- In short: An analyst is warning the federal government risks creating “zombie” projects through its clean energy investment scheme.

- The Capacity Investment Scheme will involve underwriting projects as part of efforts to hit 82 per cent renewable energy by 2030.

- What’s next: The government will kick the scheme off in May when it calls for a tender for 6 gigawatts of renewable energy.

A multi-billion-dollar plan by the federal government to spur renewable energy investment needed to meet the country’s green power targets could create “zombie” projects that never get built, an analyst has warned.

Green Energy Markets director Tristan Edis said the Commonwealth’s capacity investment scheme was so ambitious it risked attracting projects that were unviable or had no realistic prospect of success.

Under the scheme, which the government unveiled in November, taxpayers are set to underwrite a wave of new green energy projects via a series of tenders over coming years.

While the government has declined to reveal how much the scheme is expected to cost, estimates have suggested the bill could run to $67 billion.

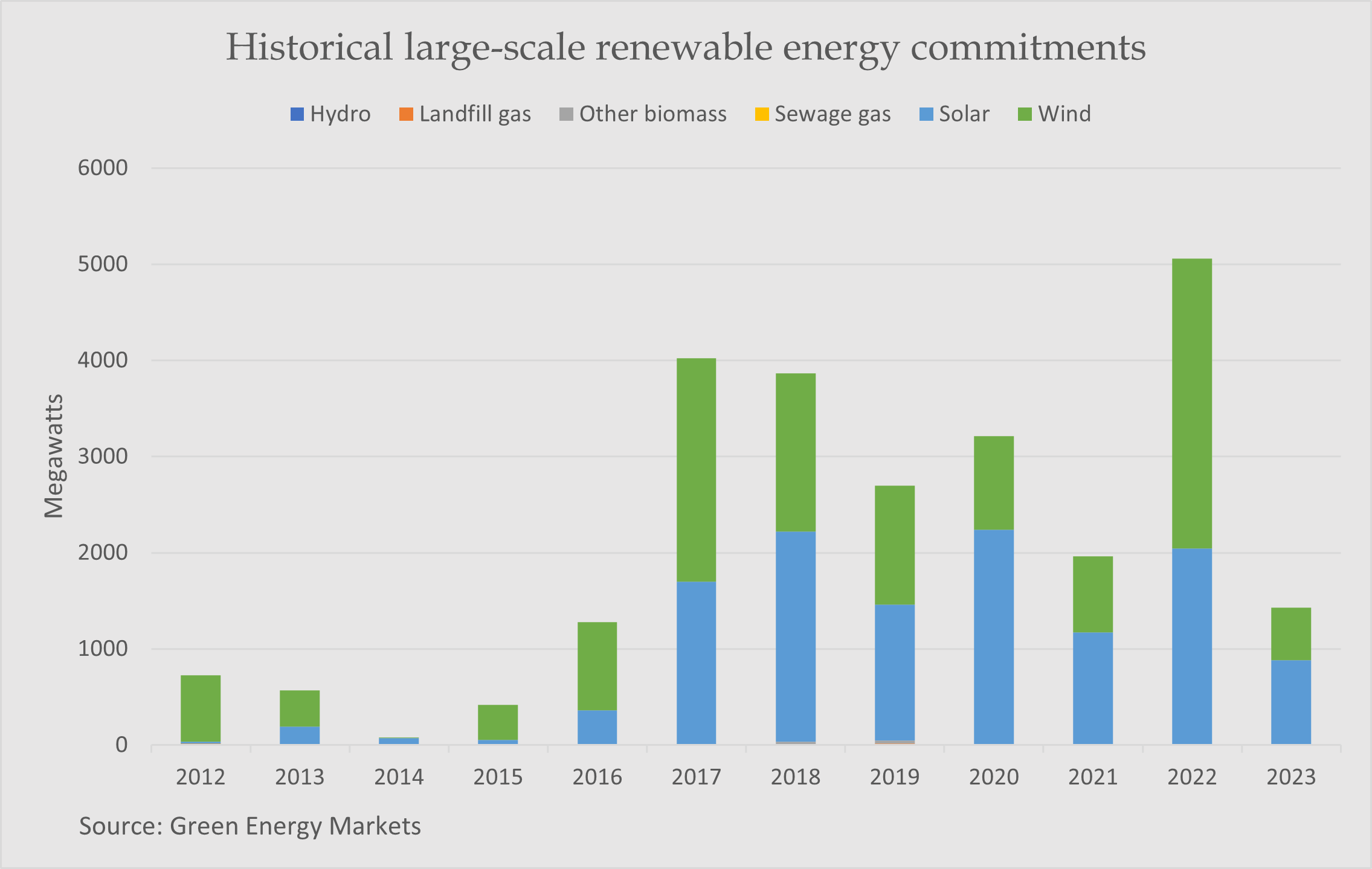

Mr Edis said the government would need to commit to a whopping 8 gigawatts of generation capacity every year to 2027 in order to meet its 82 per cent renewable energy target by 2030.

In a new report released today, he said this was more than the annual figure of 6GW the government’s plans currently assumed.

By contrast, Mr Edis said Australia had never built renewable energy projects at such a rapid rate before – committing to less than 1.5GW of mostly wind and solar power last year.

“It’s a big step up relative to the level of construction commitments Australia has achieved historically,” Mr Edis said.

Keeping out the ‘tyre kickers’

He said the scale and complexity of seeking so much new capacity was a monumental task fraught with risk.

The government, he said, needed to assess a range of things from a developer’s capability to the environmental effects that might arise.

“These are not simple questions,” he said.

“Experienced major renewable energy investors have gotten these things wrong in the Australian market.

“Several have found themselves with seriously underperforming projects which suffer from severe transmission and economic curtailment.”

The Clean Energy Investor Group, which represents the financial backers of large-scale green power projects, backed parts of the report.

Chief executive Simon Corbell said it raised some legitimate questions.

Mr Corbell said the government should ensure it had the ability to cancel the approval of a project under the scheme if developers were unable to meet deadlines.

“I think when it comes to planning and environmental issues, it’s always been important for governments to be confident that projects are well advanced,” Mr Corbell said.

“You do want to avoid the scenario where you have tyre kicking — basically proponents who are prepared to bid at very cheap rates but are not well prepared to deliver the project.”

For Mr Corbell, the biggest risk to the scheme from poorly chosen projects would be a material delay to new capacity that would undermine the government’s ability to hit its targets.

What’s more, he said it would hurt consumers by prolonging their exposure to volatile fossil fuel prices.

A spokeswoman for Federal Climate Change and Energy Minister Chris Bowen said the scheme had been carefully designed after a long consultation process to avoid such pitfalls.

“It’s designed to deliver projects that are the cream of the crop,” the spokeswoman said.

“And the huge competition and massive oversubscription in early tender rounds is proof it’s working, with the sod already being turned on construction of the 500MW Liddell Battery.

“Our plan with states along with the national plan, is delivering the incentives, levers and checks and balances to ensure that we’re delivering the high-quality energy projects we need, where and when they are needed.”

Much to do, little time to do it

According to Mr Edis, failure to properly vet projects would expose the scheme to “attack by zombie” developments that never got built or performed poorly.

He pointed to the experience in Victoria, where the state government has undertaken two rounds of tenders for 600 megawatts in 2017 and 650MW in 2020, respectively.

Mr Edis said one of the projects from the first round “is still yet to be committed to construction” almost seven years later because of grid constraints.

Of the six winning bids from the second round, he said just one had so far started construction despite the winners being announced in October 2022.

He said not all government tender processes would take as long, but Victoria’s plight was instructive.

“If you don’t do these evaluations well it can undermine the entire effectiveness of the contracting process,” he said.

“This is because it can allow unrealistically optimistic bidders to undercut the more capable proponents who have a better understanding of project economics and risks.

“At the end of the tender the government may end up with a great press release – lots of projects contracted at a low price.

“But then many of them never get built.”

Safeguards needed: observers

Mr Edis suggested the government put in place a number of safeguards to protect against the risk of dud projects.

Among them was an oversubscription of tender rounds to ensure winners had to race to reach a commitment to construction.

He said the government should also “make it a condition of tender eligibility” that projects already have necessary government planning and environmental approvals.

And he said tenders should be kept to a national basis – rather than divvied out among the states – to ensure the states competed with each other for “fast approvals and supporting infrastructure”.

“We need to make sure the [scheme] is structured to minimise the risks of zombie projects and rewards bidders who have commercially viable projects that they can deliver on a rapid time frame,” he said.

“It also needs safeguards that enable failures in the selection process to be revealed quickly, so that the causes of these failures can be addressed early rather than left to fester.”

Mr Corbell from the Clean Energy Investor Group said requiring projects to have state planning and environmental approvals as a condition of tender eligibility was a “sensible” suggestion.