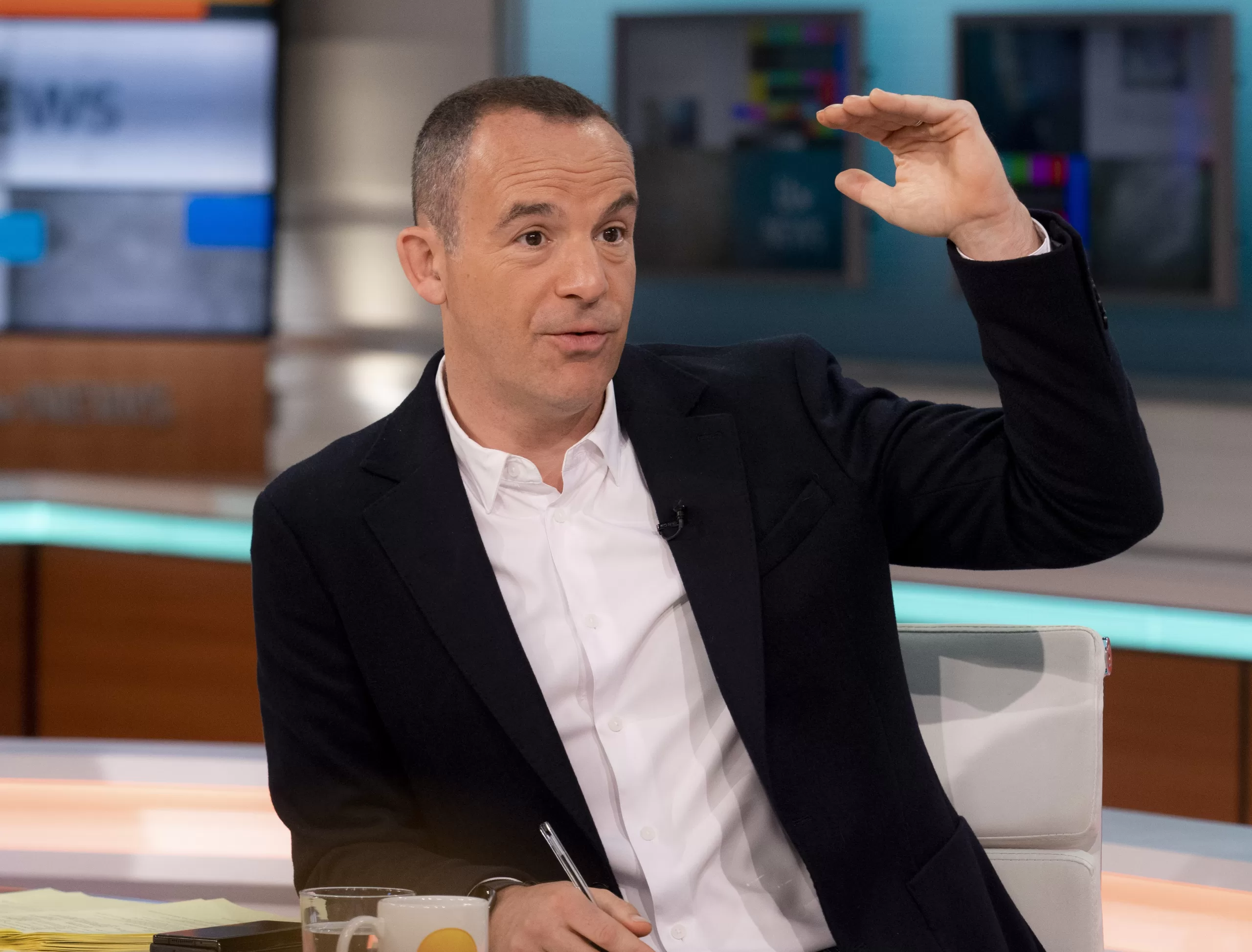

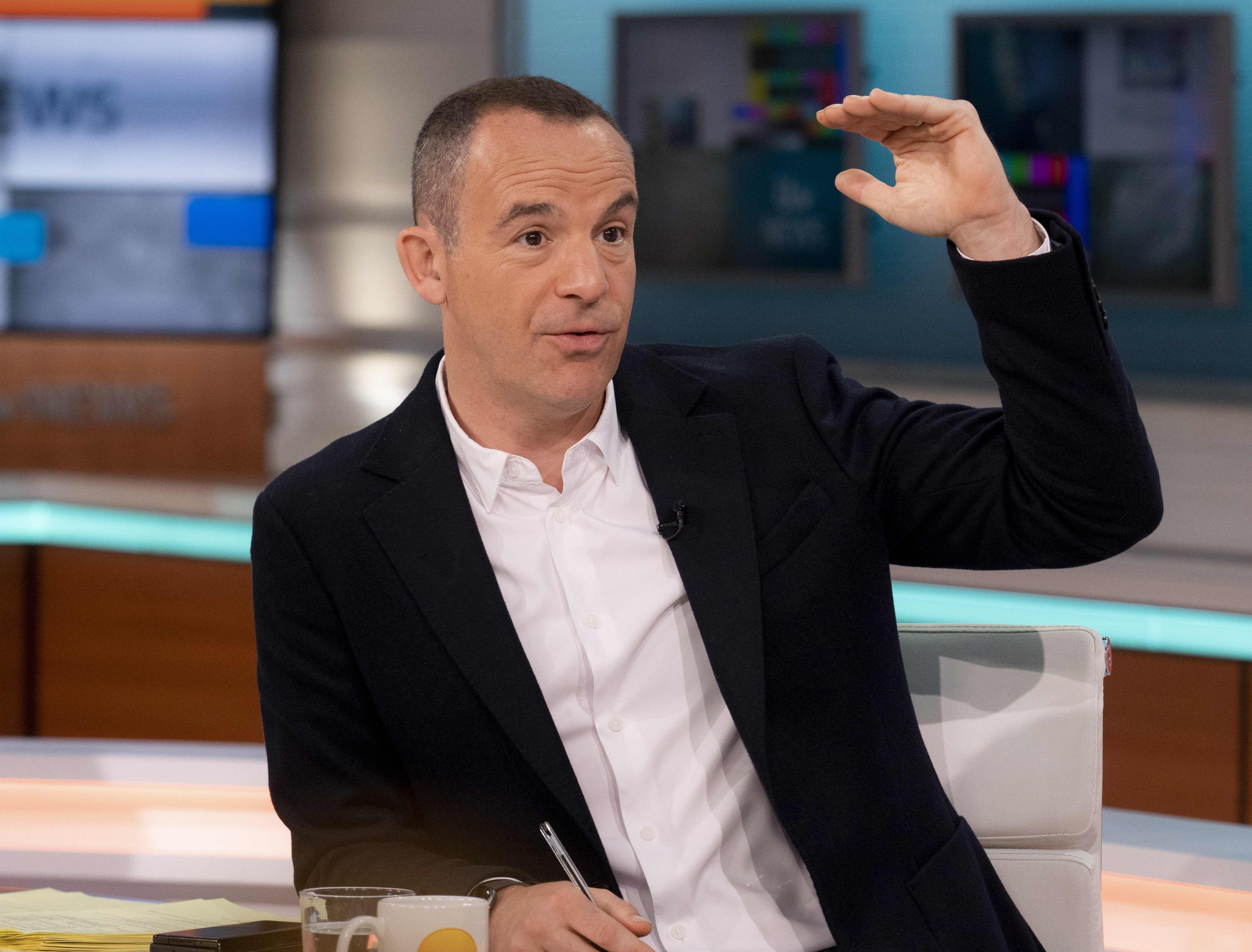

The money saving expert has summed up Wednesday’s announcement into key pointers so everyone can understand.

Hard-working Brits were handed a £450 tax boost today as Jeremy Hunt froze fuel duty for another year and overhauled child benefits.

The Chancellor also froze alcohol duty in a massive win for Sun readers after our campaigns to keep booze and fuel tax low.

But there was a mega blow to smokers, as a new tax whacked on fags and vapes will see prices hit record levels.

Martin Lewis has since laid out what it means for the country.

11 crucial takeaways from Spring Budget 2024

MARTIN Lewis’ 11 take-home points from Wednesday’s announcement:

- Millions of workers will pay less national insurance from April as rates are being cut AGAIN for both employed and self-employed workers – though some will still be worse off due to frozen personal tax thresholds. Use our updated National insurance & income tax calculator to see your new take-home pay.

- Child benefit rules will see a shake-up to end ‘unfairness’ in the system, in a major campaign win for Martin and MSE.

- The £90 debt relief order fee will be scrapped.

- Universal Credit claimants will get more time to pay back ‘Budgeting Advances’.

- Vulnerable households will get £500 million in extra support, through an extension of the Household Support Fund.

- NS&I will launch ‘British Savings Bonds’.

- A new ‘UK ISA’ will be introduced.

- Air Passenger Duty will rise in 2025/26.

- Vaping products will be taxed more from 1 October 2026.

- Alcohol duty has been frozen (again) until 1 February 2025.

- Fuel duty has also been frozen again

Martin Lewis also said: “While the following points weren’t directly mentioned in the Chancellor’s speech, the Spring Budget has also essentially confirmed:

- Personal tax thresholds will remain frozen, so many will end up paying more in tax.

- No changes to Lifetime ISAs, despite our calls for an overhaul to ensure savers aren’t fined to access their own money.

One of the changes was to how much national insurance (NI) workers would pay.

You can calculate your NI through our calculator here.

It comes after Martin Lewis hailed part of the announcement as a “major win”.

Jeremy Hunt today offered more help with child benefits to parents earning more than £50,000.

And the Money Saving Expert hailed the Chancellor’s decision saying “WE GOT THE WIN ON CHILD BENEFIT!”

The 51-year-old tweeted: “Chancellor tipped me off before budget, said this was due in large to MSE/my shows campaigning all based on all those of your who messaged me to say it was the key thing to put to him.”

In his Spring Budget, Mr Hunt explained how child benefit is withdrawn when one parent earns more than £50,000 a year.

He said: “That means two parents earning £49,000 a year receive the benefit in full but a household earning a lot less than that does not if just one parent earns over £50,000.

“Today I set out plans to end that unfairness. Doing so requires significant reform to the tax system including allowing HMRC to collect household level information.

“We will therefore consult on moving the high-income child benefit charge to a household-based system to be introduced by April 2026.

“But because that is not a quick fix, I make two changes today to make the current system fairer.”

He continued: “I confirm that from this April the high-income child benefit charge threshold will be raised from £50,000 to £60,000.

“We will raise the top of the taper at which it is withdrawn to £80,000.

“That means no one earning under £60,000 will pay the charge, taking 170,000 families out of paying it altogether.

“And because of the higher taper and threshold, nearly half a million families with children will save an average of around £1,300 next year.”

Martin explained: “So 1) From this April threshold which hasn’t moved since 2013 rises from a single parent earning £50,000 to £60,000 and you lose child benefit totally at £80,000 (not £60,000).

“2) Consultation on moving it to family income not individual income and hopefully that’ll be in place from April 2026 (this is to stop unfairness for single income/single parent) families.”

Child benefit

EVERYTHING you need to know about child benefit: