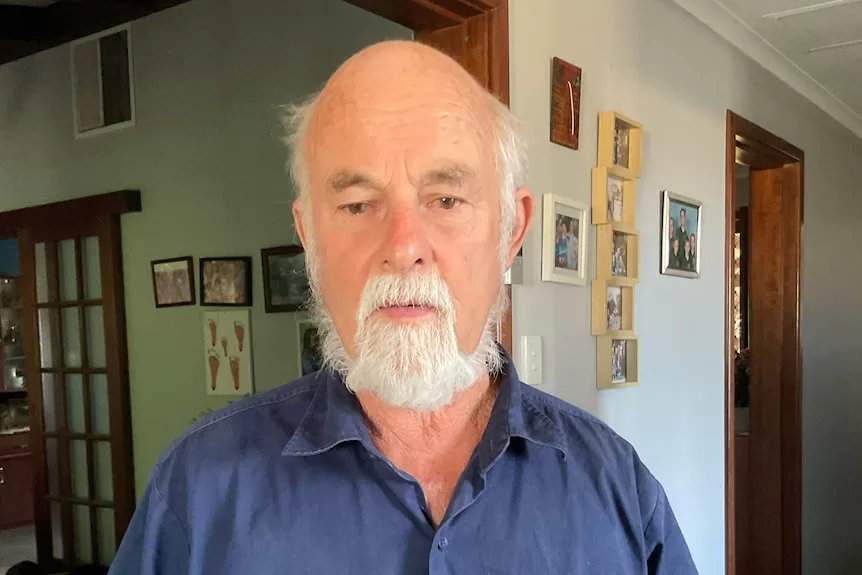

- In short: Midwest resident Graeme Reid says his nearest Bankwest branch, a 130-kilometre round trip away to Dallwalinu, refused to allow his wife to make a $300 withdrawal.

- Bankwest declined to address Mr Reid’s claims, but locals are concerned it may be a sign the branch could be closed.

- What’s next? The Senate Committee investigating the state of regional banking is due to hand down its report later this year.

Residents in WA’s Midwest fear another rural bank is preparing to close its doors after several were refused cash withdrawals.

A resident of Latham, about 300 kilometres north-east of Perth, says he wasted a 130 kilometre round trip to his bank after being told he could not withdraw cash.

Graeme Reid drove to Dalwallinu with his wife for shopping and to withdraw $300 cash from the Bankwest branch — his closest — timed around the bank’s already-limited opening days.

Mr Reid said his wife went to the bank soon after it opened at 9:30am on Wednesday, where the teller told her she was the third customer that day and she was unable to withdraw money, directing her to the post office.

“I was absolutely gobsmacked,” he said.

He said while they could withdraw a limited amount of money from their personal account at the post office with a card and personal identification number, he was unable to withdraw money from his business account.

“You can’t do that down at the post office there because you’ve got to have a pin number for that account,” he said.

He said another customer facing the same issue while he was at the bank was similarly frustrated.

“I said ‘if you can’t get money out of a bank you may as well close’ and she said ‘well we haven’t been told we’re going to close’ but I guess it won’t be long before that happens, it’s what banks are doing now.”

Dalwallinu resident Glen Jones said locals had similar frustrations with the bank refusing to allow cash out and instead directing them to a bank in Moora, a one-hour drive away, despite attempting to pre-arrange the withdrawal.

“Someone like the footy club, they want to get cash out for a big function this weekend,” he said.

“They have to go to Moora to get the cash.”

Mr Jones said the bank had also been refusing cash deposits, causing difficulties for local businesses, and sparking concerns that Bankwest could be preparing to close the branch altogether.

“The cafes, the roadhouses, the pubs… you can’t deposit, they tell you to go and deposit at the post office, and sometimes it’s not even open,” Mr Jones said.

“I just can’t see it (the bank) being open in six months time.”

In response to questions from the ABC, Bankwest did not respond to Mr Reid’s claims.

In a statement, a spokesperson said it does not have a policy limiting the number of customers able to withdraw cash from a branch.

They said withdrawal limits were set at $3,000 per day per customer, with higher values to requiring 48 hours notice to ensure sufficient cash.

Mr Reid said that was a longstanding practice that rural residents were already aware of.

The statement also referred customers to the nearby post office for cash withdrawals.

A Senate inquiry into banking in regional Australia is due to be delivered in May.