Article content

(Bloomberg) — For US credit markets now, the party is far from over, and money keeps pouring in.

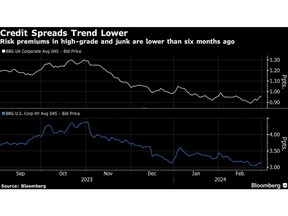

Risk premiums have been shrinking for most of the year, even if they edged higher in the latest week. The extra yield that investors demand for buying junk bonds instead of high-grade debt has been shrinking, signaling less fear of default. A key measure of that gap was just 1.02 percentage point on Thursday, according to data compiled by Bloomberg, close to the lowest in about two years.

Article content

Investors have found a series of reasons to buy corporate debt. Mixed economic data implies that the Federal Reserve won’t have reason to hike further, even if hopes of rate cuts are fading. Insurance companies that have sold annuities and pension plans that are funding retirees are eager to lock in high yields and buy company bonds.

“What we are seeing is a general move toward a growing comfort with risk,” said Richard Cheng, an investment-grade portfolio manager at Nuveen. “Expectations of a soft landing continue to grow and macro forecasts continue to remain optimistic,” he said in a phone interview on Friday.

US consumer sentiment posted a surprise drop in late February as the outlook for the economy deteriorated. But in the latest week, the Fed’s preferred inflation gauge posted its fastest acceleration in a year, implying a recession isn’t near.

There are risks ahead. Investment-grade bonds have relatively long duration, making them sensitive to rates if the Fed, for example, is much slower to cut rates than investors hope for. And money managers are showing early signs of getting full on high-grade bond sales. Companies are having to offer higher yields relative to existing securities to convince fund managers to buy.

Article content

Still, for now, investors are deluging credit funds with money. Weekly inflows for US investment-grade debt in February, for example, have averaged $6.4 billion, up 10% versus $5.8 billion seen in January, JPMorgan Chase & Co. strategists led by Eric Beinstein wrote in a note Friday. Money has flowed into US junk bond funds seven out of nine weeks so far this year, according to LSEG Lipper data.

Bank of America Corp. forecasts a record $500 billion of flows into high-grade corporate debt this year, with one strategist at the firm describing conditions as “bubbly.” Strategists at Barclays Plc say as much as $600 billion could shift out of money-market funds into riskier assets, with credit likely to be favored over stocks.

Insatiable investor demand has helped lift January and February high-grade corporate bond sales in the US to record levels, topping $387 billion as of Friday. The first quarter may end up being the busiest on record if issuance in March stays even moderately strong.

Amid that demand, the average spread for US investment-grade bonds traded at 96 basis points on Thursday. While risk premiums have widened over the past week, they have narrowed 0.03 percentage point since the start of the year. The average junk-bond spread was 3.12 percentage points, about 0.2 percentage point tighter than the end of last year.

Article content

Barclays has an index of fear in credit markets that it calls its Complacency Signal. That gauge remains elevated at 80%, the highest level since January 2022, strategist Andrew Johnson wrote in a note on Friday. The measure reflects a decrease in realized volatility of high-yield returns and a decrease in the distressed rate, which were partly offset by slight weakness in high-yield spreads.

“Fixed income still looks compelling,” said Sonali Pier, a high-yield and multi-sector credit portfolio manager at Pacific Investment Management Co. “Even if we were to see some GDP contraction, it’s still a benign enough macro environment for credit to continue to perform.”

Click here to listen to a podcast about the opportunities that could arise as banks shed loans.

Week in Review

- Blue-chip companies in the US sold a record $172 billion of bonds in February after falling yields spurred investors to buy debt and pushed companies to take advantage of relatively cheaper borrowing costs.

- The robust investor demand that’s encouraging Corporate America to borrow in debt markets is, finally, starting to show some early signs of fatigue.

- Europe is increasingly winning out over the US for global blue-chip companies seeking cheaper borrowing costs, while investors are also clamoring for corporate bonds issued in the common currency.

- A potential tax benefit is spurring US companies including PepsiCo Inc. and International Business Machines Corp. to sell bonds through their Singapore subsidiaries, fueling a record surge of sales from borrowers in the city state.

- Speculative-grade corporate bonds are beating almost every other type of fixed-income security this year and fund managers at T. Rowe Price Group Inc. and Barings see the outperformance continuing.

- Goldman Sachs Group Inc. and Morgan Stanley are increasingly willing to temporarily hold on to some of the riskiest parts of new collateralized loan obligations, in a bid to win more market share in the once again booming business of helping firms package leveraged loans into bonds.

- Chinese property giant Country Garden Holdings Co. got a wind-up petition in a Hong Kong court from an obscure lender holding a small portion of its debt.

- A state-owned firm in China’s Guizhou province is selling bonds to help repay debt issued by a local government financing vehicle, a rare move that highlights the region’s liquidity strains.

- The recent default of China South City Holdings Ltd. revives the focus on so-called keepwell deeds, a vague credit protection mechanism widely used on offshore debt, and akin to a gentleman’s agreement.

- Japan’s primary market for corporate bonds had its busiest session since 2019 after yield premiums tightened.

On the Move

- Carlyle Group Inc.’s direct-lending chief Aren LeeKong is leaving the firm.

- Banco Santander SA hired Bank of America Corp.’s head of US leveraged loan sales, Tim Gross.

- UBS’s Michael Mulholland has joined Royal Bank of Canada as director for leveraged credit sales in London.

- Fulcra Asset Management has recruited Adam Burns, who was most recently a director of high-yield credit trading at National Bank of Canada.

- Blackstone Inc. is hiring Nakul Sarin from Bridgepoint’s credit unit to focus on UK direct lending.

—With assistance from Andrew Kostic and Taryana Odayar.

Share this article in your social network