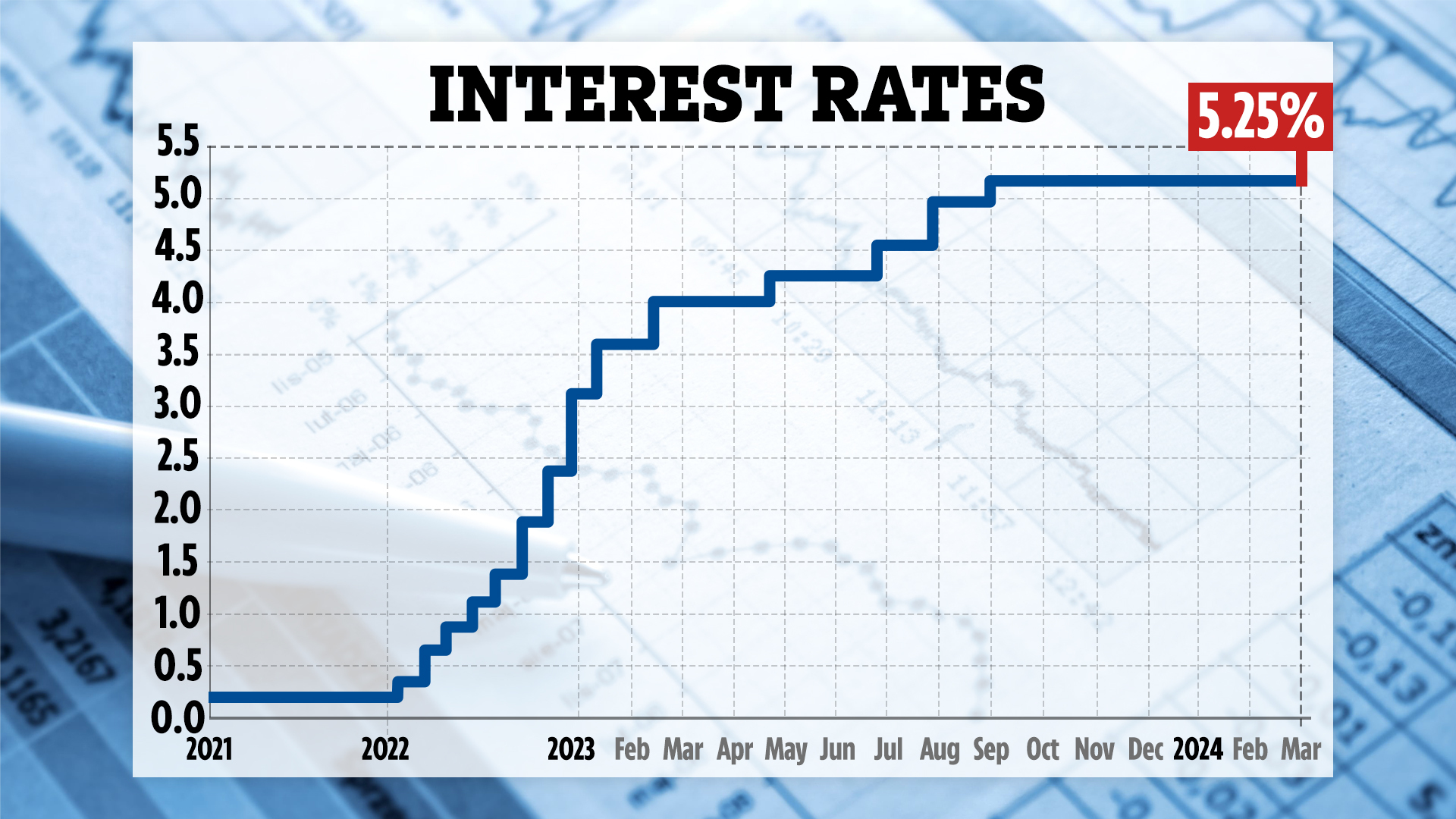

Decision-makers on the Bank’s Monetary Policy Committee (MPC) have now kept interest rates at 5.25% for a fifth consecutive time.

Banks and lenders use the Bank of England (BoE) base rate to set the interest rates it offers customers on mortgages, loans and savings.

It comes only a day after the CPI measure of inflation fell to 3.4% last month – down from 4% in January and the lowest since September 2021.

Most economists had been expecting it to come in at 3.5%.

It means that inflation is now edging closer towards the BoE’s 2% target.

Inflation is a measure of how much the prices of everyday goods like food and clothes, and services like train tickets and haircuts, are now compared to a year earlier.

Economists generally agree that cuts to the interest rate will come later this year.

And the Bank has signalled at recent meetings that cuts are likely to come in future.

It would reverse a four-year trend of rates being either hiked or kept unchanged at every Bank meeting.

A rate cut is expected to reduce mortgage costs for millions of households.

It comes after the bank rate increased from historic lows of 0.1% in December 2021.

It was increased to tackle soaring inflation.

High rates are meant to dampen demand and spending — resulting in inflation rates slowing.

Since September, the bank rate has been held at 5.25% as inflation has slowed, easing the burden on those with mortgages.

We’ve explained exactly what another rate pause means for your finances below.

What does it mean for my mortgage?

Usually, if rates rise, it means that mortgage bills, depending on the type you have, will increase.

Those on a fixed-rate deal tend to be safe until they remortgage.

However, other mortgages, such as tracker or standard variable rate (SVR) mortgages, can be impacted immediately.

Homeowners on variable-rate mortgages might not see their repayments increase immediately, but they likely increase shortly after interest rates are hiked.

But the exact amount depends on your borrowing and your loan-to-value.

However, if the BoE freezes the current rate, your lender may choose to do nothing.

This will be a huge relief to those who have faced 14 consecutive increases to their mortgage bill.

Either way, your bank should warn you of any increase to your rate before it goes up.

We’ve also explained how you can find the best mortgage rate deal.

What is the base rate and how does it affect the economy?

NINE members of the Bank of England’s Monetary Policy Committee meet eight times each year to set the base rate.

Any change to the Bank’s rate can have wide-reaching consequences as it directly influences both:

- The cost that lenders charge people to borrow money

- The amount of savings interest banks pay out to customers.

When the Bank of England lowers interest rates, consumers tend to increase spending.

This can directly affect the country’s GDP and help steer the economy into growth and out of a recession.

In this scenario, the cost of borrowing is usually cheap, and the biggest winners here are first-time buyers and homeowners with mortgages.

But those with savings tend to lose out.

However, when more credit is available to consumers, demand can increase, and prices tend to rise.

And if the inflation rate rises substantially – the Bank of England might increase interest rates to bring prices back down.

When the cost of borrowing rises – consumers and businesses have less money to spend, and in theory, as demand for goods and services falls, so should prices.

The Bank of England is tasked with keeping inflation at 2%, and hiking interest rates is a way of trying to reach this target.

In this scenario, the losers are those with debt.

First-time buyers will lose out to cheaper mortgage rates, and those on tracker or standard variable rate mortgages are usually impacted by hikes to the base rate immediately.

Those on a fixed-rate deal tend to be safe if they fixed when interest rates were lower – but their bills could drastically increase when it’s time to remortgage.

The cost of borrowing through loans, credit cards and overdrafts also increases when the base rate rises.

However, the winners in this scenario are those with money to save.

Banks tend to battle it out by offering market-leading saving rates when the base rate is high.

What does it mean for credit card and loan rates?

Again, if the base rate is hiked, the cost of borrowing through loans, credit cards, and overdrafts can increase, as banks are likely to pass on the increased rate.

Certain loans you already have, like a personal loan or car financing, will usually stay the same anyway, as you’ve already agreed on the rate.

But rates for any future loan could be higher, and lenders could increase the rate on credit cards and overdrafts – although they must let you know beforehand.

But when the rate hikes are paused, nothing is likely to change.

However, you can still cancel a credit card and have 60 days to pay off any outstanding balance.

What does it mean for my savings?

Savers are the main group to have actually benefited after the last 14 bank rate rises.

That’s because banks tend to battle it out by offering market-leading interest rates.

Although banks are usually much slower to act than with passing on higher rates for borrowing.

Of course, if the base rate doesn’t increase, banks will likely take advantage and keep their rates the same too.

Anyone currently getting a low rate on easy-access savings could find it’s worth looking around for a better rate and moving their money.