Article content

(Bloomberg) — It’s another busy earnings period with reports coming from Big Oil firms BP Plc and TotalEnergies SE, as well as Caterpillar Inc., Tyson Foods Inc., Bunge Global SA, Orsted A/S and ArcelorMittal SA. Crop traders will focus on the US Department of Agriculture’s monthly report on global supply and demand, with particular attention to South America’s soybean harvest. In the US, President Joe Biden’s decision to freeze approvals of new liquefied natural gas export licenses is under fire.

Article content

Here are five notable charts to consider in global commodity markets as the week gets underway.

Article content

Natural Gas

There are growing calls to reverse Biden’s LNG decision, with moderate Democrats now urging the president to “refocus” his policy. On Tuesday, EQT Corp. Chief Executive Officer Toby Rice will testify at a House Energy and Commerce subcommittee hearing. The head of the largest US natural gas producer has been critical of the move, saying it will result in higher emissions and hurt global energy security. The Senate will hold a separate hearing on Thursday, led by West Virginia Democrat Joe Manchin. Meanwhile, Exxon Mobil Corp.’s Chief Financial Officer Kathy Mikells called the halt a “mistake.” This moratorium affects LNG companies needing final US approval to export to countries without free trade agreements, a necessary permit to move forward with customers and financing. Wood Mackenzie estimates another group of projects will require extensions of their existing permits before 2027, totaling almost the same amount of capacity as projects waiting for non-FTA approval.

Article content

Shale

It’s a good time to be working in the US shale patch. While explorers are planning to keep drilling budgets relatively flat this year, their labor costs seem to remain in growth mode. Average hourly earnings for front-line oil-and-gas workers are now the highest ever. It’s a key measure to watch as shale explorers push for greater efficiency by pulling more production from fewer drilling and frack crews.

Agriculture

Soybean futures traded in Chicago are being walloped on slowing US exports and competition from Brazil, where the harvest is expected to be the second-largest on record. That has helped prop up expectations for a 12% boost in production for all of South America to a record 217.3 million metric tons in the current season. Traders will await the USDA’s World Agricultural Supply and Demand Estimates report on Thursday for the latest assessment of foreign harvests.

Metals

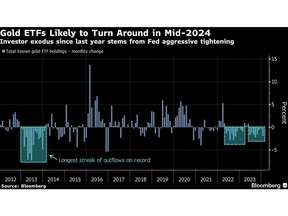

Spot gold has been trading in a sideways pattern above $2,000 a ounce this year as traders weigh the outlook for Federal Reserve monetary policy. That wait-and-see approach is further evident when looking at trends in bullion-backed exchange-traded funds, which investors continue to shun. January marked the eighth straight month of outflows, the longest such streak since a year ago. While the weakness is likely to continue in the short term, a turnaround may unfold mid-year, helped by expected rate cuts by key global central banks and ongoing geopolitical risks, according to the World Gold Council. The non-interest bearing metal typically benefits from looser monetary policy when Treasury yields are lower and the dollar tends to be weaker.

Article content

Shipping

Ship traffic near Africa’s Cape of Good Hope remains elevated as vessels avoid the risks associated with transit through the Red Sea. Despite logging hundreds of extra miles and enduring higher costs, the total number of ships embarking on this alternate route has surged from a year ago, according to IMF PortWatch, which analyzes daily satellite vessel location and movement data. French container shipping giant CMA CGM SA became the latest to suspend operations through the Red Sea because of the threat of attacks by Iran-backed Houthi militants.

—With assistance from Yvonne Yue Li, David Wethe, Gerson Freitas Jr., Michael Hirtzer, Ruth Liao and Jennifer A. Dlouhy.

Share this article in your social network