Article content

(Bloomberg) — The Bank of Canada is tracking wage growth as one of its key metrics to determine the appropriate timing for interest rate cuts. Early indicators suggest slower gains are ahead.

Wages are still running hot and aren’t yet slowing at levels that could give policymakers confidence inflation is on a sustained path downward. But a period of outsized compensation increases may be over.

Article content

Average union wage settlements rising more than 5% are becoming more rare. Wage growth for permanent employees is expected to decelerate to 5.1% in February from 5.3% a month earlier, according to the median estimate in a Bloomberg survey of economists ahead of jobs data to be released Friday.

Across 20 sectors in Statistics Canada’s most recent payroll employment survey, average weekly wages in December were lower than their respective peaks in 15 industries, with only five still recording new highs.

“I expect wages to cool off as the labor market does,” said Brendon Bernard, senior economist at job-listing website Indeed. “It’d be surprising if they don’t start slowing down this year with firms’ expectations coming down, posted wages and salaries gradually edging down over time.”

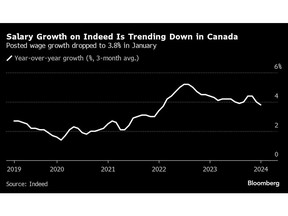

Posted wage growth on Indeed ticked down below 4% early this year. Small and medium-sized firms surveyed by the Canadian Federation of Independent Business expect wages to rise 2.5% in the next year, extending a descent from the mid-2022 peak when the jobless rate was at record low.

Article content

Compensation tends to adjust slowly to rising prices due to the duration of contracts. But these signs are pointing to Canada’s softer labor market — which has seen immigration-driven labor force gains outpacing job creation — beginning to influence compensation negotiations and settings, resulting in slower gains.

Read More: Canada Must End Reliance on Cheap Foreign Labor, Minister Says

Bank of Canada policymakers view wage growth as a lagging indicator of labor market activity and believe that past gains largely reflect catch-up with the cost of living. On Wednesday, when the central bank held the policy rate steady for a fifth straight meeting, Governor Tiff Macklem said there are now “some signs that wage pressures may be easing” as the labor market comes into better balance.

“Wages are way past the peak and are trending down. We’re about 60% of the way there, so at that trend, it would probably take a bit more than six months to normalize,” said Simon Gaudreault, CFIB’s chief economist. Price increase plans — an indicator of inflation — also show a similar trend, he said.

Article content

In collective bargaining across Canada, the average annual increase of major wage settlements fell to 3.9% in November, compared with 5% a month earlier. In Ontario, Canada’s most populous province, the share of private-sector employees who saw average annual wage increases of 5% or more declined to 5.1% last year, from 13.4% a year earlier. The share of public workers who saw similar gains dropped to 0.6%, from 4.9% in 2022.

To be sure, despite signs of slowing wage growth across different metrics, unions and their members are still pushing for higher wage gains. That’s even after inflation eased to 2.9% early this year.

“It hasn’t changed our viewpoint because the reality is that you’re not yet feeling any relief,” said Bea Bruske, president of the Canadian Labor Congress.

“Although a downward trend might have started, the reality is that people are still living paycheck to paycheck. Unless you can deal with that issue, we’re still going to see an increased, heightened focus on making more progress at bargaining tables.”

—With assistance from Jay Zhao-Murray.

Share this article in your social network