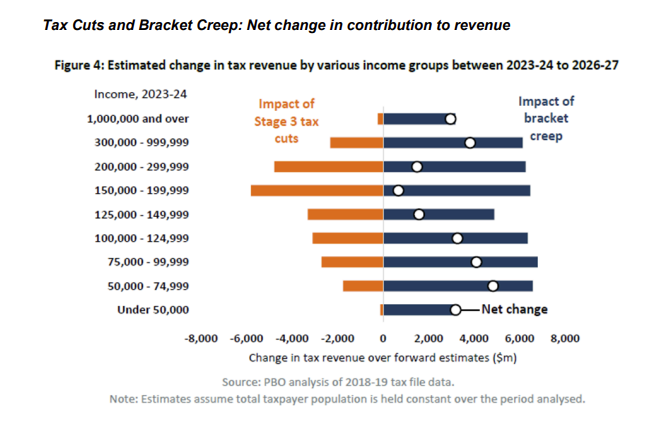

The median income earner will pay an extra $5,000 in the next three years due to bracket creep but get minimal benefit from the stage three tax cuts, according to analysis by the independent Parliamentary Budget Office.

The tax cuts, which take effect in July, will apply a 30 per cent tax rate to income earned between $45,000 and $200,000. Those with taxable incomes below $45,000 will get no benefit, while those above $200,000 will get $9,075.

The government has insisted it remains committed to the tax cuts, and says returning bracket creep is a key reason why.

But the PBO analysis shows stage three does not return bracket creep evenly. Those who earn between $150,000 and $200,000 will have most of their bracket creep returned by stage three between now and 2026-27.

At the same time, those who earn under $75,000 will pay thousands extra due to bracket creep but will see little returned from stage three.

The figures do not include the stage one and two tax cuts, which started in 2018-19 and have given an extra $1,080 a year, on an ongoing basis, to those earning between $48,000 and $90,000.

Bracket creep happens because the boundaries of income tax brackets are not adjusted for inflation. It means a taxpayer with unchanged real income pays a higher proportion of their income in tax over time.

Higher price tag

The PBO analysis also included an updated estimate of the price tag of the cuts.

The PBO now expects they will redistribute $324 billion from the federal budget to taxpayers over the next decade, $10 billion more than previously thought.

The change reflects higher-than-expected incomes.

The analysis also finds that around three-quarters of the tax cut will be received by the top fifth of earners, and around two-thirds will be received by men.

Acting Greens leader Mehreen Faruqi and economics spokesperson Nick McKim have written to Treasurer Jim Chalmers repeating calls to scrap the tax cuts.

Last week, Prime Minister Anthony Albanese said the tax cuts would begin in July “as planned”, but left open the possibility of re-designing the cuts.

The Labor caucus will meet in Canberra tomorrow to discuss options for further cost of living relief.