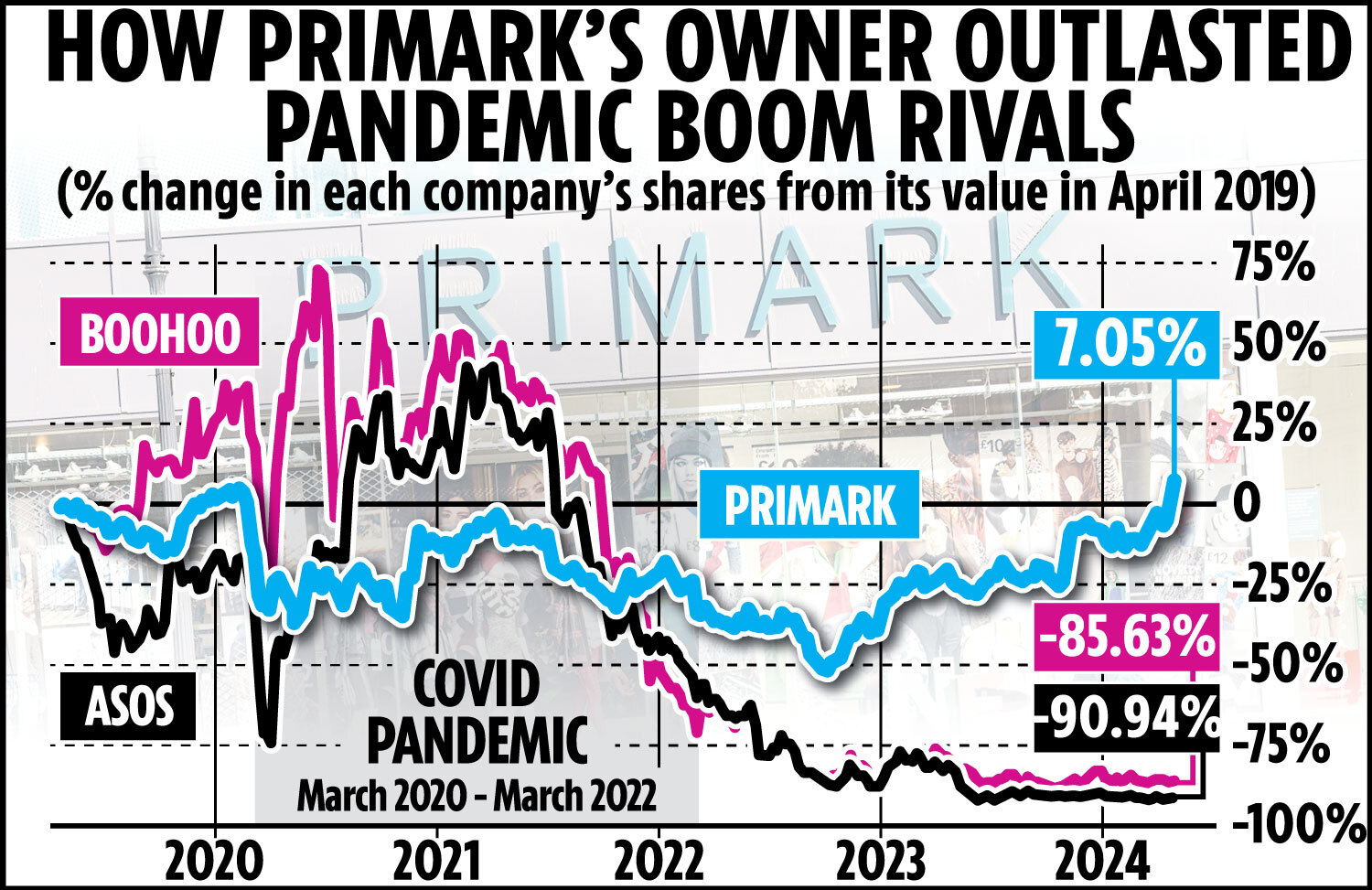

Meanwhile, online fashion retailers ASOS and Boohoo have seen their share prices crash by 90 per cent as investors question their expensive models.

On their diverging fortunes, Mr Weston said: “I had noticed.”

By forcing shoppers to come to its shops to pick up online orders, Primark is also not wasting its investment in its stores.

Mr Weston revealed that 40 to 60 per cent of online shoppers make a second, bigger purchase when picking up their online shop.

The expansion of click and collect came as Primark grew its sales by 6 per cent to £4.5billion, while its operating profits surged by 46 per cent to £508million.

The retailer’s collaboration with pop star Rita Ora has also lured more shoppers to its stores, with a third, “festival-inspired” fashion collection launching soon.

Profits were also helped by falling cost pressures and higher prices, although Mr Weston ruled out any further increases this year and for the foreseeable future.

The boss toasted a “return to normality” following Covid and said it was the first time in four years it was not facing rocketing inflation or supply chain disruptions.

Easing cost pressures meant profits at parent group ABF have boomed 37 per cent to £911million in the six months to March.

£899M JD DASH AT U.S. RIVAL

JD Sports is flexing its US muscles with an £899million bid for rival Hibbett.

A takeover of the Nasdaq-listed company will add 1,169 stores across 36 states to the retailer’s growing empire.

It also marks a welcome switch from the trend of British companies being snapped up by US listed rivals.

JD, the so-called “King of Trainers” opened its first US store in 2018 but has grown quickly through acquisitions.

It now has 955 there, more than double the 444 it has at home.

The Bury-based company made £2.8billion of sales in the US last year, and the Hibbett deal will take it to a combined £4.7billion turnover there.

JD Sports chief executive Regis Schultz said the deal “is a very important transaction for our strategic and financial development”.

Its shares rose by almost 4 per cent to 123.10p as analysts at Peel Hunt called it a “highly pleasing deal”.

SHARES

BARCLAYS up 3.06 to 192.24

BP up 0.60 to 523.10

CENTRICA up 1.55 to 133.30

HSBC up 1.20 to 667.70

LLOYDS up 0.20 to 667.70

M&S up 6.30 to 262.90

NATWEST up 6.10 to 285.50

ROYAL MAIL up 4.20 to 279.60

SAINSBURY’S flat at 269.00

SHELL down 12.00 to 2,895.00

TESCO up 1.90 to 293.00

WIMPEY’S FEARLESS

TAYLOR Wimpey had a “good start” to the year as mortgage availability and consumer confidence returned to the market.

The housebuilder said traffic to its website was “encouraging” — although its order book was lower at 7,686 homes compared with 8,576 last year.

Higher mortgage rates have made home-ownership too expensive for many Brits.

Analysts at Goodbody said they took “comfort in the full-year guidance remaining unchanged”.

FLYING FTSE FUELS RATES HOPE

WHAT’S HAPPENING WITH THE FTSE 100?

London’s index of top 100 firms hit a new mid-trading high yesterday, briefly surging to 8,076.52 to beat last February’s peak of 8,047.

It lost some gains after a Bank of England economist warned rate cuts were “some way off” but closed 20.94 points up at 8,044.81, also an all-time high.

WHY THE RALLY?

Fears over Middle East tensions have eased after the flashpoint of last week’s strikes by Iran on Israel.

The FTSE is also bolstered by traders betting on a shock US rate rise.

This has fuelled hopes the BoE could cut interest rates first.

Lower rates here mean investors seek better returns from equities, rather than cash sitting on balance sheets.

Lower rates also depress the pound against the dollar, which boosts the FTSE 100 as three quarters of the firms report higher earnings from abroad after converting from dollars to pounds.

WHY DOES IT MATTER?

The strength of the FTSE 100 is important to the UK’s reputation for finance.

The stock exchange has had a battering as a number of British companies have been swooped on or sought higher valuations in the US.

WHY SHOULD I CARE?

Our pension funds typically track FTSE 100 trading.

A stronger index means stocks in blue chip firms such as BP, Shell and AstraZeneca are valued higher, so pension pots which own them are worth more too.