Article content

(Bloomberg) — Singapore will likely seek to defray living costs and support retrenched workers and small businesses through its annual budget Friday, with the spending plan seen as the priority list for the city-state’s new generation of leaders.

In his second budget speech after being anointed the prime minister-in-waiting, Finance Minister Lawrence Wong is also expected to train his sights on longer-term objectives including boosting Singapore’s competitiveness as an investment destination and managing green goals.

Article content

Analysts surveyed by Bloomberg expect the passing of the baton from Prime Minister Lee Hsien Loong to Wong to be smooth, priming the economy for faster expansion. There are more immediate risks Wong must contend with, including supply chain disruptions amid a conflict in the Middle East, elevated borrowing costs and tepid growth in the US and China.

Most analysts forecast that his budget will aim for prudence, with more than half of 12 surveyed by Bloomberg expecting a back-to-back surplus — both in the fiscal year starting April and the current one ending March. Some predicted a deficit.

“Singapore requires careful consideration and strategic decision-making by policymakers in navigating the nation’s current economic landscape,” said RHB Bank Bhd Senior Economist Barnabas Gan.

Here’s a look at what might be in Wong’s budget speech to Parliament:

Cost of Living

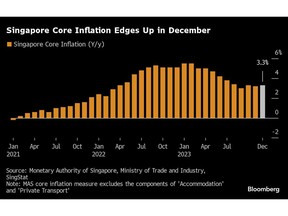

While core inflation has eased from multi-year highs, it still remains elevated in the wake of rising electricity and gas prices, as well as the increase in the goods and services tax in January to 9% from 8%. Singapore’s reliance on imports also means it could be vulnerable to any uptick in global energy and food prices with the logistics bottlenecks in the Red Sea and the El Nino dry spell.

Article content

The price pain is being felt across the city-state. In a poll by Blackbox Research from Jan. 26 to Feb. 7, only 34% of Singaporeans expect an improvement in domestic economic conditions in the next 12 months, fewer than the 40% who think things will get worse. Cost of living and salaries remain the top two concerns, similar to the results of the October poll. Housing affordability, jobs and the GST hike were also raised by respondents, in the latest survey released this week.

“The biggest short-term focus is still likely to be easing cost-of-living pressures, especially given the forthcoming election,” said Alex Holmes, senior Asia economist at Oxford Economics.

The island nation, which has been led by Lee for almost two decades, must hold its next general election by November 2025. The People’s Action Party, which has ruled Singapore since independence in 1965, has faced a number of setbacks in the past year, from public anxiety over high living costs to political scandals that included a minister charged with corruption.

Skills Training

The budget may also introduce financial support to retrain workers displaced by economic and technological changes, according to a report by Malayan Banking Bhd. This would likely come with “strict guardrails” to discourage long-term welfare dependency, with time-bound benefits tied to attendance in upskilling courses and job interviews.

Article content

“On a macro level, conditional unemployment benefits could benefit the economy by reducing skills mismatches and improving productivity. With a safety net (financial help) and trampoline (subsidy for retraining), job-seekers are allowed more time to find well-suited roles,” said Maybank analysts Brian Lee and Chua Hak Bin.

Small businesses struggling with higher costs could also be targeted. The government may look to extend programs for trade and working capital loans that are due to expire in March 31, among other measures. “Defraying business costs could indirectly alleviate inflation pressures, by reducing the pressure to pass higher costs to consumers,” they said.

Global Competitiveness

Investing in talent development and enhancing productivity should help keep Singapore a competitive regional and global hub. The government could top this up with incentives for firms that expand into artificial intelligence, digital technology and the green transition.

“In addition, we look for some enhancements to the existing or introduction to new sustainability policies via the introduction and enhancement of grant and tax incentives in the form of deductions, refundable tax credits, and investment allowance to incentivise businesses’ activities towards a sustainable life cycle,” RHB’s Gan said.

Share this article in your social network