Article content

(Bloomberg) — Adani Enterprises Ltd.’s quarterly profit more than doubled boosted by higher earnings from its newer businesses as the port-to-power conglomerate continues to rebound from a brutal short seller attack early last year. Shares jumped as much as 3%.

The flagship firm of billionaire Gautam Adani’s empire posted net income of 18.9 billion rupees ($228 million) for the quarter through December, compared with 8.2 billion rupees in the year-ago quarter, according to an exchange filing Thursday. There weren’t enough brokerages tracking the firm to derive an average profit forecast.

Article content

Revenue increased 6.5% to 283.4 billion rupees, bolstered by double digit growth in airports and new energy ecosystem business units. Total costs were up 1.1% to 264.7 billion rupees, the filing said.

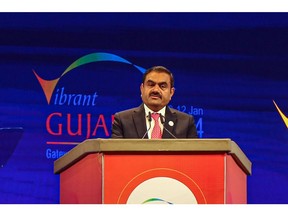

The company “has had a robust third quarter, with two of our major incubating businesses picking up momentum,” Adani, group chairman, said in a statement post earnings.

The ports-to-power conglomerate has been steadily clawing back lost ground after denying Hindenburg Research’s allegations of wide-ranging corporate fraud in January 2023 that forced the Adani Group into months of damage control. It has since then trimmed debt, secured new backers and begun communicating extensively with its investors, helping four of the ten listed stocks fully recoup the stock losses since the bombshell short seller report.

Read More: Adani’s Lessons From Hindenburg Hit Fuel $93 Billion Rebound

The group also got a big vote of confidence from India’s top court refusal last month to order additional probes and a US agency funding for its Sri Lanka port project in November.

Article content

Revenue at the IRM unit, which mostly consists of coal trading and contributes the largest chunk to overall revenues, slipped 9.7% to 160.2 billion rupees despite volumes rising nearly 32% to 20.8 million tons.

Shipments from its Carmichael mine in Australia rose from a year earlier, as did sales of its solar modules during the quarter.

Stellar Performance

Meanwhile, the newer businesses turned in a stellar performance with revenue from its airports unit up 26% to 21.8 billion rupees while new energy ecosystem jumped 44% to 20.6 billion rupees.

As the Adani Group draws a line under the Hindenburg episode, it has doubled down on its infrastructure projects and plans to spend as much as $100 billion on its green transition. Adani Enterprises — known as the group’s incubator for new businesses that are later spun off and listed — is redeveloping Mumbai’s storied Dharavi slum and building a second airport on the city’s outskirts.

Adani Enterprises, which manages a motley mix of businesses ranging from airports and roads to data centers and media, has finally begun to get some analyst coverage. Cantor Fitzgerald, the only brokerage with an active recommendation on the stock, initiated coverage on the stock with an overweight recommendation last month.

Article content

The stock climbed 18% in the December quarter, almost double the rise posted by the benchmark S&P BSE Sensex. It has surged 11% this year and is just a little short of touching the pre-Hindenburg level.

“We believe the company is at the core of everything India wants to accomplish,” Cantor analysts Brett Knoblauch and Thomas Shinske wrote in a Jan. 28 note, outlining the importance of Adani Group in Indian government’s nation-building priorities.

Read More: Adani’s Grip on India’s Economy Fuels Rebound After Hindenburg

Investors, however, are still looking for steer on its fund raising plans and any guidance on when any of the fledgling businesses could be hived off as a separately listed entity. They are also awaiting the findings of a court-mandated probe by India’s markets regulator into potential breaches by the Adani Group or its founders.

—With assistance from Chiranjivi Chakraborty and Rajesh Kumar Singh.

(Updates with details throughout.)

Share this article in your social network