It comes after the government announced a second National Insurance cut, kicking in from next month.

The 2p reduction to the main rate of National Insurance Contributions (NICs) was confirmed by the Chancellor in the Spring Budget.

The change means that someone earning an average salary of £35,000 will save more than £448.60 a year.

It follows a two percentage point cut from 12% to 10% that came into effect in January.

When combined with the autumn reductions, it means 27million employees will get an average tax cut of £900 in 2024.

What is National Insurance?

NATIONAL Insurance is a tax on your earnings, or profits if you’re self-employed.

You’ll usually pay National Insurance Contributions (NICs) when you’re over the age of 16 and earning a certain amount.

For example, if you earn £1,000 a week, you pay nothing on the first £242.

Earn over that and you pay 10% on the next £725 – so £72.50. Then you pay 2%o on the rest, so £33, which works out as 66p.

For the self-employed rates are slightly different.

You can also get something known as National Insurance in some circumstances when you’re not working, for example when you have kids and claim certain benefits.

NICs are usually taken automatically by your employer and paid to HMRC, so you don’t need to do anything.

You can see how much NICs you pay on your wage slip.

Anyone working for themselves usually has to pay NICs themselves when completing a self assessment tax return.

However, it’s important to note that how much you save depends on your salary, as that affects how much you pay in NI to begin with.

The move will come as a welcome break for many already struggling to keep up with high energy bills and the cost of living.

But, those without the need to touch the extra cash right away have the unique opportunity to increase its worth, says Canada Life.

This is done by putting the cash in your workplace pension before you even get the chance to miss it.

And though you won’t notice it now, the extra top-up could drastically increase the money that you retire with.

John, tax and estate planning specialist, told The Sun: “Whilst for some, these cuts will be needed to contribute to the cost of living, for others, there is an opportunity to turbo-charge your long-term financial future.

“If you can afford to save the extra money from your pay packet into a pension, thanks to the miracles of interest compounding, it can make a significant difference to the size of your pension at the point of retirement.

“You’ll also benefit from saving income tax on any additional contributions you make, so a double-win, in effect.”

He also issued a reminder that the sooner you save into a pension the better, but it’s “never too late to start”.

Everyone is automatically signed up to their workplace pension scheme through their job if they’re over 22 and earn above £10,000.

It’s separate from the State Pension and money is deducted from your pay unless you opt out.

A minimum of 8% goes into the pension – you contribute 5% and your employer pays at least 3%.

The majority of employers will allow you to increase your contributions to whatever you want – either as a percentage of salary or in pounds and pence.

Making the sacrifice of the NI cut today means that in the future when you leave work the annual income from your pot will be higher.

What are the different types of pensions?

WE round-up the main types of pension and how they differ:

- Personal pension or self-invested personal pension (SIPP) – This is probably the most flexible type of pension as you can choose your own provider and how much you invest.

- Workplace pension – The Government has made it compulsory for employers to automatically enrol you in your workplace pension unless you opt out.

These so-called defined contribution (DC) pensions are usually chosen by your employer and you won’t be able to change it. Minimum contributions are 8%, with employees paying 5% (1% in tax relief) and employers contributing 3%. - Final salary pension – This is also a workplace pension but here, what you get in retirement is decided based on your salary, and you’ll be paid a set amount each year upon retiring. It’s often referred to as a gold-plated pension or a defined benefit (DB) pension. But they’re not typically offered by employers anymore.

- New state pension – This is what the state pays to those who reach state pension age after April 6 2016. The maximum payout is £203.85 a week and you’ll need 35 years of National Insurance contributions to get this. You also need at least ten years’ worth to qualify for anything at all.

- Basic state pension – If you reach the state pension age on or before April 2016, you’ll get the basic state pension. The full amount is £156.20 per week and you’ll need 30 years of National Insurance contributions to get this. If you have the basic state pension you may also get a top-up from what’s known as the additional or second state pension. Those who have built up National Insurance contributions under both the basic and new state pensions will get a combination of both schemes.

How much could you save by investing the NI cut into your pension?

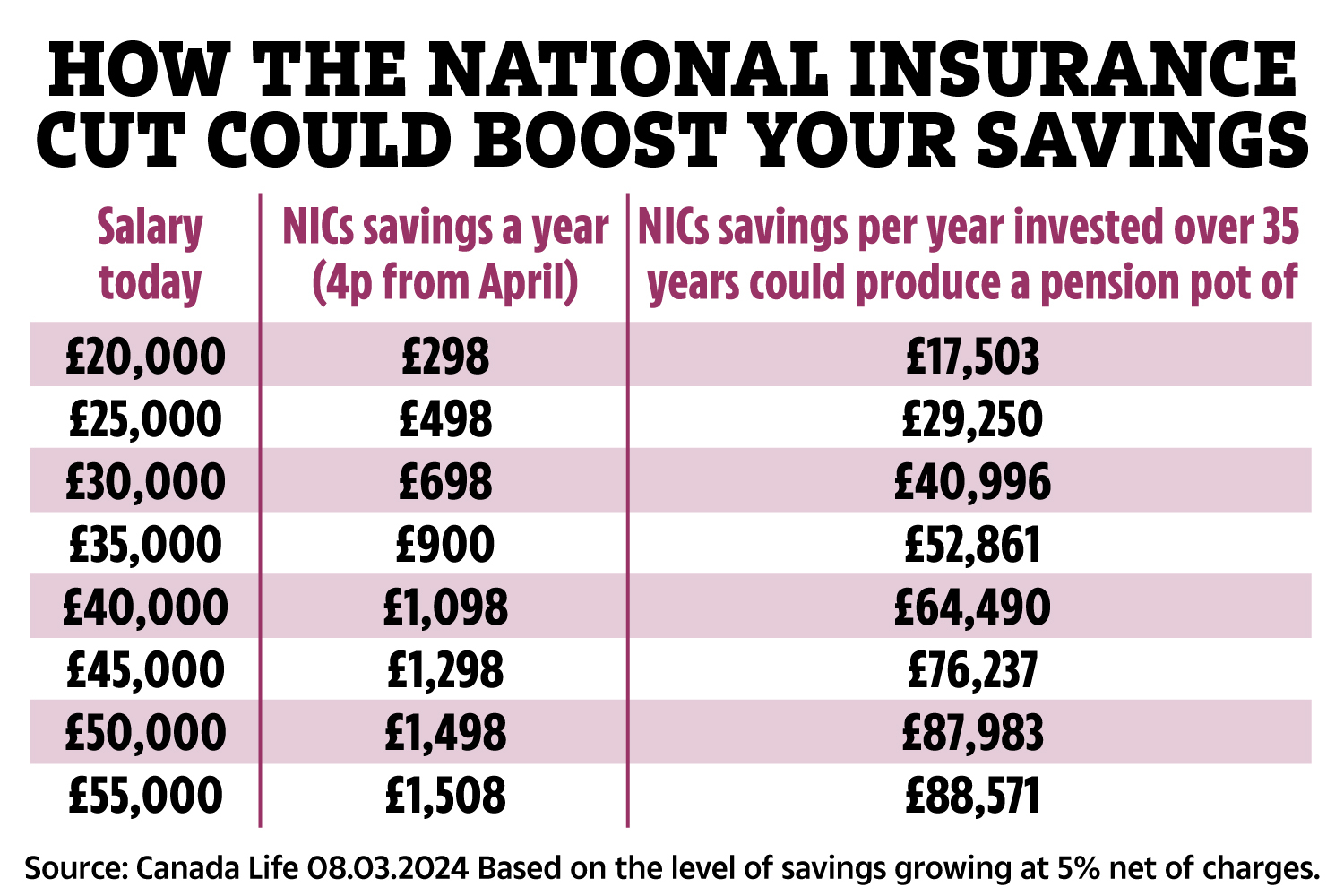

The experts at Canada Life crunched the numbers to see exactly how much this increase could be depending on various salaries.

Tax relief means when you pay £80 into your pension, the government tops it up to £100, instead of taking the 20% tax on it.

Also, the money in your pension is invested, for example in stocks and shares, and grows over time.

By how much is hard to predict, but Canada Life’s calculations are based on 5% real growth.

For example, someone on a £20,000 salary today is set to save a total of £298 in NICs in 2024 just from the NI cuts.

The total saving every year invested over a 35-year period could ramp up your pot to £17,503.

A worker on £25,000 a year will save £498 in a year in, but when invested into a pension this could go up to £29,250 over 35 years.

If you earn £30,000 now, you’ll save £698 this year in NICs which would produce a pot of £40,996 after the same period.

While if you earn the UK average salary of £35,000, the NI cut will save you £900 in a calendar year.

Once put into a pension, over 35 years, this could produce a pot of £52,861.

To find out how to add more to your pension, speak to your employer directly.

Of course, if you are in need of the cash, you’ll need to consider whether you need the added money more now rather than in the future.

Or consider splitting up any rise you might receive – you don’t need to put it all in.

There is also an annual allowance to consider, which is the maximum amount you can contribute to your pension each year while still receiving tax relief.

For 2023 to 2024 this stands at £60,000, as long as you haven’t already accessed your pension cash, which you can do at the age of 55 (though this is rising to 57 in 2028).

Even a 1% increase in your pension contributions – as little as £136 a year – could boost your pension pot by £25k.

You could also save more for retirement by changing how your pension is invested – and it won’t cost a penny more.

Top tips to boost your pension pot

DON’T know where to start? Here are some tips from financial provider Aviva on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, you’ll need to understand where you stand today. Look into your current pension savings and research when you’ll be eligible for the state pension, and how much support you’ll receive.

- Take advantage of your workplace pension: All employers are legally required to provide a workplace pension. If you save, your employer will usually have to contribute too.

- Take advantage of online planning tools: Financial providers Aviva and Royal London have tools that give you an idea of what your retirement income will be based on how much you’re saving.

- Find out if your workplace offers advice: Many employers offer sessions with financial advisers to help you plan for your future retirement.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.