L.A.’s film and TV production economy has gotten off to a slow start this year, and that’s been a painful reality for the screenwriters, performers and below-the-line workers who make the industry hum.

After the end of the writers’ and actors’ strikes, which brought the business to a standstill for about six months last year, one might have expected Hollywood to come roaring back to work to satisfy demand for shows and movies, considering the damage the work stoppages did to studios’ and networks’ film slates and programming schedules.

That hasn’t happened, at least not in Southern California, as would be apparent to anyone who’s been paying attention to the Wide Shot’s weekly on-location filming data updates, courtesy of FilmLA.

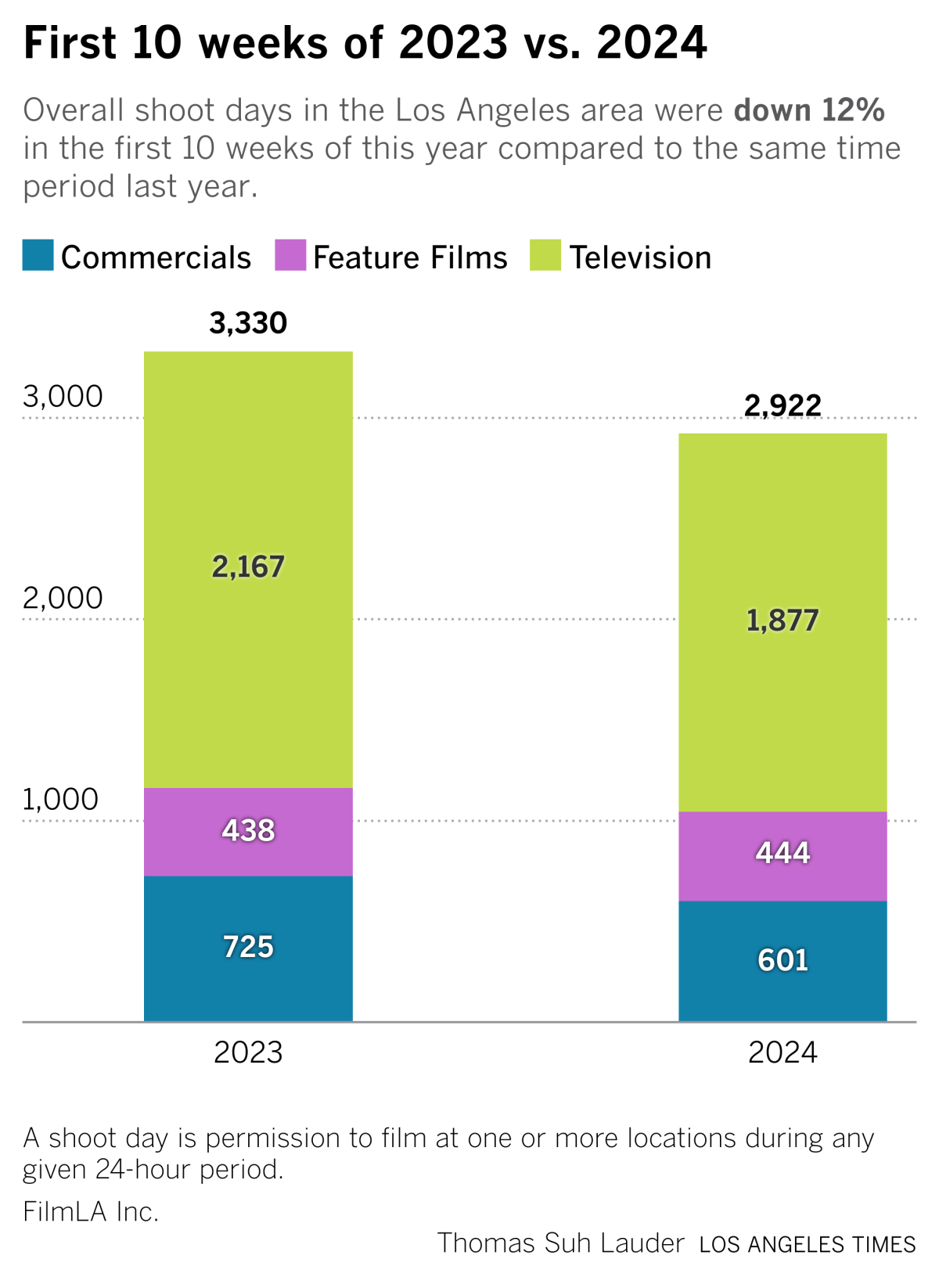

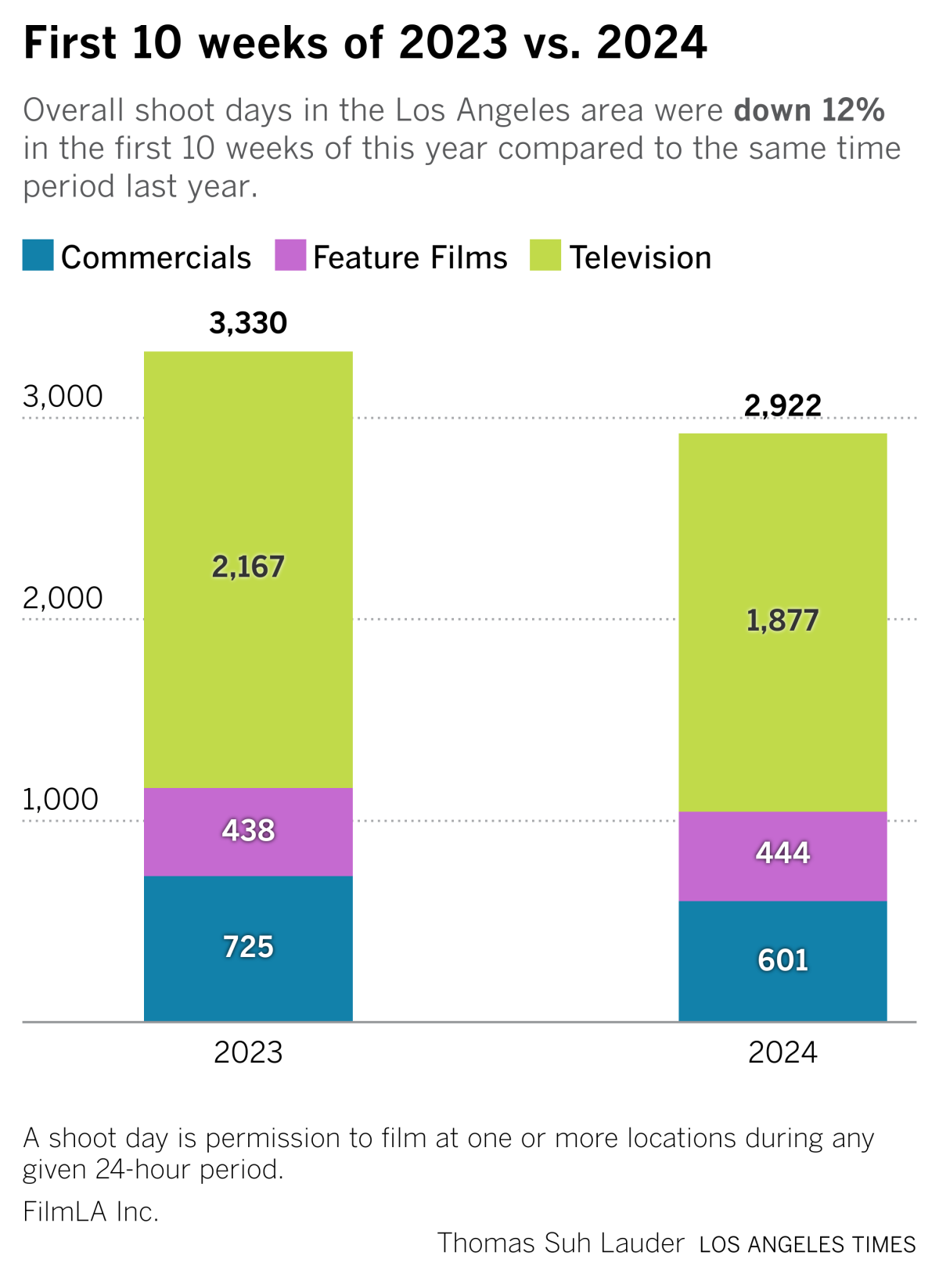

During the first 10 weeks of 2024, the nonprofit recorded 2,922 permitted shooting days in the Los Angeles area, down 12% from the same stretch of time last year.

The bulk of the downturn, reported in detail last week by The Times’ Christi Carras and Marisa Gerber, was because of a slowing in television activity, which was underway even before the strikes. TV shoot days were down 13% to 1,877 during the initial 10 weeks of 2024. Movies are actually fairly stable compared with last year (444 days, up from 438), while shoot days for commercials are down quite a bit, falling 17% to 601.

There are a variety of explanations for the sluggishness.

One is that the networks and streaming services have been in a serious austerity period following the gangbusters “Peak TV” year of 2022, during which a staggering 599 scripted shows aired. Turns out, that level of production wasn’t sustainable, and the studios have been much more risk-averse lately, canceling projects and dragging their feet during the greenlighting process. The companies have been hobbled by anxiety as they try to adapt to the economics of streaming.

In creative fields, fear is the ultimate job killer.

Studio bosses will also contend that the costs of doing business in California make it particularly difficult to justify starting big projects. In addition, they blame competition from other filming destinations, such as Georgia, New Mexico, New York, Louisiana and the United Kingdom. Industry experts say California’s tax credit program, which awards about $330 million annually to companies, is helpful but not enough to fully prevent the exodus.

There’s also, many believe, some hesitation due to the looming threat of a potential walkout by the International Alliance of Theatrical Stage Employees, though such an outcome is seen as unlikely. Teamsters and IATSE, which represents crew members, began contract negotiations with the studios early this month. Both sides are hoping to avoid the sorts of impasses that sent thousands of Writers Guild of America and Screen Actors Guild-American Federation of Television and Radio Artists rank-and-file marching to picket lines.

The tepid comeback is yet another blow to the Los Angeles economy, where countless ancillary businesses — florists, marketing agencies, dry cleaners — are supported by entertainment. This is especially challenging, having come so soon after the COVID-19 pandemic pause and amid the rising cost of living in the region. It’s little wonder that people would consider taking jobs out of state.

The number of cast and crew members listed on permits in L.A. for January was down about 30% compared with 2023, according to FilmLA. That’s an even greater drop than the 26% decline in shoot days tallied during the same period of time, indicating that many of the productions that did launch were smaller and less likely to be from the major studios.

Those challenges don’t even include the potential displacement that’s coming because of artificial intelligence, which became a centerpiece issue during the “hot labor summer” of 2023.

As my colleagues Samantha Masunaga and Don Lee recently reported, Silicon Valley has already gone through multiple rounds of layoffs to orient itself for the AI-driven future (for an overview of what may lie ahead for a plethora of sectors, I suggest watching this speech by Jensen Huang, the CEO of Nvidia). Studio executives, producers and agencies have been meeting with OpenAI, eager to better understand the company’s eye-popping text-to-video model, known as Sora.

OpenAI, for its part, wants filmmakers to see the rapidly delevoping tech’s potential applications to their work. Producers including Tyler Perry have seen Sora’s capabilities and said that the innovations could result in significant job losses.

At least in tech companies, the new automation revolution could create new careers and opportunities, not just replace certain roles. For many of Hollywood’s artists and craftspeople, it’s just the latest disruption.

Newsletter

You’re reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

MedMen’s fall shows the difficulties of the legal weed business. Once hailed as the Apple store of cannabis, MedMen has shuttered many of its locations. What does that say about shopping for pot in California?

What the DOJ’s antitrust suit against Apple means for everyone with an iPhone. Consumers may see lower prices on app subscriptions and purchases if the Department of Justice succeeds in its lawsuit against Apple, consumer advocates said.

They made ‘Game of Thrones’ into blockbuster TV. Why they went full sci-fi for Netflix. The streaming service is betting that epic tale “3 Body Problem,” based on Chinese sci-fi novels that chronicle an impending alien invasion, could be the next “Game of Thrones.”

NBC News in revolt over Ronna McDaniel hiring. Will the company reverse course? Former “Meet the Press” moderator Chuck Todd criticized the network for the decision to make the ex-Republican National Committee Chair paid contributor to NBC News.

The docket:

Numbers of the week

Paramount Global’s stock surged after reports that Apollo Global Management had offered $11 billion for the struggling media giant’s film and television studios, including its prized Melrose Avenue lot.

The shares later retreated after further reporting indicated that Shari Redstone, who controls Paramount’s fate, wasn’t enthused about the private equity giant’s bid.

That’s an understandable reaction. Selling just the studios and the Los Angeles real estate would leave Redstone with one of the major broadcasters and a collection of declining cable channels, including MTV and Comedy Central.

It’s not that Apollo isn’t a serious player. The New York asset manager already has a foothold in Hollywood after acquiring a $760-million minority stake in “Dune” producer Legendary. Analysts have long seen private equity firms as likely buyers for the cable channels, rather than the studios, because they still throw off cash despite cord-cutting and shrinking ratings.

Apollo may not win the prize, but the leak of its bid could spur other, potentially more attractive deals to move faster. Warner Bros. Discovery is no longer interested. Comcast isn’t in this game. Wall Street remains skeptical that Byron Allen will have the financing to pull off his proposed deal, which is valued at about $30 billion including debt.

So the frontrunner remains David Ellison’s bid — backed by RedBird and KKR — to acquire Redstone’s National Amusements and merge his company Skydance with Paramount.

Best of the web

— Global music revenue grew 10% to the highest levels since 1999, not adjusting for inflation. (Billboard)

— Do streaming subscribers stick around after big NFL games? Mostly yes. (Antenna)

— The Village Voice gets the rollicking, rebellious oral history it deserves. (LAT)

— Nelson Peltz may have the support of advisory firm ISS. But what about Marvel fans after some of these quotes about Disney going too woke? (FT)

Finally …

The Los Angeles Times Festival of Books is coming up next month. I will be hosting a panel in which authors discuss their journeys bringing their books to the screen. If you happen to be there, please make sure to stop by.