Article content

(Bloomberg) — Stocks in Asia are primed for early declines after higher-than-expected US inflation data supported the view the Federal Reserve may keep interest rates higher for longer.

Equity futures for Japan, Australia and Hong Kong all tumbled, mirroring selling on Wall Street on Wednesday. The S&P 500 fell 1% and the Nasdaq 100 dropped 0.9%, with futures for the benchmarks edging lower in early Asian trading.

Article content

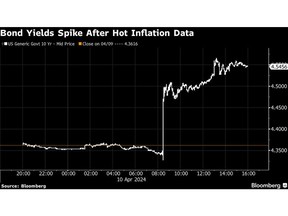

The dollar strengthened as Treasury yields rose across the curve Wednesday. The policy-sensitive two-year yield climbed 23 points, while the 10-year rose by 18 basis points to top 4.5% for the first time since November.

The moves were driven by the March US core consumer price index, which excludes food and energy costs. The gauge increased 0.4% from February, more than the 0.3% consensus forecasts, to beat expectations for a third straight month.

Investors are now signaling the Federal Reserve will cut interest rates just twice this year, starting in September, less than the most recent Federal Reserve dot plot that indicated three 2024 cuts. At the start of the year, market pricing indicated six cuts were expected.

“You can kiss a June interest-rate cut goodbye,” said Greg McBride at Bankrate. “There is no improvement here, we’re moving in the wrong direction.”

“Easy financial conditions continue to provide a significant tailwind to growth and inflation. As a result, the Fed is not done fighting inflation and rates will stay higher for longer,” said Torsten Slok at Apollo Global Management. “We are sticking to our view that the Fed will not cut rates in 2024.”

Article content

Former Treasury Secretary Lawrence Summers went a step further to say that one would have to “take seriously the possibility that the next rate move will be upwards rather than downwards.” Such a likelihood is somewhere in the 15% to 25% range, he told Bloomberg Television’s Wall Street Week with David Westin.

In Asia, data set for release includes Australian inflation expectations, consumer and producer prices for China, and Philippine trade figures. Markets are closed in Indonesia, Malaysia, India, Pakistan, Sri Lanka and Bangladesh.

The yen inched higher after weakening to levels not seen since 1990 against the dollar. The weakening has sparked fresh speculation Japanese authorities might step into the market to support the currency.

Oil prices rallied on worries about further conflict in the Middle East. West Texas Intermediate, the US oil price, inched higher after rising more than 1% Wednesday on news the US and its allies believe major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent.

Key events this week:

Article content

- China PPI, CPI, Thursday

- Eurozone ECB rate decision, Thursday

- US initial jobless claims, PPI, Thursday

- New York Fed President John Williams speaks, Thursday

- Boston Fed President Susan Collins speaks, Thursday

- China trade, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan and Wells Fargo due to report results, Friday.

- San Francisco Fed President Mary Daly speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 7:38 a.m. Tokyo time

- Nasdaq 100 futures fell 0.1%

- Nikkei 225 futures fell 1.1%

- Hang Seng futures fell 1.7%

- S&P/ASX 200 futures fell 0.8%

Currencies

- The Bloomberg Dollar Spot Index rose 0.8%

- The euro was little changed at $1.0742

- The Japanese yen rose 0.1% to 152.96 per dollar

- The offshore yuan was little changed at 7.2623 per dollar

Cryptocurrencies

- Bitcoin rose 1.2% to $70,643.96

- Ether rose 0.8% to $3,540.16

Bonds

- The yield on 10-year Treasuries advanced 18 basis points to 4.54%

Commodities

- West Texas Intermediate crude rose 0.2% to $86.35 a barrel

- Spot gold fell 0.8% to $2,334.04 an ounce

This story was produced with the assistance of Bloomberg Automation.

Share this article in your social network