Article content

(Bloomberg) — Oil shrugged off Iran’s unprecedented attack on Israel, with gains held in check by speculation that the conflict would remain contained as leading powers including the US urged restraint.

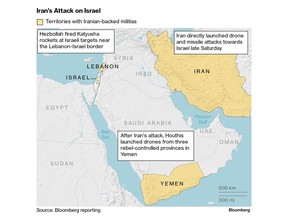

Global crude benchmark Brent crude initially rose just 0.7% to $91.05 a barrel in early trade, before trading flat. More than 300 missiles and drones were fired by Iran at the weekend, the first time it has struck Israel from its soil, though most were intercepted. The attack — which had been expected for days — came in retaliation for a strike in Syria that killed top Iranian military officers.

Article content

Oil has been one of the strongest performers in commodities this year as OPEC+ keeps a tight rein on supply to drain inventories and support prices. The latest attack escalates tensions in a region that produces about a third of the world’s crude, and represents the latest twist in a showdown that’s followed the assault by Tehran-backed Hamas against Israel last October. Still, the Iranian mission to the United Nations said the issue “can be deemed concluded,” reducing for now the risks of a wider conflict.

Oil markets have tightened significantly in recent months, lifting energy costs and posing a headache for central bankers as they seek to drive home their push to quell inflation. Ahead of the Tehran’s weekend strike, crude analysts had already been addressing the possibility that prices could once again hit $100 a barrel.

OPEC — the producers’ cartel that counts Iran as a founding member — said last week that oil would need to be closely watched in the coming months to ensure “a sound and sustainable market balance,” according to a monthly report. The International Energy Agency, meanwhile, put the spotlight on another conflict, saying Ukrainian drone attacks against Russian oil refineries risked disrupting petroleum product markets.

Article content

The Iranian strike came as demand is ramping up. US refiners are preparing to boost fuel production for the summer, the traditional driving season when consumption peaks. In Asia, recent macro-economic prints from China have suggested that the economy may be turning the corner, bolstering the outlook for fuel consumption.

Shipping risks have also been in focus after Iran seized a vessel, the MSC Aries, near the key Strait of Hormuz waterway shortly before the strikes against Israel. The ship’s beneficial owner is part of Israel-linked Zodiac Group, according to data compiled by Bloomberg. The move raises concerns over the safety of vessels in the region, adding to previous logistical disruptions from attacks in the Red Sea.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Share this article in your social network