But what can you say about a budget that’s nothing but political?

Therein lies the challenge in analyzing a document titled “Fiscal Sanity to Save America.” It’s the proposed federal budget for fiscal 2025 issued by the Republican Study Committee, which comprises most of the Republicans in the House.

80% of House Republicans released a Budget that … rigs the economy for the wealthy and large corporations against middle class families.

— President Biden on the GOP budget plan

It’s a lumbering 180-page document filled with GOP talking points about federal spending. Therefore it brims with misconceptions, misstatements and outright lies.

I read it so you don’t have to, but feel free to do so, just (advisedly) not on a full stomach. It calls for cuts in federal pay and benefits, repealing Obamacare, and — most importantly — slashing benefits in Medicare, Medicaid and Social Security.

Newsletter

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Unsurprisingly, Democrats see the document as providing grist for their campaign commercials from now to the end of recorded time. President Biden wasted no time voicing his opinion about it, saying, “80% of House Republicans released a Budget that … rigs the economy for the wealthy and large corporations against middle class families.”

The main thrust of Democratic attack is likely to be the proposal’s prescriptions for Social Security. I’ll focus my analysis there, but first, a few words about some of its other features.

Start with abortion. Referring to the 2022 decision in which the Supreme Court overturned Roe vs. Wade, the Republican Study Committee says it “celebrates the … decision as a historic victory in the effort to defend innocent life and to return to the Constitution as it was written.”

The committee endorses requiring abortion providers to ply patients with antiabortion propaganda before performing the procedure and blocking the approval and usage of abortion drugs — something even the Supreme Court appears unwilling to do.

The document also supports effectively outlawing in-vitro fertilization, or IVF; and outlawing the use of Affordable Care Act premium subsidies and other credits to pay for health plans that cover abortion.

The budget plan would rescind government funding of renewable energy technologies and block EPA rule-making aimed at reducing automobile emissions, a contributor to global warming.

It would repeal funding for the IRS that improves the agency’s ability to go after rich tax cheats, and cut capital gains tax rates even below the preferential rates enjoyed by investment income. It would impose work requirements on a panoply of assistance programs for low-income Americans.

“We know work requirements have been successful,” the document states. Actually, the reverse is true. When applied to Medicaid, work requirements have been a disaster. They’re costly to administer, do nothing to help people find work, and result in the loss of benefits for a significant number of program enrollees who are actually eligible for help.

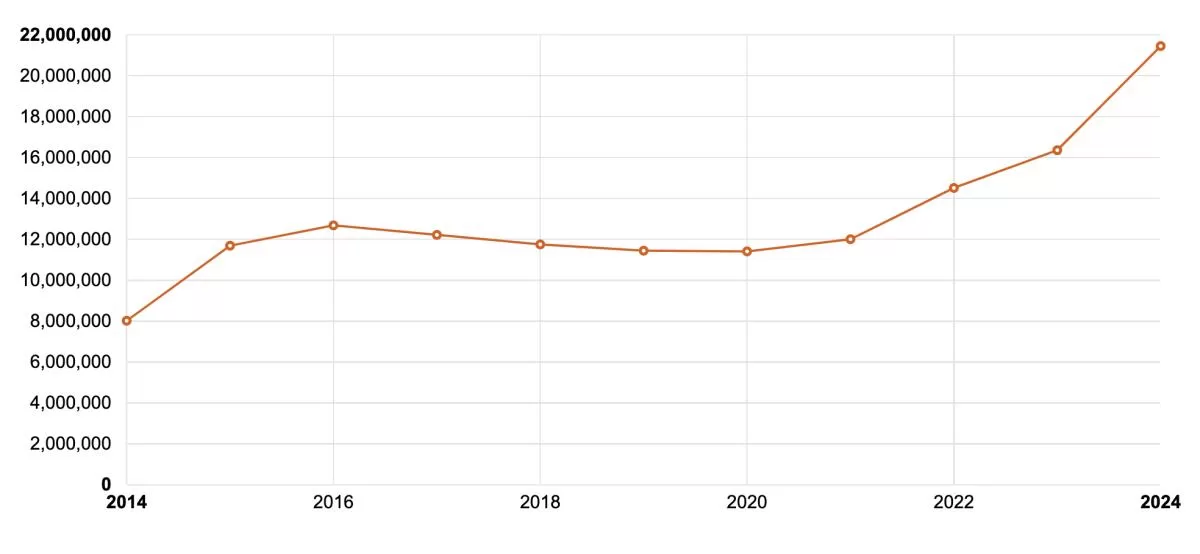

Enrollment in the Obamacare marketplaces reached a record 21.3 million for 2024 coverage, up from 8 million when the marketplaces opened in 2014.

(KFF)

There and at some other points, the study committee can justify their prescriptions by arguing that black is white and night is day. In arguing for the effective repeal of the ACA, for instance, the committee asserts that “Obamacare has not fulfilled its promise to guarantee plan retainment, affordability, quality of care or availability of doctors.”

Yet for some reason the program is more popular than ever. A record 21.3 million people chose ACA marketplace plans for 2024, up from 8 million when the marketplaces opened in 2014.

The study also asserts that the ACA “has dramatically escalated the unsustainable rise in American health care spending.”

Actually, the opposite is true. The growth rate in U.S. healthcare spending has fallen by about one-third since the ACA’s enactment in 2010. Healthcare economists estimated in mid-2023 that medical inflation during the previous year had come to about 0.1% — while inflation for all goods and services came to 3%.

In the 12 years prior to the enactment of the ACA, per capital healthcare spending in the U.S. rose by more than 93%. In the 12 years that followed, it rose by about 61% — including a sharp one-time 10% spending spike in the first pandemic year of 2020. That was about twice the annual increase during the previous decade and more than three times the increase in 2021. By any measure, Obamacare has succeeded in flattening the healthcare cost curve.

That brings us to the Republican Study Committee’s prescriptions for Social Security and the other major benefit programs, Medicare and Medicaid.

The committee members grouse about how Social Security has expanded since it was originally signed into law by Franklin Roosevelt in 1935, through “the addition of disability benefits, dependents and survivors benefits, and the incorporation of automatic cost-of-living adjustments.”

Predictably, they don’t mention who was responsible for these changes: Disability was added in 1956, under Dwight Eisenhower; cost-of-living adjustments were enacted in 1972, under Richard Nixon, and went into effect in 1975, under Gerald Ford. All three presidents were Republicans.

The committee calls for “modest adjustments to the retirement age for future retirees to account for increases in life expectancy.” It doesn’t specify what the age should be, but in earlier versions the committee has called for raising the retirement age to 69 from the current standard of 67 for new retirees.

I’ve written before that raising the retirement age is the stupidest and most dishonest proposed “fix” for Social Security. It’s cherished by think tankers and politicians who spend their working lives with their bellies pressed against a desk in air conditioned offices and have zero conception of what it’s like to spend a career hauling, digging, driving and building in the elements.

Nor do they account for disparities in life expectancy among ethnic, educational and income cohorts. For all Americans and white workers, average life expectancy at age 65 has risen since the 1930s by about 6.6 years, to about 84 and a half.

But for Black people in general, the gain is just over five years, to an average of a bit over 83, and for Black men it’s less than four years and two months, to an average of about 81 and four months.

For males among the lowest 20% of income, according to a 2015 study by the National Academy of Sciences, life expectancy for those who reached the age of 50 was 76.1; for those in the top 20% of income, it was nearly 89. For women, it was 78.3 for those in the lowest 20%, and nearly 92 for the richest 20%.

The Republicans rule out the most obvious solution for Social Security’s fiscal issues: raising the taxes funding the program. The budget’s authors take aim at Biden’s promise, in his 2023 State of the Union address, not to raise taxes on anyone earning less than $400,000. Applying that threshold to the payroll tax, they say, “would only extend the [Social Security] trust fund for a couple of years” past its potential exhaustion in 2034.

This is exactly wrong. The program’s chief actuary determined last year that the tax increases in the Social Security 2100 Act proposed by Rep. John Larson (D-Conn.) would extend the life of the trust fund to 2066. That’s 32 years, not “a couple of years.” And that would happen despite improvements in benefits incorporated into the 2100 Act.

Larson’s proposal would extend the standard 12.4% payroll tax, which is levied this year on all wage income up to $168,600, to income over $400,000, leaving an income gap that would be narrowed over time. Larson would also levy the payroll tax on investment income over $400,000; that income is currently not taxed at all.

When it comes to Medicare and Medicaid, the GOP program is as unforgiving as it is about Social Security. It would replace the existing Medicare system, which reimburses healthcare providers for all covered care they administer to enrollees, with a “premium support” or voucher system in which enrollees would receive a fixed amount they could use to purchase a health plan.

In effect, this would amount to a benefit cut while giving private health insurers a greater role in Medicare. It resembles a proposal advanced in 2016 by then-House Speaker Paul Ryan (R-Wis.), which went over like a lead balloon with Medicare enrollees and died an unlamented death.

The Republicans would repeal Medicare’s authority to negotiate drug prices, which was enacted in the Inflation Reduction Act of 2022 and which the study committee describes as “socialist price controls,” as well as the act’s $35 monthly cap on insulin. (Also repealed would be the expanded premium subsidies for ACA plans written into the IRA.)

The Republican committee is especially hostile to Medicaid, which covers the most medically vulnerable members of society. It would require Medicaid beneficiaries to work at least 80 hours a month, cut the federal portion of Medicaid spending shared with the states from an average 64.6% to 50% — forcing massive budget cuts at the state level — and reduce Medicaid spending by $4.5 trillion over 10 years, or by nearly half the program’s current budget.

Of course this GOP budget proposal has no chance of passing just now, even in pieces. So why would the committee members publish a document so likely to leave millions of Americans nauseated? The only answer must be that they intended to plant a flag: Give us the power, they’re saying, and this is the world you’ll live in. The general theme was that of getting government off the backs of the people. Its corollary — that the goal is to allow Big Business to saddle up — remained implicit.

At a certain level, the Republican Study Committee deserves your respect. As a digest of what the party really thinks about how the average American should be treated by a Republican government, it may be the most honest document the GOP has produced in years.