An outback mine that promised to deliver “ethically sourced, low emissions” cobalt has dramatically downsized its “major project status”.

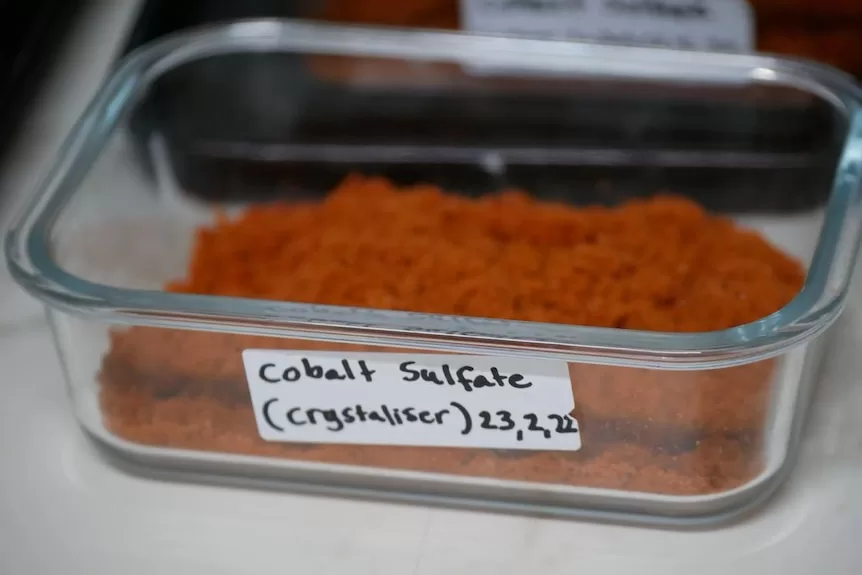

The Broken Hill Cobalt Project, valued at $560 million, had been projected to create around 400 full-time jobs and to produce almost 17,000 tonnes of high-quality cobalt sulfate a year for the renewable energy industry.

But in the company’s latest update, that outlook has been significantly scaled back due to an oversupply of cobalt in the global market.

Cobalt Blue chief executive Joe Kaderavek told the ABC that, in the current conditions, the project in its current shape “was not financeable”.

“We need to convert this project into something that is and makes a quid,” he said.

Cobalt Blue had touted the NSW mine as “ethically sourced” cobalt due to the majority of the mineral being mined in the Democratic Republic of Congo and then processed by China in conditions that would not meet “the minimum of Western safety standards”.

The company had previously told the ABC’s Four Corners the Broken Hill project alone would produce enough cobalt to power 5 million electric vehicles.

In its latest review, the company said it would now concentrate on downscaling the mine to ensure it still had a high margin with low capital costs.

Part of that scaling back of operations will involve reducing the mining inventory to higher-grade material and targeting lower strip ratios by reducing pit sizes.

Its minimum operating life will be reduced from 20 years to between 10 and 12 years, with the option to continue if the price of cobalt goes up.

In 2022, the project had been given “major project status” by the Coalition government before its election loss, meaning the project was one of national significance.

Mr Kaderavek believed the federal government should throw its support behind cobalt as it had for the nickel industry.

“Ultimately, banks and lenders want to see the colour of your money and see what the reality of that support is financially,” he said.

“It doesn’t mean we expect the government to be in the mining business, but we do expect the government to lend support and be a cornerstone of some of these projects.”

The organisation is also going through a retention of core skills at the demonstration plant in Broken Hill.

The way forward

Independent mining analyst Peter Strachan was not surprised the project would be downsized due to the current economic climate.

“The price of cobalt is back at about $13 a pound, it’s like $28 a kilogram, and it’s fallen back to the low levels we’ve seen through the decade before the pandemic really,” Mr Strachan said.

“At the current price, given the amount of mineral in the ground that they can recover, it’s just not going to stand the capital costs of building the project.”

Mr Strachan said it was logical the organisation was reviewing the model and concentrating on a smaller workforce, on a smaller area, and on higher-grade minerals.

“I think it’s sensible to look at a project that could get off the ground at a low capital cost, and that’s what they’re doing,” he said.

“They’re saying, maybe if we set our jib to meet the prevailing winds, we can get this project up at a smaller scale, with a smaller capital impost and a higher grade so it will actually cut our cost.”

Get our local newsletter, delivered free each Friday