Fast forward to last Saturday, when

Biden used X to tout “good news” for folks to start the weekend: “The stock market going strong is a sign of confidence in America’s economy.”

Tuesday’s steep drop in stocks, triggered by unexpectedly strong inflation data, illustrated the risks in the approach. The new messaging comes as poll after poll shows deep skepticism from voters on Biden’s handling of the economy.

“If I were there, I’d be telling the president: ‘Stock markets go up, but stock markets also go down,’” said Jason Furman, a top economic adviser to former President Barack Obama. “You’re taking a risk if you’re resting too much of your case on something that could prove ephemeral.”

Trump not only took credit for the stock market’s run during his administration, but he’s also tried to argue that the most recent surge can be attributed to anticipation of his return to office.

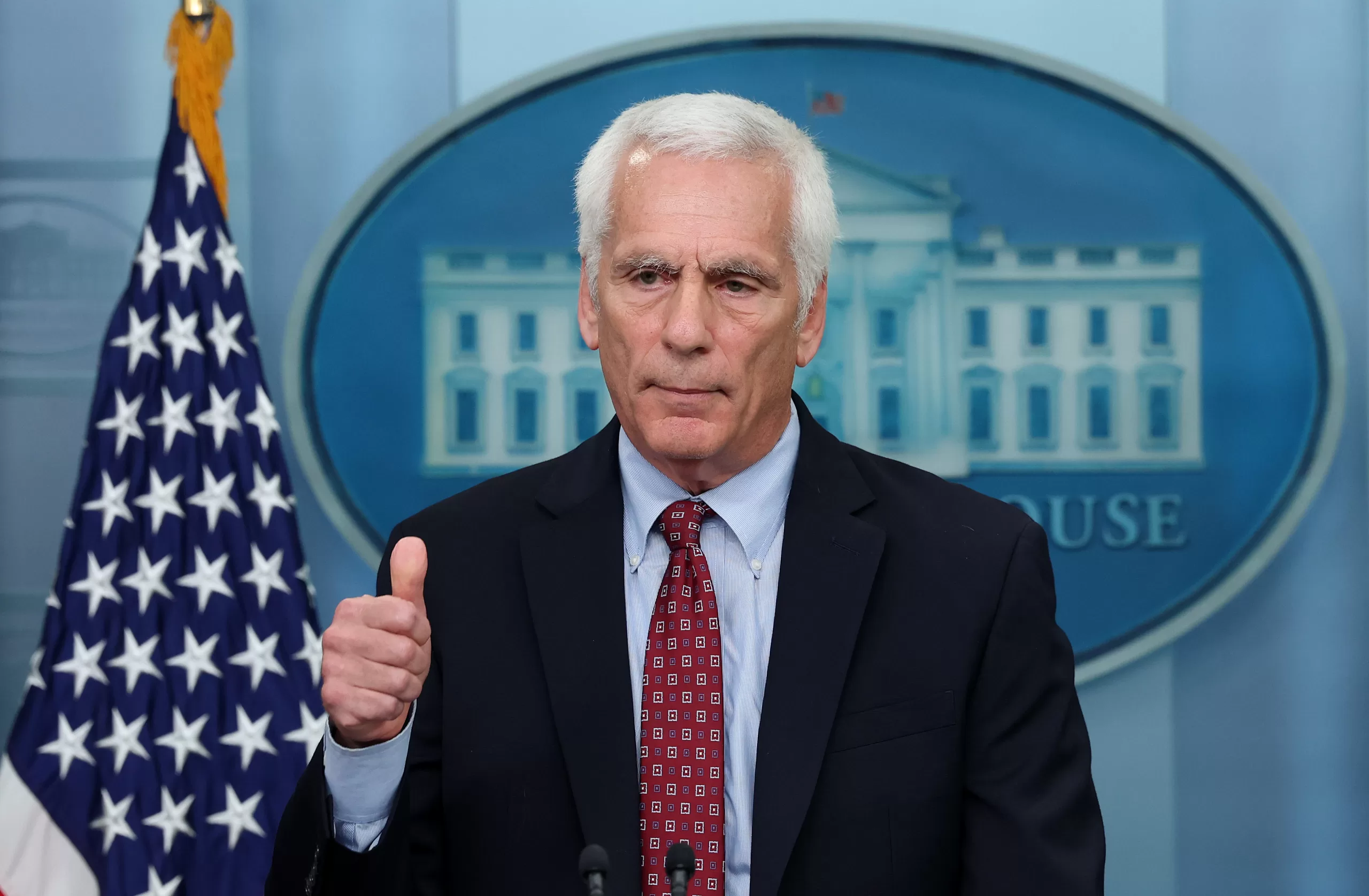

Jared Bernstein, the chair of the White House Council of Economic Advisers, said in an interview that the administration’s recent posts trumpeting the stock market were not a response to the former president.

Bernstein, a long-time Biden aide, said it’s “just our team’s substantive take on a set of forces that look like they’re in play in this rally.”

White House communications director Ben LaBolt

posted on X Saturday that “Americans are going to be happy with their 401(k) statements,” a message that Bernstein

reposted and cheered on from his own X account.

“No one’s saying anything about where the market is headed,” Bernstein said on a call Monday, adding that the messaging push was about the rally over the past few months.

“We think some of the forces behind the rally are those that this president has helped to put in play.”

He pointed to reversed recession expectations, a bright domestic investment outlook driven by Biden’s legislative agenda, and the strength of the U.S. economy compared to global competitors. And to be sure, the president’s speeches focus largely on the real economy, not the markets.

When politicians try to take credit for rising stocks, there’s not only the risk that share prices will fall. It also draws attention to the fact that the market delivers the biggest benefits to those who are already well-off.

The wealthiest Americans are far more likely to hold stocks than those with lower incomes. Josh Bivens, chief economist at the left-leaning Economic Policy Institute, said stock market gains are “really about how the wealthiest are faring” and are “mostly irrelevant to most peoples’ real economic circumstances.”

Bernstein acknowledges that direct stock holdings are concentrated among the wealthiest, but he highlights that many middle-class families are invested in retirement accounts.

“We’re going to fight hard to maintain the strength in the real economy — particularly the job market — while continuing to put downward pressure on prices because that’s what leads to stronger paychecks, and that is absolutely at the core. But for a lot of people — even in the middle class — a rising stock market is an important benefit,” Bernstein said. “The fact that some of the forces that have been supporting the rally relate to the president’s agenda — that seems like fair game to point out.”