Quick Read

- In short: Doctors have been operating as independent practitioners based in GP clinics rather than employees.

- They say changes to payroll law will mean they have to pay tax, forcing clinics to close and patients to pay $20 more per visit.

- What’s next? Posters will be displayed in waiting rooms encouraging patients to support a joint campaign against the tax.

Doctors say there will be widespread closures of medical clinics and Victorians will pay more to see a GP if the Victorian government pushes ahead with changes to payroll tax.

Three industry groups have launched a campaign against a move to deem doctors employees of GP clinics instead of independent practitioners.

The Royal Australian College of General Practitioners (RACGP) said GPs paid the tax for their receptionists, GPs-in-training, and nurses, but it had never applied to the doctors.

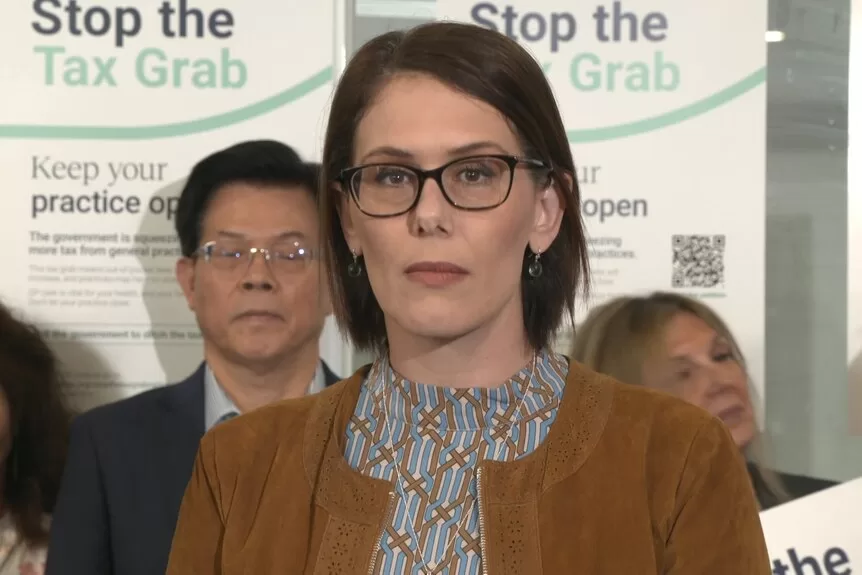

“They do not get any benefits from the practice, including no leave, sick leave, annual leave and WorkSafe entitlements,” RACGP Victorian chair Anita Munoz said.

“In fact, they operate their own business within the umbrella of the clinic.”

Dr Munoz said a poll of 1,297 members found most clinics would not be able to absorb the extra payroll tax into their costs.

“More than 30 per cent of practices that have to meet that taxation bill are likely to become instantly insolvent,” Dr Munoz said.

“We see this as an absolute catastrophe for general practice, for our patients and for the health system at large.

“This really is the biggest existential threat to general practice and the health system, certainly in my entire career.”

One large medical chain, Sia Medical, said it had been given two weeks to provide payroll details for GPs working at its eight clinics, dating back 10 years.

It said if payroll tax was imposed retrospectively, it would have to pay between $2 million and $5 million.

“When you consider that Dr Sia and his group alone services half a million people, the loss of his group would be an absolute catastrophe,” Dr Munoz said.

Another clinic in Tullamarine was facing an $800,000 bill.

Dr Munoz said it was likely to spell the closure of that practice, which she said serviced a disadvantaged section of the community

“I can’t overstate the urgency and the severity of the threat to the health system that this tax is posing,” Dr Munoz said.

Cost of seeing a doctor to rise

Mukesh Haikerwal has been a GP in Melbourne’s west for 30 years and is the chair of the Australian GP Alliance.

He said GP clinics operated on slim margins and the tax would have to be passed onto patients, costing them about $20 more to see a doctor.

“Bulk-billing is on the ropes,” Dr Haikerwal said.

“We are, in world terms, one of the best healthcare systems in the world and our longevity as a nation is one of the greatest in the world, and to see that disappear will be a problem.

“We’re not going to get universal health care. It’s going to be [for] those who can afford it. And that’s wrong.”

Martin Clark from the Primary Care Business Council said the higher fees could see patients overwhelming the hospital system.

“A lot of our patients that come to our practices won’t be able to attend very much or they may in fact not be able to attend at all because of the costs from this new tax, and that’s going to fall to these new urgent care centres and back onto emergency departments,” Dr Clark said.

Dr Munoz said that would be a significant cost to the state.

“Medicare provides a $42 rebate for a 15-minute consultation with a general practitioner,” she said.

“If that person then goes to an emergency department to have a 15 or 30-minute experience there, it costs the taxpayer $515 for the patient just to walk in the door, not to have any service rendered, so the false economy in suggesting that we should be taxing general practice is very difficult to understand.”

The RACGP has sent posters to 1,500 clinics across the state to draw patients’ attention to the tax changes.

Dr Munoz said she hoped the change of premier from Daniel Andrews to Jacinta Allan would spark a fresh conversation on the issue.

“If we don’t get this right and if we fail in this opportunity, then we will not have GPs to train, we won’t have GPs to teach and we won’t have the practices available to see patients who need care,” she said.

Government frontbencher Steve Dimopoulos said GPs were not being treated any differently to other industries or workers in Victoria.

“The State Revenue Office does what it normally does as a normal course of its work, which is it assesses different employment arrangements, and that’s all it’s been doing,” he said.